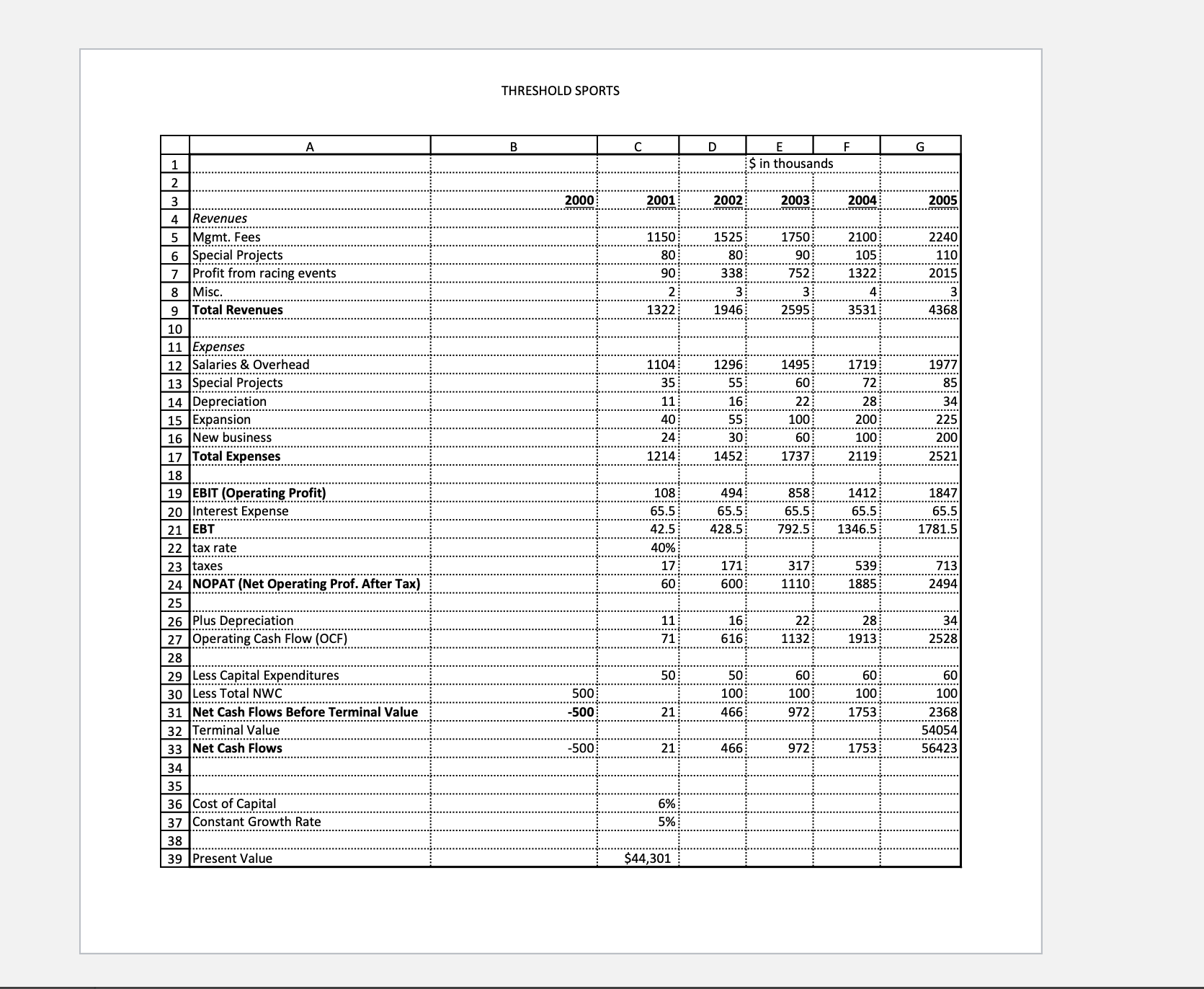

Question: 1. Review the Excel spreadsheet provided by the instructor that contains an estimate of the value of Threshold Sports. Identify and explain any possible improvements

1. Review the Excel spreadsheet provided by the instructor that contains an estimate of the value of Threshold Sports. Identify and explain any possible improvements for the spreadsheet.

2. How do the three financing alternatives compare based on a FRICTO analysis, i.e., flexibility, risk, income (or valuation), control, timing, and any other considerations that you think may be important? In other words, you need to systematically go through the FRICTO criteria, and for each criterion explain which financing source would be the best, which financing source would be the worst, and which would be somewhere in between. Do not organize your answer by the financing type. Instead organize by the FRICTO criteria. Start with the F (i.e., flexibility) and look at flexibility for the three possible financing options. Then move on to R, and so forth. After you have looked at the three financing sources for each of the criteria, provide a recommendation for what Frischkorn should do about financing. A FRICTO document is posted in the course shell that provides more explanation about the FRICTO criteria. You can find the link to the document on the left-hand side of the Blackboard page. IMPORTANT NOTE: When evaluating the financing alternatives be sure that you do not fall into the trap of evaluating them from the investor's perspective. You are determining what would be good financing choices for the company. Your perspective needs to be that of the company. And be sure that you are using the FRICTO definitions. For example, don't use your own concept for flexibility, the "F" in FRICTO.

**The Week 4 Threshold Sports case does not include enough information to estimate future changes in net working capital. Assume that the initial investment in net working capital is sufficient to cover the first year. After the first year, assume that continued growth in the company will require an additional investment in working capital of $100,000 each year for the next four years. Also, you should assume that a 5% constant growth is reasonable after 2005. This assumes continual growth with the economy and with inflation. Long-term economic growth has been about 2-3% per year, and long-term inflation has been about 2-3% per year.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts