Question: 1. Statement of cash flows - Indirect method Aa Aa The income statement and comparative balance sheets for Thomas Inc. are shown below. The statement

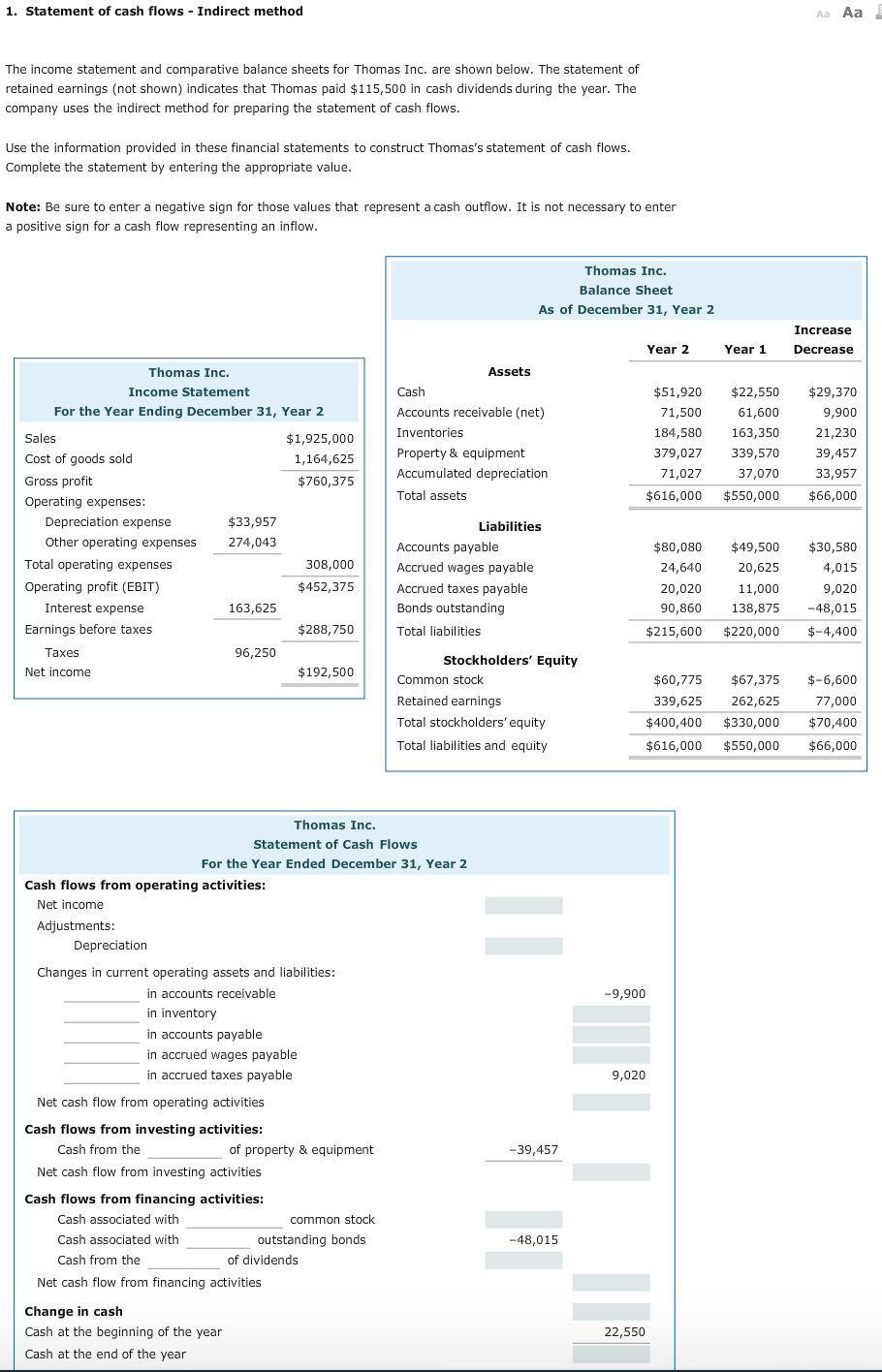

1. Statement of cash flows - Indirect method Aa Aa The income statement and comparative balance sheets for Thomas Inc. are shown below. The statement of retained earnings (not shown) indicates that Thomas paid $115,500 in cash dividends during the year. The company uses the indirect method for preparing the statement of cash flows. Use the information provided in these financial statements to construct Thomas's statement of cash flows. Complete the statement by entering the appropriate value. Note: Be sure to enter a negative sign for those values that represent a cash outflow. It is not necessary to enter a positive sign for a cash flow representing an inflow. Thomas Inc. Balance Sheet As of December 31, Year 2 Year 2 Increase Decrease Year 1 Thomas Inc. Income Statement For the Year Ending December 31, Year 2 $1,925,000 1,164,625 $760,375 Assets Cash Accounts receivable (net) Inventories Property & equipment Accumulated depreciation Total assets $51,920 71,500 184,580 379,027 71,027 $616,000 $22,550 61,600 163,350 339,570 37,070 $550,000 $29,370 9,900 21,230 39,457 33,957 $66,000 $33,957 274,043 Sales Cost of goods sold Gross profit Operating expenses: Depreciation expense Other operating expenses Total operating expenses Operating profit (EBIT) Interest expense Earnings before taxes Taxes Net income 308,000 $452,375 Liabilities Accounts payable Accrued wages payable Accrued taxes payable Bonds outstanding Total liabilities $80,080 24,640 20,020 90,860 $215,600 $49,500 20,625 11,000 138,875 $220,000 $30,580 4,015 9,020 -48,015 $-4,400 163,625 $288,750 96,250 $192,500 Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and equity $60,775 339,625 $400,400 $616,000 $67,375 262,625 $330,000 $550,000 $-6,600 77,000 $70,400 $66,000 Thomas Inc. Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Net income Adjustments: Depreciation -9,900 Changes in current operating assets and liabilities: in accounts receivable in inventory in accounts payable in accrued wages payable in accrued taxes payable Net cash flow from operating activities Cash flows from investing activities: Cash from the of property & equipment Net cash flow from investing activities 9,020 -39,457 Cash flows from financing activities: Cash associated with common stock Cash associated with outstanding bonds Cash from the of dividends Net cash flow from financing activities -48,015 Change in cash Cash at the beginning of the year Cash at the end of the year 22,550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts