Question: 1. Regarding the one year PP-ELN described in the case, how should the bank allocate the $1 million to deliver this note with 40% of

1. Regarding the one year PP-ELN described in the case, how should the bank allocate the $1 million to deliver this note with 40% of the upside return in the S&P 500 Index for the client? [Note: 6% p.a. continuously compounded = 6.1837% on an annualized basis.]

2. You see the following prices of 1-year call options on $1,000 (notional amount) of the S&P 500 Index:

| Strike Price | Call @ 20% Vol. | Call @ 25% Vol. |

| 1,900 | $142.53 | $178.00 |

| 2,090 | $76.80 | $110.77 |

| 2,280 | $38.42 | $66.31 |

Assuming the volatility cost to the Bank is 25% p.a., is the PP-ELN described in the case a fair deal for the client? What if the volatility cost was 20% p.a.? Explain your answers.

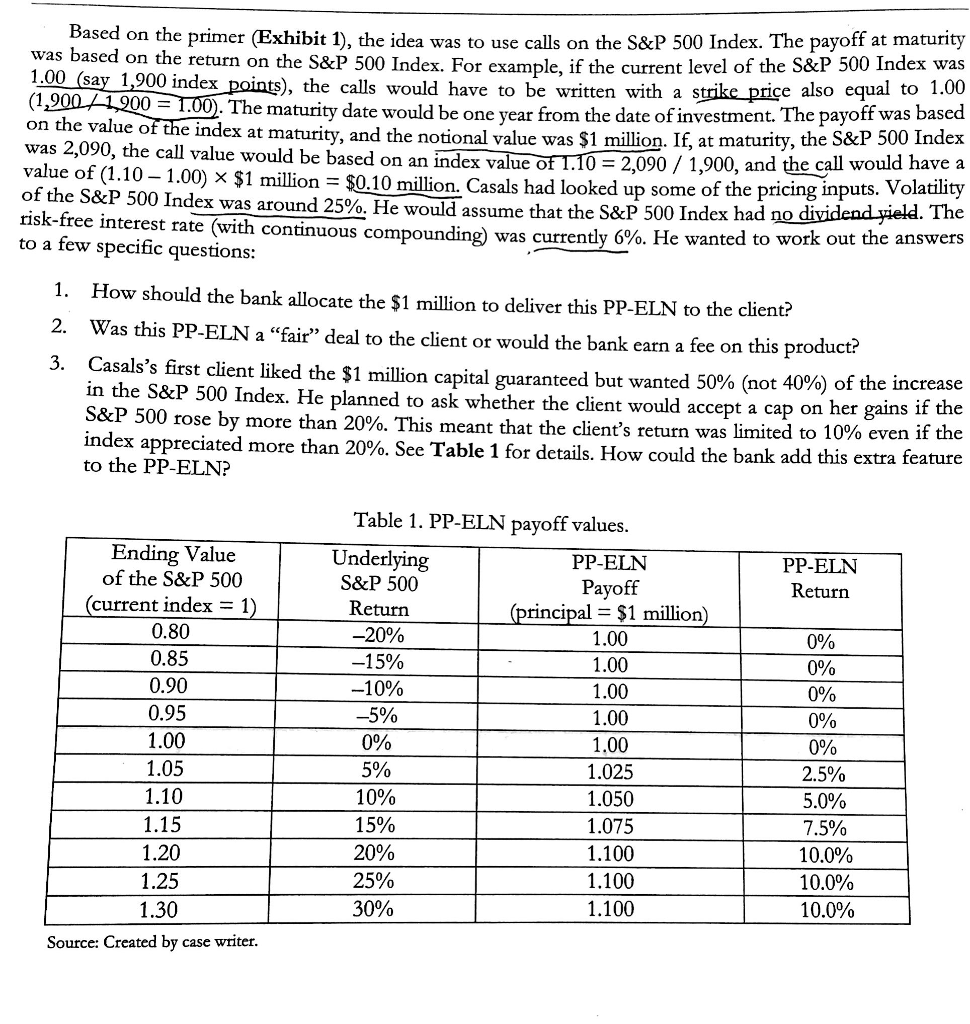

Based on the primer (Exhibit 1), the idea was to use calls on the S&P 500 Index. The payoff at maturity was based on the return on the S&P 500 Index. For example. if the current level of the S&P 500 Index was 1.00 (say 1,900 index ), the calls would have to be written with a s e also equal to 1.00 lhe maturity date would be one year from the date of investment. The payoff was based of the index at maturity, and the notional value was $1 million. If, at maturity, the S&P 500 Index the call value would be based on an index value of T.10 2,090/1,900, and the call would have a uts. Volatility on the value of the index at ma was 2,090, the call value would be value of (1.10-1.00) $1 million-30.10 million Casals had looked up some of the pricing inp of the S&P 500 Index was around 25% He would assume that the S&P 500 Index had no risk-free interest rate (with continuous compound to a few specific questions: di ing was currently 69 He wanted to work out the a nswers 1. How should the bank allocate the $1 million to deliver this PP-ELN to the client? 2. Was this PP-ELN a "fair" deal to the client or would the bank earn a fee on this product? 3 Casals's first client liked the $1 million capital guaranteed but wanted 50% not 40% of the incre in the S&P 500 Index. He planned to ask whether the client would accept a cap on her S&P 500 rose by more than 20 inde ase gains if the %. This meant that the client's return was limited to 10% even if the x appreciated more than 20%. See Table 1 for details. How could the bank add this extra feature to the PP-ELN? Table 1. PP-ELN payoff values. PP-ELN Return Ending Value of the S&P 500 current index 1 0.80 0.85 0.90 0.95 1.00 1.05 PP-ELN Underlying S&P 500 Return -20% rincipal= $1 million 1.00 1.00 1.00 1.00 1.00 1.025 1.050 1.075 1.100 1.100 1.100 0 0 0 0% 0 0 10% 0 0 0% 25% 5.0% 75% 10.0% 10.0% 10.0% 0% 1.15 1.20 1.25 1.30 10% 15% 20% 25% 30% Source: Created by case writer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts