Question: 1. Set up the problem (you do not need to do the calculations) for determining the minimum premium that an insurance company should charge for

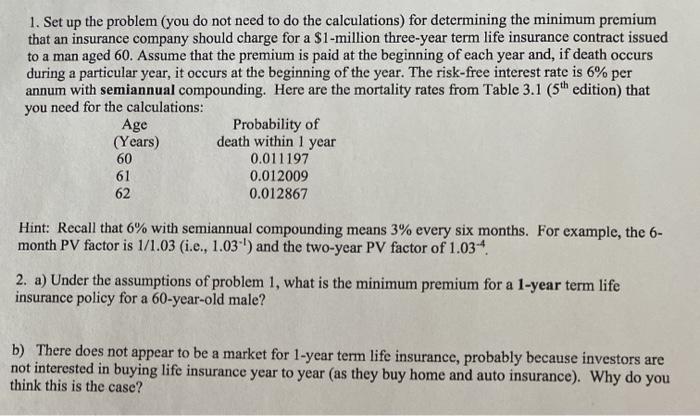

1. Set up the problem (you do not need to do the calculations) for determining the minimum premium that an insurance company should charge for a $1-million three-year term life insurance contract issued to a man aged 60. Assume that the premium is paid at the beginning of each year and, if death occurs during a particular year, it occurs at the beginning of the year. The risk-free interest rate is 6% per annum with semiannual compounding. Here are the mortality rates from Table 3.1 (5th edition) that you need for the calculations: Age Probability of (Years) death within 1 year 60 0.011197 61 0.012009 62 0.012867 Hint: Recall that 6% with semiannual compounding means 3% every six months. For example, the 6- month PV factor is 1/1.03 i.e., 1.03-') and the two-year PV factor of 1.034 2. a) Under the assumptions of problem 1, what is the minimum premium for a 1-year term life insurance policy for a 60-year-old male? b) There does not appear to be a market for 1-year term life insurance, probably because investors are not interested in buying life insurance year to year (as they buy home and auto insurance). Why do you think this is the case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts