Question: 1. Risk Aversion assumption implies that A. investors do not like to take on risk B. investors do like to take on risk C. investors

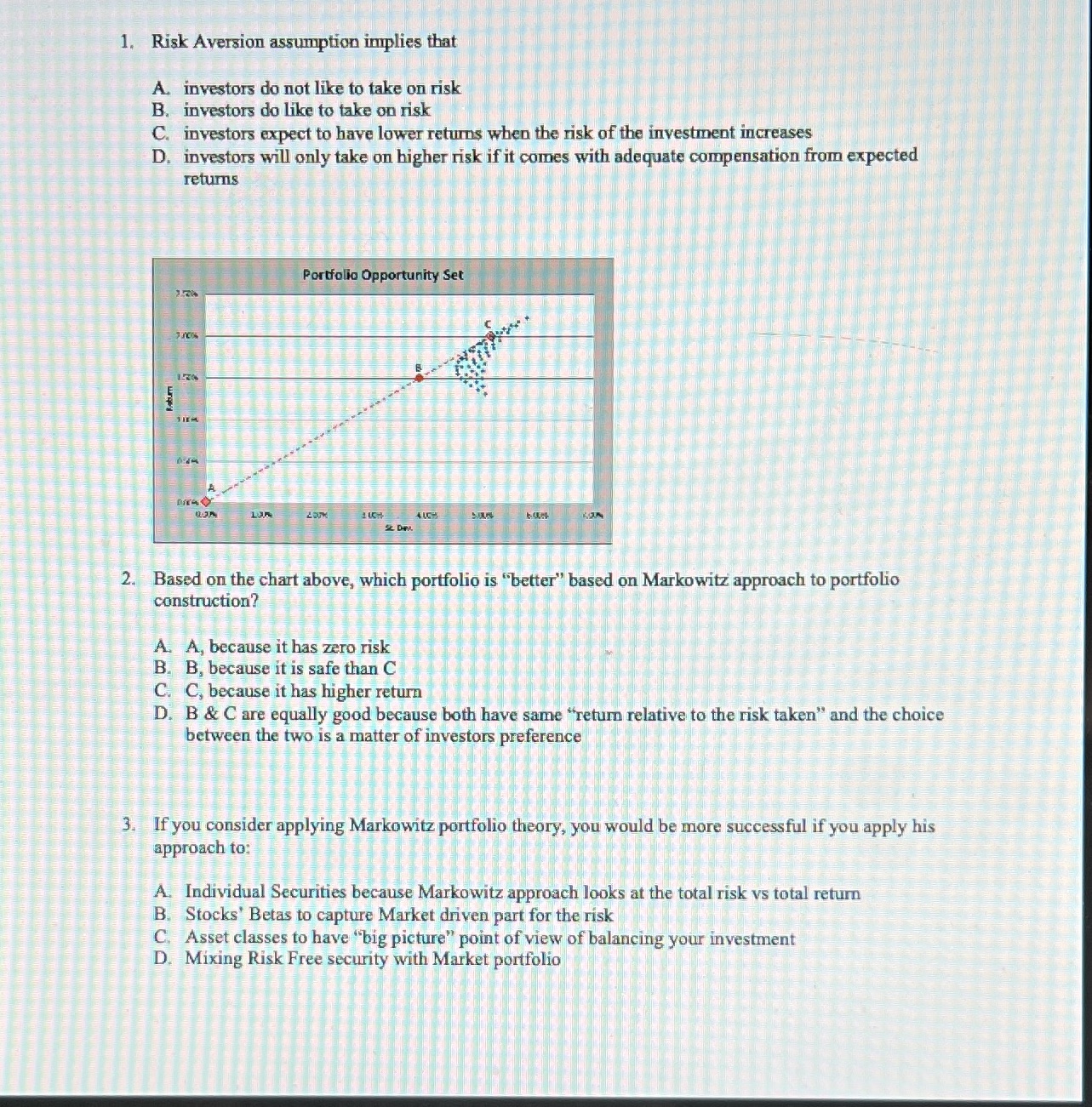

1. Risk Aversion assumption implies that A. investors do not like to take on risk B. investors do like to take on risk C. investors expect to have lower returns when the risk of the investment increases D. investors will only take on higher risk if it comes with adequate compensation from expected returns Portfolio Opportunity Set 2. Based on the chart above, which portfolio is "better" based on Markowitz approach to portfolio construction? A. A, because it has zero risk B. B, because it is safe than C C. C, because it has higher return D. B & C are equally good because both have same "return relative to the risk taken" and the choice between the two is a matter of investors preference 3. If you consider applying Markowitz portfolio theory, you would be more successful if you apply his approach to: A. Individual Securities because Markowitz approach looks at the total risk vs total return B. Stocks' Betas to capture Market driven part for the risk C. Asset classes to have "big picture" point of view of balancing your investment D. Mixing Risk Free security with Market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts