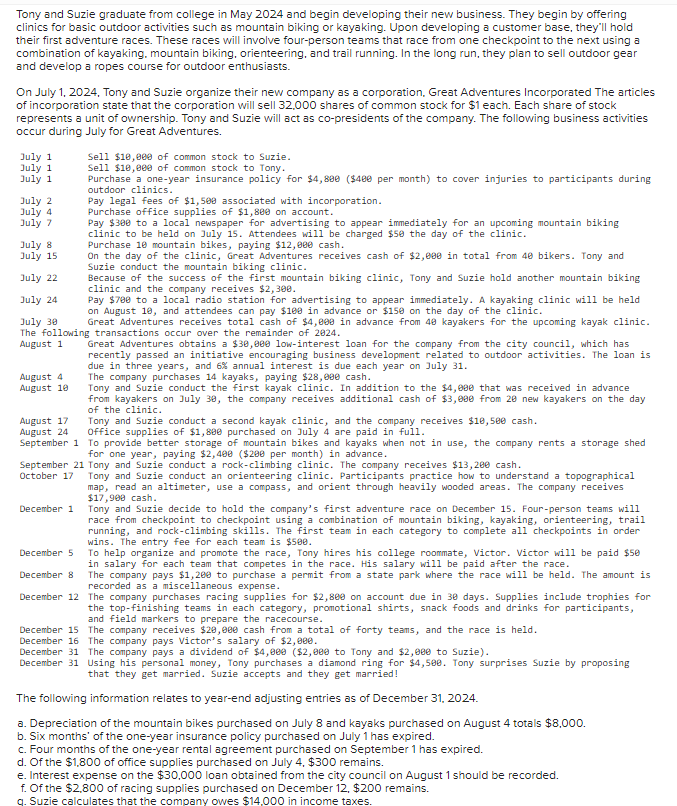

Question: 1 . Record transactions from July 1 through December 3 1 . ( If no entry is required for a transaction / event , select

Record transactions from July through December If no entry is required for a transactionevent select No journal entry required" in the first account field.

Record adjusting entries as of December If no entry is required for a transactionevent select No journal entry required" in the first account field.

Post transactions from July through December and adjusting and closing entries on December to Taccounts.

Prepare an adjusted trial balance as of December

For the period July to December prepare an income statement, statement of stockholders equity and classified balance sheet.

Post the closing entries of retained earnings to the Taccount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock