Question: 1 Required information Problem 7 - 5 6 ( LO 7 - 3 ) ( Algo ) [ The following information applies to the questions

Required information

Problem LO Algo

The following information applies to the questions displayed below

Mickey and Jenny Porter file a joint tax return, and they themize deductions. The Porters incur $ in investment expenses. They also incur $ of investment interest expense during the year. The Porters' income for the year consists of $ in salary and $ of interest income.

Problem Parta Algo

a What is the amount of the Porters' investment interest expense deduction for the year?

Investment interest expense deduction

Required information

Problem LO Algo

The following information applies to the questions displayed below

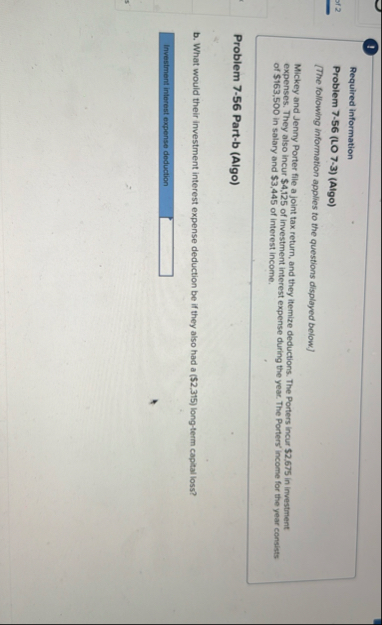

Mickey and Jenny Porter file a joint tax return, and they itemize deductions. The Porters incur $ in investment expenses. They also incur $ of investment interest expense during the year. The Porters' income for the year consists of $ in salary and $ of interest income.

Problem Partb Algo

b What would their investment interest expense deduction be if they also had a $ longterm capital loss?

Investment interest expense deduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock