Question: 1. Record the write off receivables 2. Record the reinstatement of an account that was previously written off 3. Record the collection of an account

1. Record the write off receivables

1. Record the write off receivables

2. Record the reinstatement of an account that was previously written off

3. Record the collection of an account previously written off

4. Record bad debt expense for the year

How would accounts receivable be shown in the 2016 year end balance sheet?

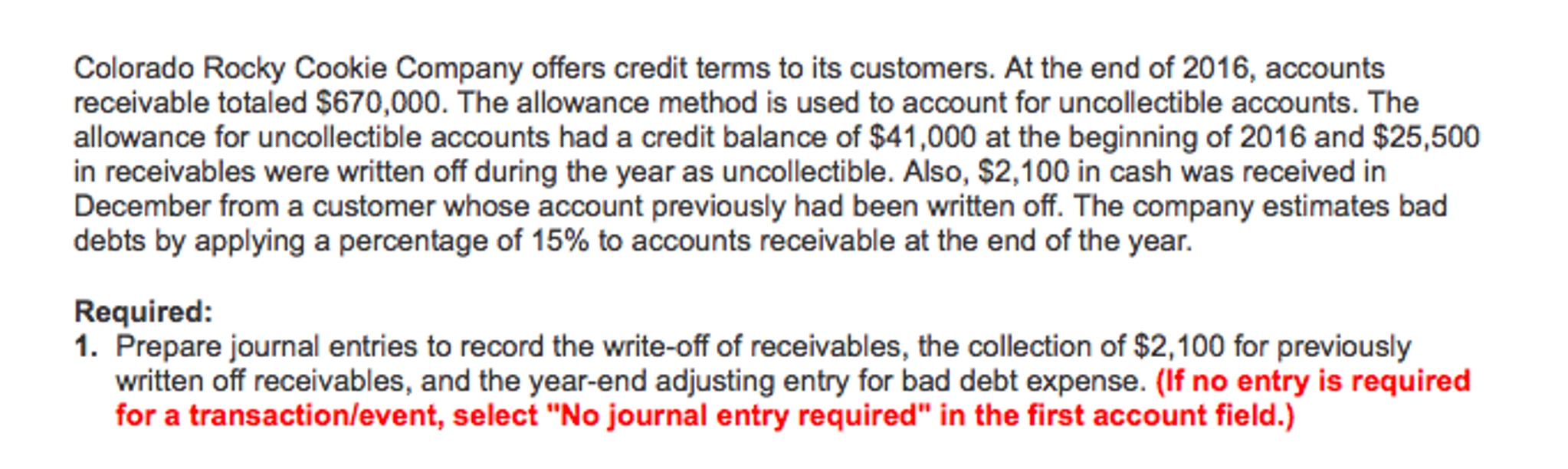

Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2016, accounts receivable totaled $670,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $41,000 at the beginning of 2016 and $25,500 in receivables were written off during the year as uncollectible. Also, $2,100 in cash was received in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year Required: 1. Prepare journal entries to record the write-off of receivables, the collection of $2,100 for previously written off receivables, and the year-end adjusting entry for bad debt expense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts