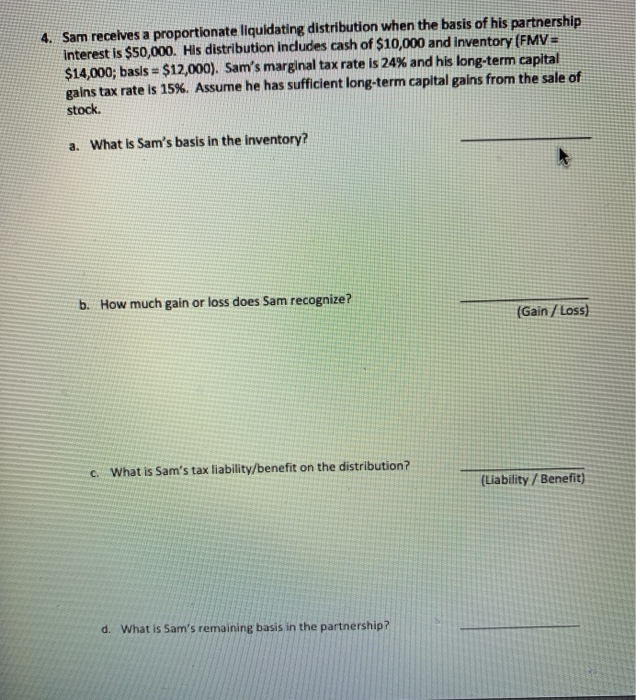

Question: 1. Sam receives a proportionate liquidating distribution when the basis of his partnership Interest is $50,000. His distribution includes cash of $10,000 and Inventory (FMV=

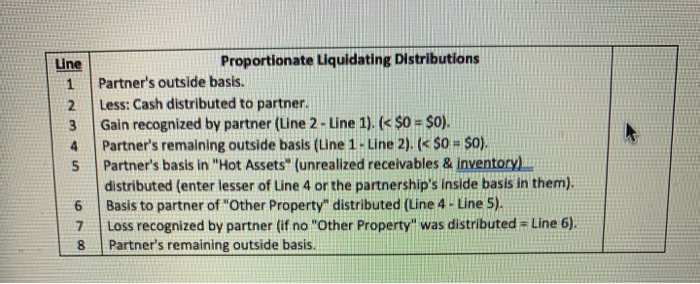

1. Sam receives a proportionate liquidating distribution when the basis of his partnership Interest is $50,000. His distribution includes cash of $10,000 and Inventory (FMV= $14,000; basis = $12,000). Sam's marginal tax rate is 24% and his long-term capital gains tax rate is 15%. Assume he has sufficient long-term capital gains from the sale of stock. a. What is Sam's basis in the inventory? b. How much gain or loss does Sam recognize? (Gain / Loss) c. What is Sam's tax liability/benefit on the distribution? (Liability / Benefit) d. What is Sam's remaining basis in the partnership? Proportionate Liquidating Distributions Partner's outside basis. Less: Cash distributed to partner. Gain recognized by partner (Line 2 - Line 1). (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts