Question: 1. Sooner Company has the following transactions: May 1 Customer ordered an installation service to be done on May 15 May 2 Customer paid cash

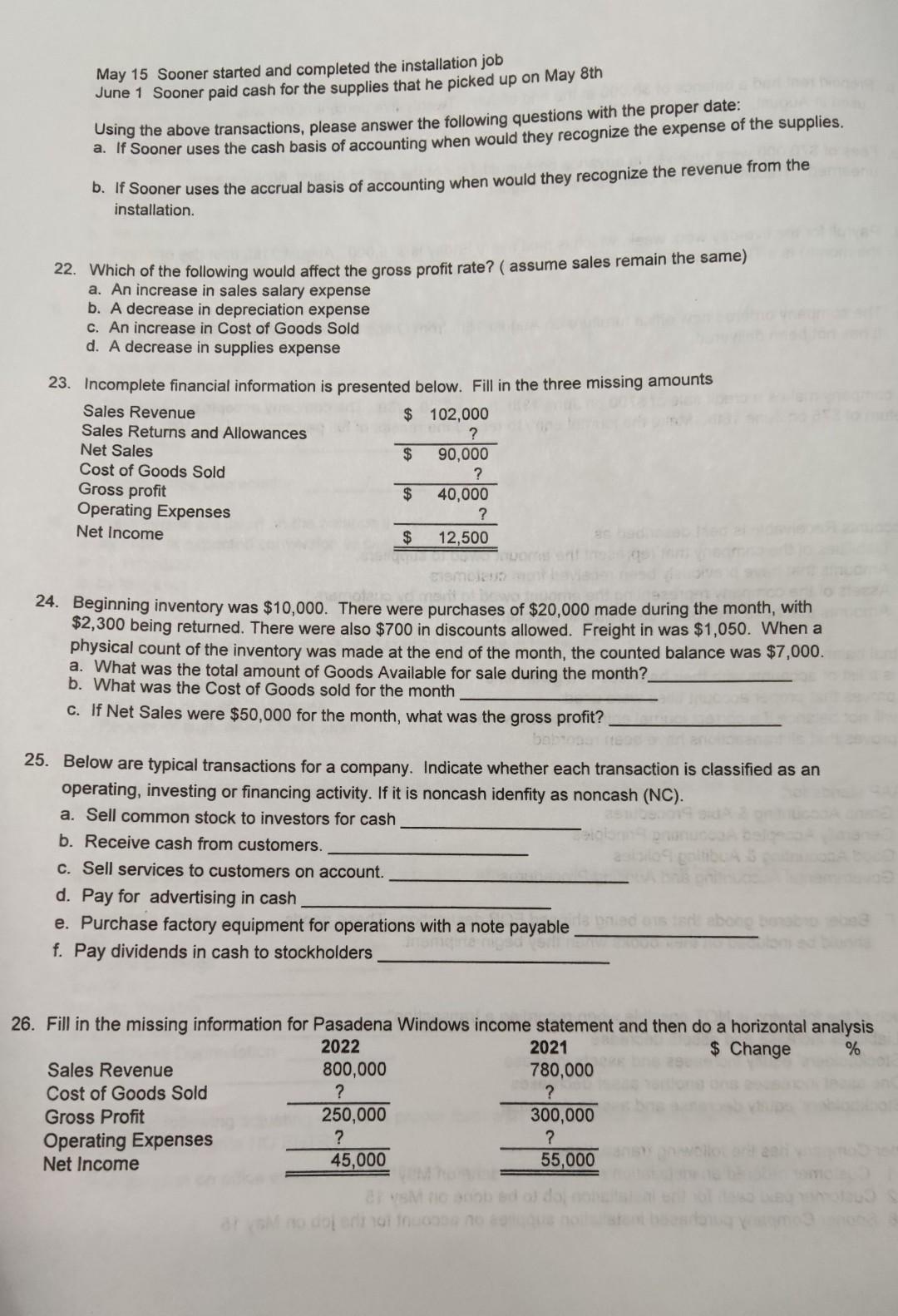

1. Sooner Company has the following transactions: May 1 Customer ordered an installation service to be done on May 15 May 2 Customer paid cash for the installation job to be done on May 15 May 8 Sooner Company purchased installation supplies on account for the job on May 15 May 15 Sooner started and completed the installation job June 1 Sooner paid cash for the supplies that he picked up on May 8th Using the above transactions, please answer the following questions with the proper date: a. If Sooner uses the cash basis of accounting when would they recognize the expense of the supplies. b. If Sooner uses the accrual basis of accounting when would they recognize the revenue from the installation. 22. Which of the following would affect the gross profit rate? (assume sales remain the same) a. An increase in sales salary expense b. A decrease in depreciation expense c. An increase in Cost of Goods Sold d. A decrease in supplies expense 23. Incomplete financial information is presented below. Fill in the three missing amounts 24. Beginning inventory was $10,000. There were purchases of $20,000 made during the month, with $2,300 being returned. There were also $700 in discounts allowed. Freight in was $1,050. When a physical count of the inventory was made at the end of the month, the counted balance was $7,000. a. What was the total amount of Goods Available for sale during the month? b. What was the Cost of Goods sold for the month c. If Net Sales were $50,000 for the month, what was the gross profit? 25. Below are typical transactions for a company. Indicate whether each transaction is classified as an operating, investing or financing activity. If it is noncash idenfity as noncash (NC). a. Sell common stock to investors for cash b. Receive cash from customers. c. Sell services to customers on account. d. Pay for advertising in cash e. Purchase factory equipment for operations with a note payable f. Pay dividends in cash to stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts