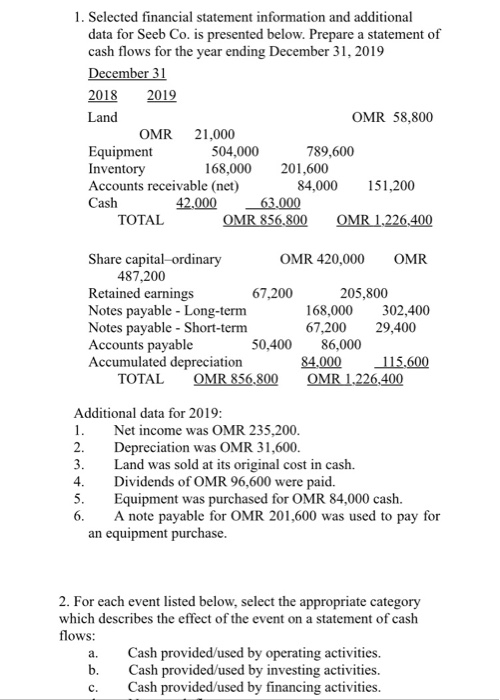

Question: 1. Selected financial statement information and additional data for Seeb Co. is presented below. Prepare a statement of cash flows for the year ending December

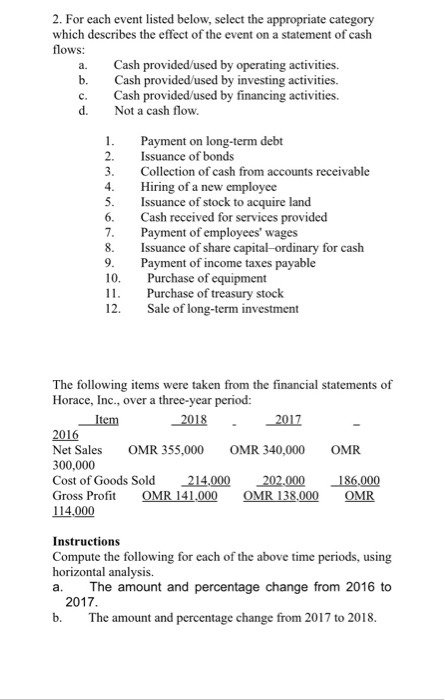

1. Selected financial statement information and additional data for Seeb Co. is presented below. Prepare a statement of cash flows for the year ending December 31, 2019 December 31 2018 2019 Land OMR 58,800 OMR 21,000 Equipment 504,000 789,600 Inventory 168,000 201,600 Accounts receivable (net) 84,000 151,200 Cash 42,000 63.000 TOTAL OMR 856,800 OMR 1,226,400 Share capital ordinary OMR 420,000 OMR 487,200 Retained earnings 67,200 205,800 Notes payable - Long-term 168,000 302,400 Notes payable - Short-term 67,200 29,400 Accounts payable 50,400 86,000 Accumulated depreciation 84.000 115,600 TOTAL OMR 856,800 OMR 1,226,400 Additional data for 2019: 1. Net income was OMR 235,200. 2. Depreciation was OMR 31,600. 3. Land was sold at its original cost in cash. 4. Dividends of OMR 96,600 were paid. 5. Equipment was purchased for OMR 84,000 cash. 6. A note payable for OMR 201,600 was used to pay for an equipment purchase. 2. For each event listed below, select the appropriate category which describes the effect of the event on a statement of cash flows: Cash provided/used by operating activities. b. Cash provided/used by investing activities. Cash provided/used by financing activities. a. C. a. c. d 2. For each event listed below, select the appropriate category which describes the effect of the event on a statement of cash flows: Cash provided/used by operating activities. b. Cash provided/used by investing activities. Cash provided/used by financing activities. Not a cash flow. 1. Payment on long-term debt 2. Issuance of bonds 3. Collection of cash from accounts receivable Hiring of a new employee 5. Issuance of stock to acquire land Cash received for services provided 7. Payment of employees' wages Issuance of share capital-ordinary for cash 9. Payment of income taxes payable 10. Purchase of equipment 11. Purchase of treasury stock 12. Sale of long-term investment 4. 6. 8. The following items were taken from the financial statements of Horace, Inc., over a three-year period: Item 2018 2017 2016 Net Sales OMR 355,000 OMR 340,000 OMR 300,000 Cost of Goods Sold 214,000 202.000 186.000 Gross Profit OMR 141,000 OMR 138.000 OMR 114,000 Instructions Compute the following for each of the above time periods, using horizontal analysis. The amount and percentage change from 2016 to 2017. b. The amount and percentage change from 2017 to 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts