Question: 1. Statistical measures of standalone risk Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to

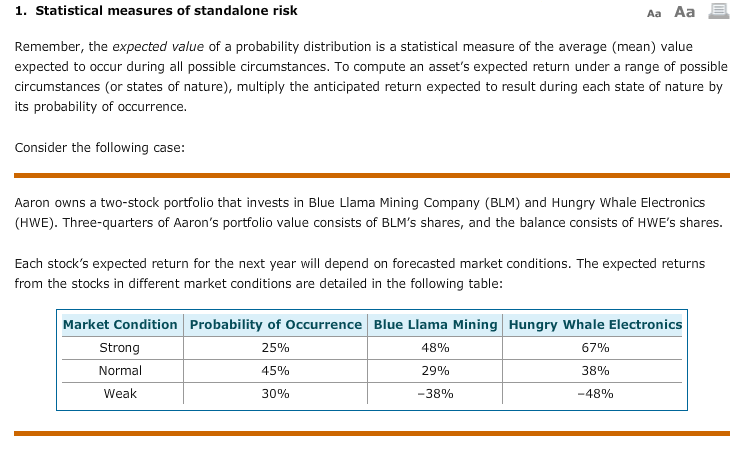

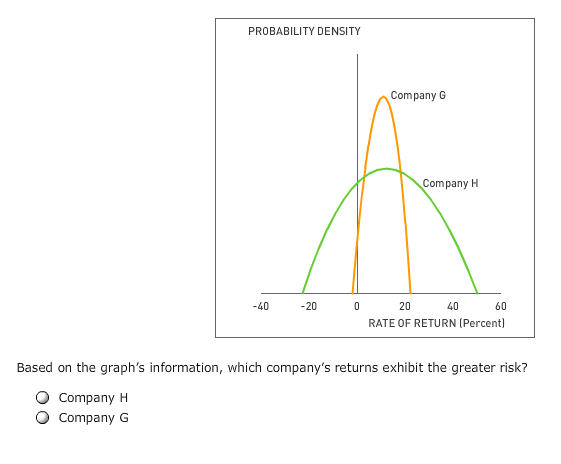

1. Statistical measures of standalone risk Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence Consider the following case: Aaron owns a two-stock portfolio that invests in Blue Llama Mining Company (BLM) and Hungry Whale Electronics (HWE). Three-quarters of Aaron's portfolio value consists of BLM's Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table consists of HWE's shares Market Condition Probability of Occurrence Blue Llama Mining Hungry Whale Electronics Strong Norma Weak 25% 45% 30% 48% 29% -38% 67% 38% -4890

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts