Question: 1 Remaining Time: 57 minutes 45 seconds Support Question Completion Status: 5 10 11 12 13 14 15 16 17 10 19 21 22 23

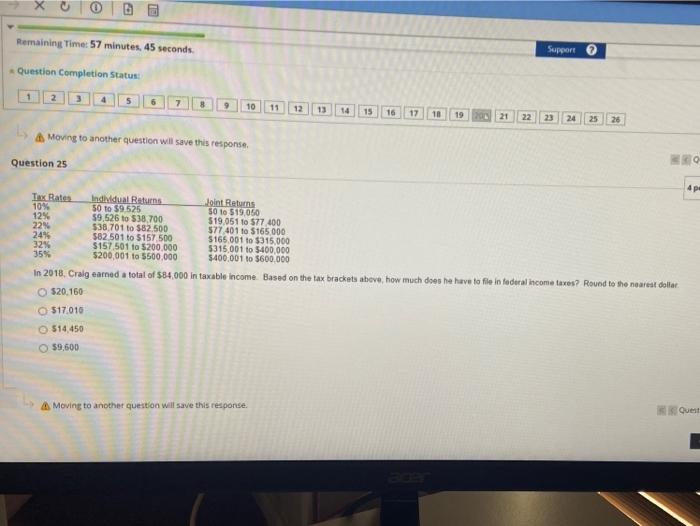

1 Remaining Time: 57 minutes 45 seconds Support Question Completion Status: 5 10 11 12 13 14 15 16 17 10 19 21 22 23 24 25 26 A Moving to another question will save this response, Question 25 4 p. Tx Rates Individual Returns Joint Returns 10% 50 to $9525 12% 50 to 519,050 59,526 to 538,700 $19.051 to $77.100 22 $38.701 to $82,500 577 401 to $165 24% 582 501 to $157500 $165.001 to $315.000 32% $157,501 to $200.000 5315.001 to $400,000 35% $200,001 to 5500,000 $400,001 to $600.000 In 2018, Craig earned a total of $84,000 in taxable income Based on the tax brackets above, how much does he have to file in faderal income taxes? Round to the nearest delta. 520.160 $17.016 514.450 59,600 A Moving to another question will save this response. Quest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts