Question: 1. Record the necessary adjusting journal entries 2. Post the Journal entries to the T-accounts 3. Create an adjusted trial balance 4. Create an income

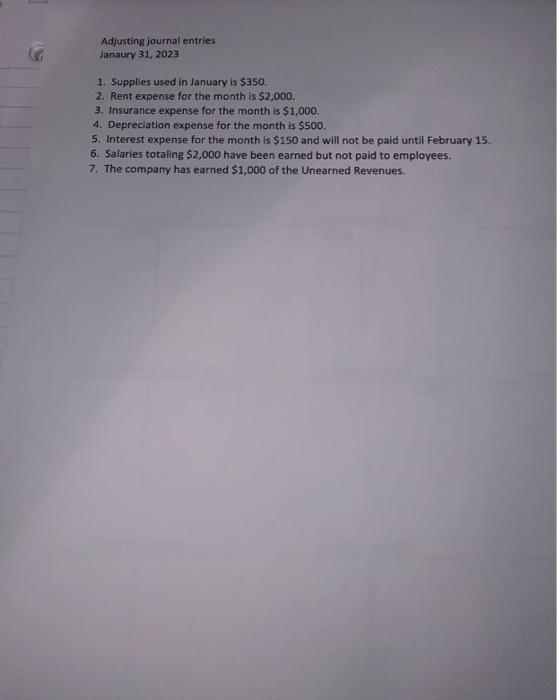

1. Record the necessary adjusting journal entries

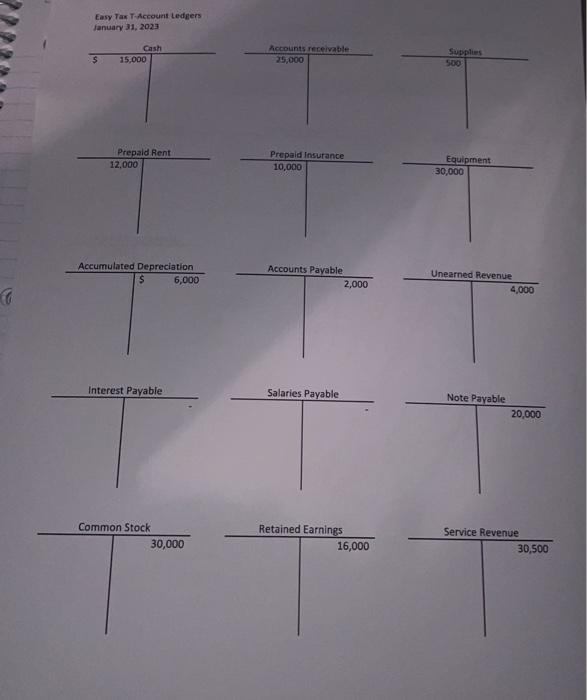

2. Post the Journal entries to the T-accounts

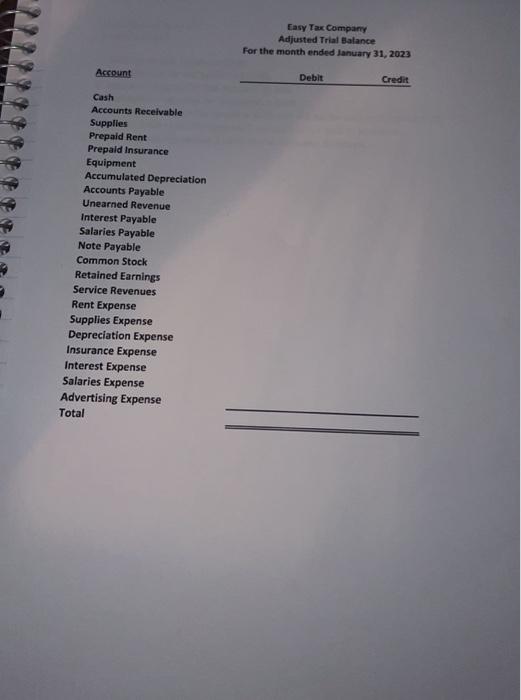

3. Create an adjusted trial balance

4. Create an income statement, statement of retained earnings and a balance sheet.

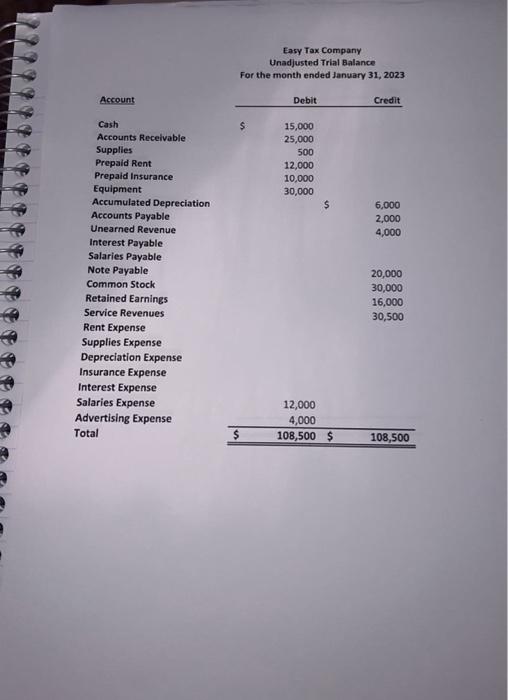

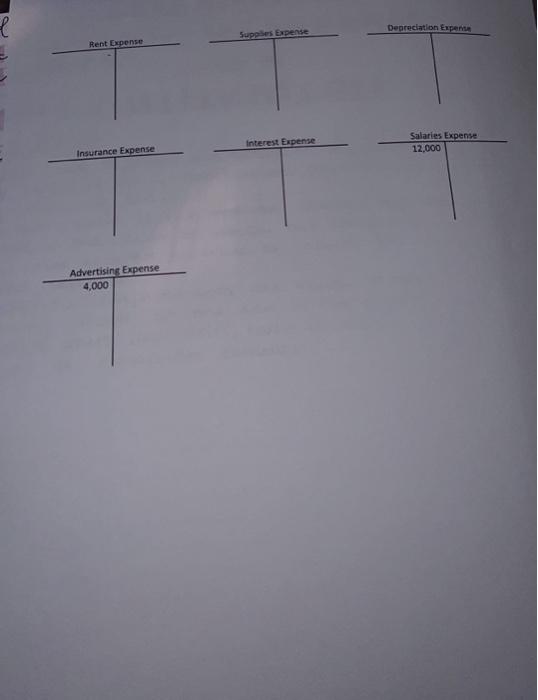

Easy Tax Company Unadjusted Trial Balance For the month ended Januarv 31. 2023 Easy Tax Company Adjusted Trial Elalance For the month ended lanuary 31, 2023 Account Debit Credit Cash Accounts Recelvable Supplles Prepaid Rent Prepald Insurance Equipment Accumulated Depreciation Accounts Payable Unearned Revenue Interest Payable Salaries Payable Note Payable. Common Stock Retained Earnings Service Revenues Rent Expense Supplies Expense Depreciation Expense Insurance Expense Interest Expense Salaries Expense Advertising Expense Total Adjusting journal entries danaury 31,2023 1. Supplies used in January is $350. 2. Rent expense for the month is $2,000. 3. Insurance expense for the month is $1,000. 4. Depreciation expense for the month is $500. 5. Interest expense for the month is $150 and will not be paid until February 15. 6. Salaries totaling $2,000 have been earned but not paid to employees. 7. The company has earned $1,000 of the Unearned Revenues. Easy Tax T-Accouet Ledgers fanuacx 31, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts