Question: 1) Solve ALL problems using a financial calculator; please do not use annuity formulas 2) Please show all work!!! This helps me understand how you

1) Solve ALL problems using a financial calculator; please do not use annuity formulas 2) Please show all work!!! This helps me understand how you are thinking

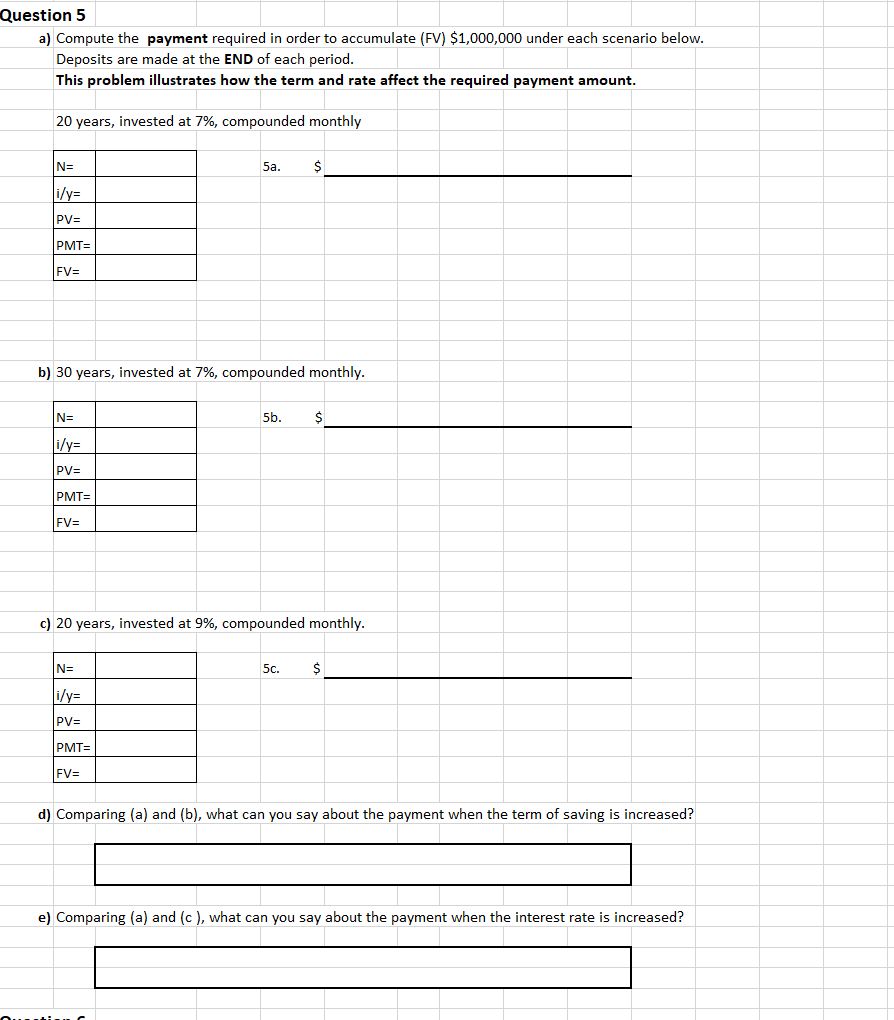

Question 5 a) Compute the payment required in order to accumulate (FV) $1,000,000 under each scenario below. Deposits are made at the END of each period. This problem illustrates how the term and rate affect the required payment amount. 20 years, invested at 7%, compounded monthly \begin{tabular}{|l|l|} \hline N= & \\ \hline i/Y= & \\ \hline PV= & \\ \hline PMT= & \\ \hline FV= & \\ \hline \end{tabular} 5a. b) 30 years, invested at 7%, compounded monthly. \begin{tabular}{|l|l|} \hline N= & \\ \hline i/Y= & \\ \hline PV= & \\ \hline PMT= & \\ \hline FV= & \\ \hline \end{tabular} 5b. c) 20 years, invested at 9%, compounded monthly. \begin{tabular}{|l|l|} \hline N= & \\ \hline i/y= & \\ \hline PV= & \\ \hline PMT= & \\ \hline FV= & \\ \hline \end{tabular} 5c. d) Comparing (a) and (b), what can you say about the payment when the term of saving is increased? e) Comparing (a) and (c), what can you say about the payment when the interest rate is increased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts