Question: 1. Sara's Bake Shop uses the Aging-of-Receivables method to estimate uncollectible amounts. For 2020, Sara estimates that a total of $8,000 worth of her Accounts

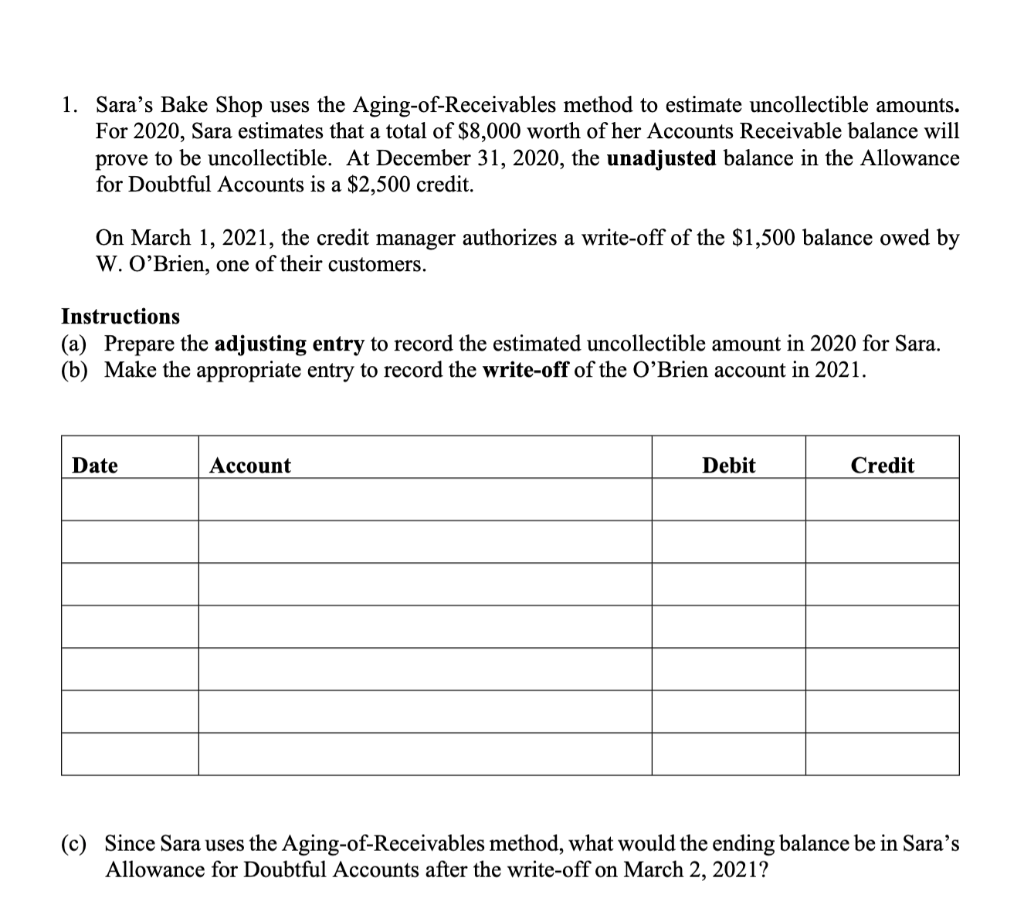

1. Sara's Bake Shop uses the Aging-of-Receivables method to estimate uncollectible amounts. For 2020, Sara estimates that a total of $8,000 worth of her Accounts Receivable balance will prove to be uncollectible. At December 31, 2020, the unadjusted balance in the Allowance for Doubtful Accounts is a $2,500 credit. On March 1, 2021, the credit manager authorizes a write-off of the $1,500 balance owed by W. O'Brien, one of their customers. Instructions (a) Prepare the adjusting entry to record the estimated uncollectible amount in 2020 for Sara. (b) Make the appropriate entry to record the write-off of the O'Brien account in 2021. Date Account Debit Credit (c) Since Sara uses the Aging-of-Receivables method, what would the ending balance be in Sara's Allowance for Doubtful Accounts after the write-off on March 2, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts