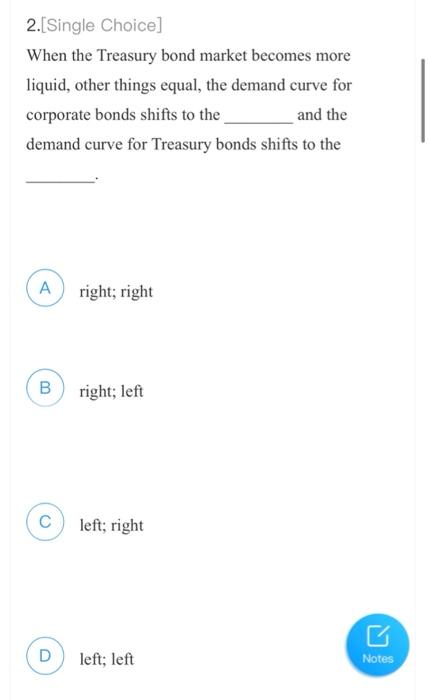

Question: 1. [Single Choice] A bond with default risk will always have a risk premium and an increase in its default risk will the risk premium.

![1. [Single Choice] A bond with default risk will always have](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67025610a179e_35267025610416b6.jpg)

![lower 2.[Single Choice] When the Treasury bond market becomes more liquid, other](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670256127b0e9_354670256121e247.jpg)

![Bright; left left; right D left; left Notes 3. Single Choice] Which](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670256144f590_3566702561401afc.jpg)

![B U.S. Treasury bonds Investment-grade bonds D Corporate Baa bonds 4.[Single Choice]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670256156230d_35767025615144d0.jpg)

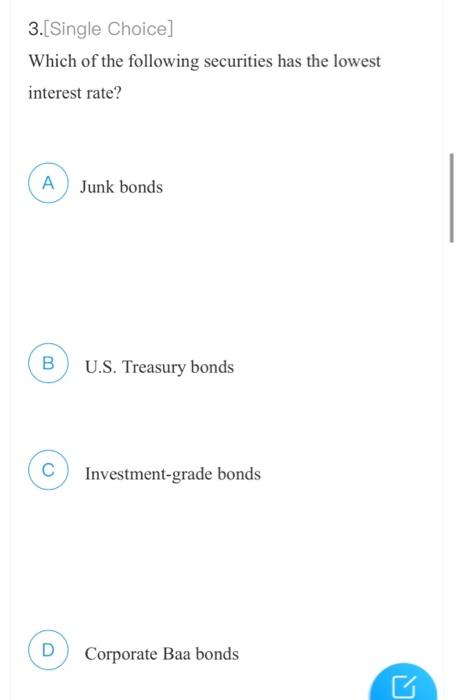

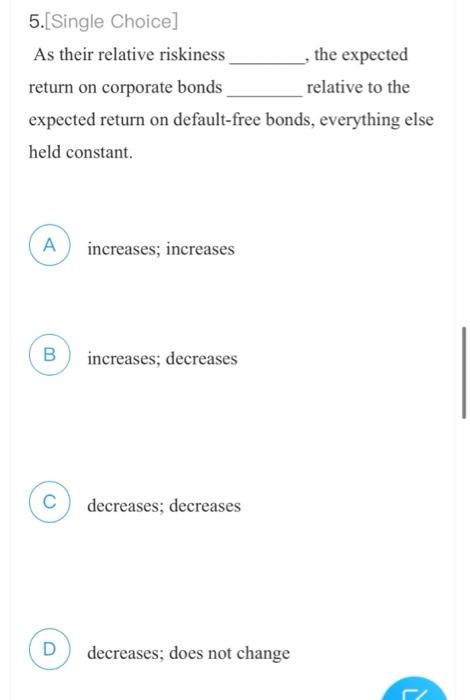

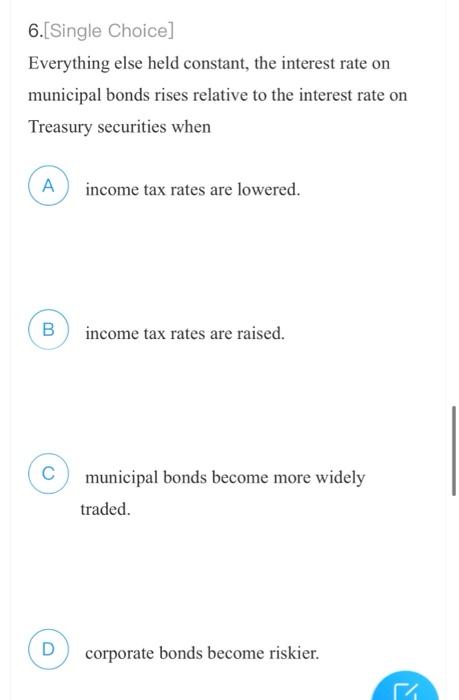

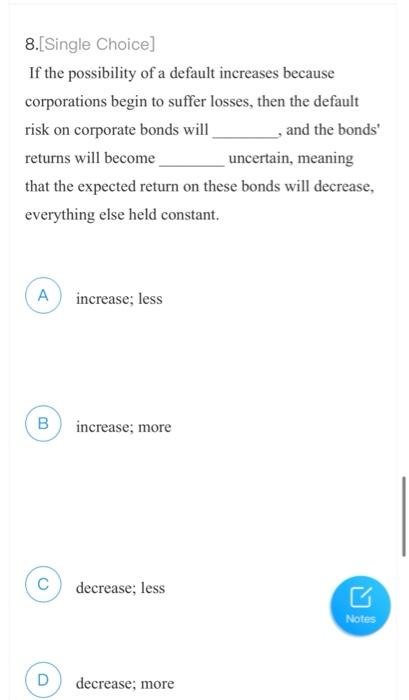

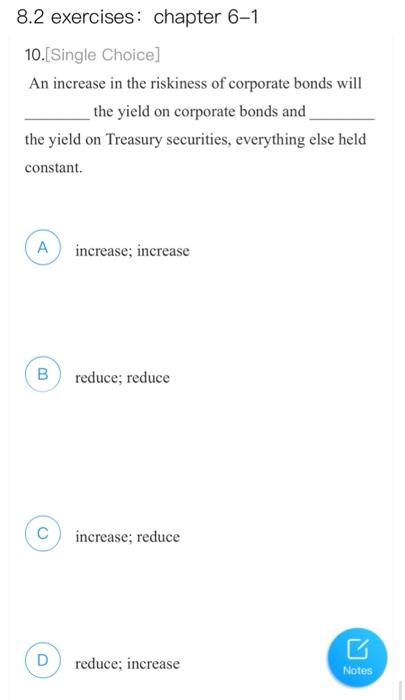

1. [Single Choice] A bond with default risk will always have a risk premium and an increase in its default risk will the risk premium. A positive; raise B) positive; lowe negative; raise D negative; lower 2.[Single Choice] When the Treasury bond market becomes more liquid, other things equal, the demand curve for corporate bonds shifts to the and the demand curve for Treasury bonds shifts to the A right; right Bright; left left; right D left; left Notes 3. Single Choice] Which of the following securities has the lowest interest rate? A Junk bonds B U.S. Treasury bonds Investment-grade bonds D Corporate Baa bonds 4.[Single Choice] If the probability of a bond default increases because corporations begin to suffer large losses, then the default risk on corporate bonds will and the expected return on these bonds will everything else held constant. A decrease; increase B decrease; decrease C increase; increase increase; decrease Notes 5.[Single Choice] As their relative riskiness the expected return on corporate bonds relative to the expected return on default-free bonds, everything else held constant. A increases; increases 00 B increases; decreases decreases; decreases D decreases; does not change 6.[Single Choice] Everything else held constant, the interest rate on municipal bonds rises relative to the interest rate on Treasury securities when income tax rates are lowered. B income tax rates are raised. municipal bonds become more widely traded. D corporate bonds become riskier. 7.[Single Choice] Which of the following bonds are considered to be default-risk free? A Municipal bonds B Investment-grade bonds U.S. Treasury bonds D Junk bonds Notes 8.[Single Choice] If the possibility of a default increases because corporations begin to suffer losses, then the default risk on corporate bonds will _, and the bonds returns will become uncertain, meaning that the expected return on these bonds will decrease, everything else held constant. increase; less B increase; more C decrease; less Notes D decrease; more 9.(Single Choice] Bonds with relatively high risk of default are called Brady bonds. B junk bonds. zero coupon bonds. D investment grade bonds. 8.2 exercises: chapter 6-1 10.[Single Choice] An increase in the riskiness of corporate bonds will the yield on corporate bonds and the yield on Treasury securities, everything else held constant. A increase; increase B reduce; reduce C increase; reduce D reduce; increase Notes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts