Question: 1 Required information [ 1 - 4 ( Static ) Completing a Balance Sheet and Inferring Net Income [ LO 1 . 2 , LO

Required information

Static Completing a Balance Sheet and Inferring Net Income LO LO

The following informidion applies to the quetstions displiyed belowe

Ken Houng and Kirm Sherwoed organlaed Reader Direct as a corporationc each contributed $ carih to statt the business and received shares of stock. The store completed fis first year of operations on Deceriber On that date the following finandal hema for the year nert defermined exth an hand ond in the bank, $ amounts doe from customers from sales of books, $; equipment, $; amounts ewed to publiphers for books purchased, ; eneyear netes payable to a local bark for $ No duidends were declared or paid to the stockholders ouring the year.

EStatic Part

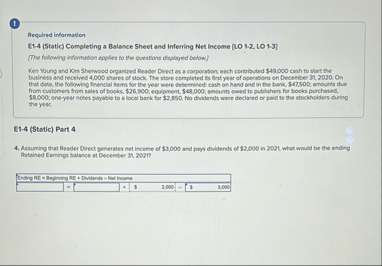

Assuming that Reader Direct generates net income of $ and pays dividends of $ in what would be the ending Retained Earnings balance at December

tableEnding RE Beginning RE Devefende Nat Income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock