Question: 1. Scanlin, Inc., is considering a project that will result in initial aftertax cash savings of $1.7 million at the end of the first year,

| 1. Scanlin, Inc., is considering a project that will result in initial aftertax cash savings of $1.7 million at the end of the first year, and these savings will grow at a rate of 3 percent per year indefinitely. The firm has a target debtequity ratio of .85, a cost of equity of 11 percent, and an aftertax cost of debt of 3.8 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects. |

| What is the maximum initial cost the company would be willing to pay for the project? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole dollar amount, e.g., 32.)

BELOW IS ANOTHER EXAMPLE QUESTION. I FOLLOWED THESE STEPS AND STILL GOT QUESTION 1 WRONG.

|

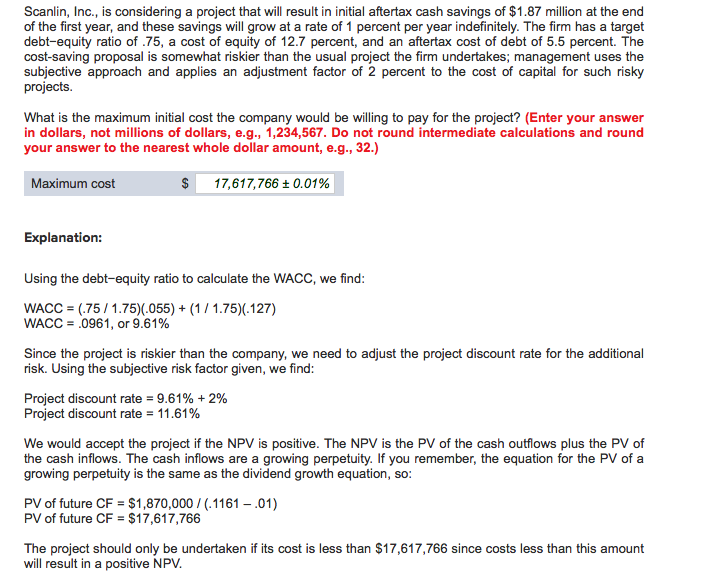

Scanlin, Inc., is considering a project that will result in initial aftertax cash savings of $1.87 million at the end of the first year, and these savings will grow at a rate of 1 percent per year indefinitely. The firm has a target debt-equity ratio of .75, a cost of equity of 12.7 percent, and an aftertax cost of debt of 5.5 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects What is the maximum initial cost the company would be willing to pay for the project? (Enter your answer in dollars, not millions of dollars, e.g., 1,234,567. Do not round intermediate calculations and round your answer to the nearest whole dollar amount, e.g., 32.) Maximum cost 17,617,766 t 0.01% Explanation: Using the debt-equity ratio to calculate the WACC, we find: WACC (.75 1.75)(.055) (1 1.75)(.127) WACC 0961, or 9.61% Since the project is riskier than the company, we need to adjust the project discount rate for the additional risk. Using the subjective risk factor given, we find Project discount rate 9.61% 2% Project discount rate 11.61% We would accept the project if the NPV is positive. The NPV is the PV of the cash outflows plus the PV of the cash inflows. The cash inflows are a growing perpetuity. If you remember, the equation for the PV of a growing perpetuity is the same as the dividend growth equation, so: PV of future CF $1,870,000 1161 01) PV of future CF $17,617,766 The project should only be undertaken if its cost is less than $17,617,766 since costs less than this amount will result in a positive NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts