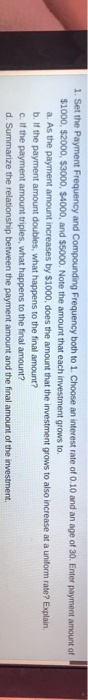

Question: 1. Set the Payment Frequency and Compounding Frequency both to 1. Choose an interest rate of 0.10 and an age of 30. Enter payment amount

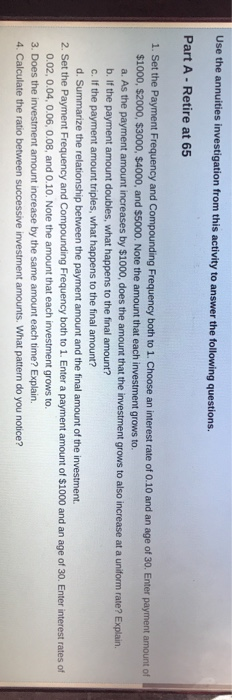

1. Set the Payment Frequency and Compounding Frequency both to 1. Choose an interest rate of 0.10 and an age of 30. Enter payment amount of $1000, 52000, S3000, $4000, and $5000. Note the amount that each investment grows to a. As the payment amount increases by $1000, does the amount that the investment grows to also increase at a uniform rate? Explain b. If the payment amount doubles, what happens to the final amount? c. If the payment amount triples, what happens to the final amount? d. Summarize the relationship between the payment amount and the final amount of the investment Use the annuities investigation from this activity to answer the following questions. Part A - Retire at 65 1. Set the Payment Frequency and Compounding Frequency both to 1. Choose an interest rate of 0.10 and an age of 30. Enter payment amount of $1000, $2000, $3000, $4000, and $5000. Note the amount that each investment grows to. a. As the payment amount increases by $1000, does the amount that the investment grows to also increase at a uniform rate? Explain. b. If the payment amount doubles, what happens to the final amount? c. If the payment amount triples, what happens to the final amount? d. Summarize the relationship between the payment amount and the final amount of the investment. 2. Set the Payment Frequency and Compounding Frequency both to 1. Enter a payment amount of $1000 and an age of 30. Enter interest rates of 0.02, 0.04, 0.06, 0.08, and 0.10. Note the amount that each investment grows to 3. Does the investment amount increase by the same amount each time? Explain. 4. Calculate the ratio between successive investment amounts. What pattern do you notice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts