Question: (1) Ross buys a callable bond with a par value of 1000 that pays annual coupons at a rate of 6%. The bond is redeemable

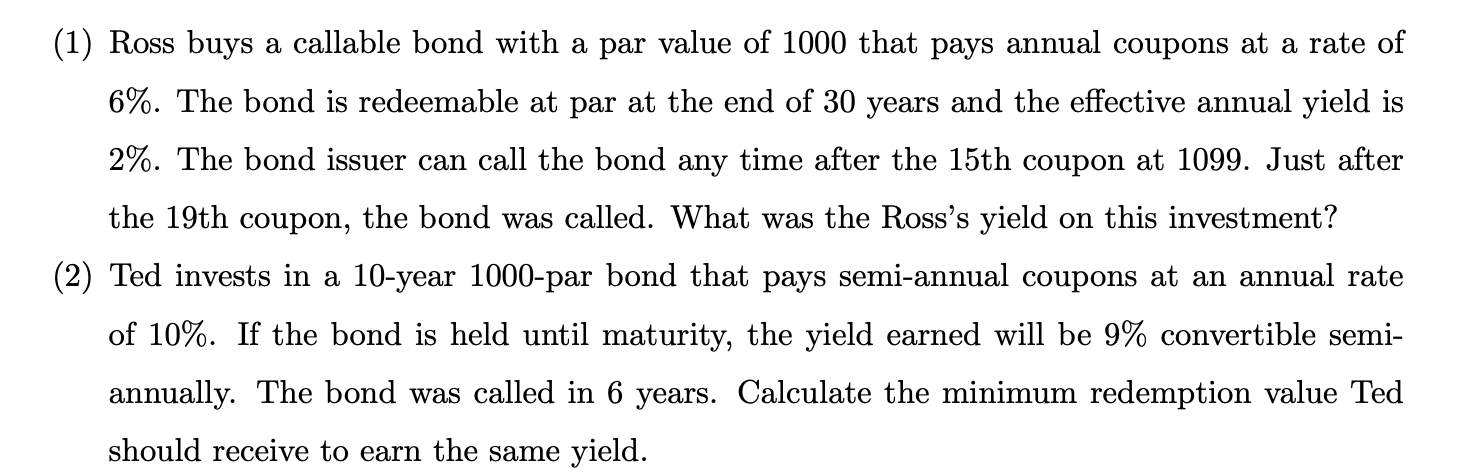

(1) Ross buys a callable bond with a par value of 1000 that pays annual coupons at a rate of 6%. The bond is redeemable at par at the end of 30 years and the effective annual yield is 2%. The bond issuer can call the bond any time after the 15th coupon at 1099. Just after the 19th coupon, the bond was called. What was the Ross's yield on this investment? (2) Ted invests in a 10-year 1000-par bond that pays semi-annual coupons at an annual rate of 10%. If the bond is held until maturity, the yield earned will be 9% convertible semiannually. The bond was called in 6 years. Calculate the minimum redemption value Ted should receive to earn the same yield. (1) Ross buys a callable bond with a par value of 1000 that pays annual coupons at a rate of 6%. The bond is redeemable at par at the end of 30 years and the effective annual yield is 2%. The bond issuer can call the bond any time after the 15th coupon at 1099. Just after the 19th coupon, the bond was called. What was the Ross's yield on this investment? (2) Ted invests in a 10-year 1000-par bond that pays semi-annual coupons at an annual rate of 10%. If the bond is held until maturity, the yield earned will be 9% convertible semiannually. The bond was called in 6 years. Calculate the minimum redemption value Ted should receive to earn the same yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts