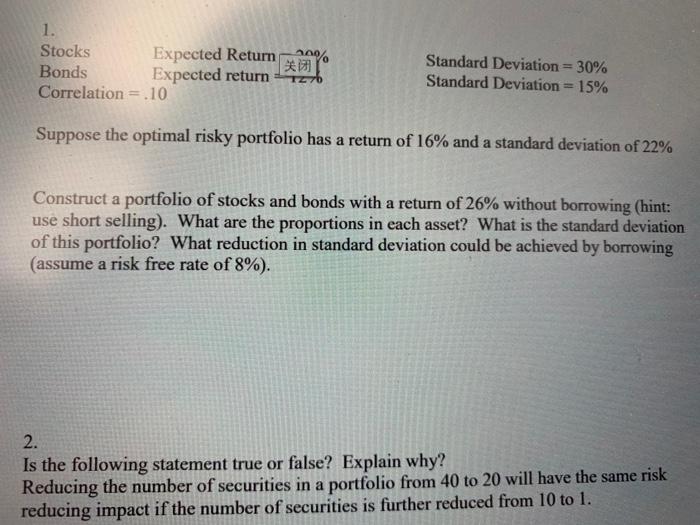

Question: 1. Stocks Expected Return Bonds Expected return Correlation = .10 Standard Deviation = 30% Standard Deviation = 15% Suppose the optimal risky portfolio has a

1. Stocks Expected Return Bonds Expected return Correlation = .10 Standard Deviation = 30% Standard Deviation = 15% Suppose the optimal risky portfolio has a return of 16% and a standard deviation of 22% Construct a portfolio of stocks and bonds with a return of 26% without borrowing (hint: use short selling). What are the proportions in each asset? What is the standard deviation of this portfolio? What reduction in standard deviation could be achieved by borrowing (assume a risk free rate of 8%). 2. Is the following statement true or false? Explain why? Reducing the number of securities in a portfolio from 40 to 20 will have the same risk reducing impact if the number of securities is further reduced from 10 to 1. 1. Stocks Expected Return Bonds Expected return Correlation = .10 Standard Deviation = 30% Standard Deviation = 15% Suppose the optimal risky portfolio has a return of 16% and a standard deviation of 22% Construct a portfolio of stocks and bonds with a return of 26% without borrowing (hint: use short selling). What are the proportions in each asset? What is the standard deviation of this portfolio? What reduction in standard deviation could be achieved by borrowing (assume a risk free rate of 8%). 2. Is the following statement true or false? Explain why? Reducing the number of securities in a portfolio from 40 to 20 will have the same risk reducing impact if the number of securities is further reduced from 10 to 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts