Question: 1) Stocks K,L and M each has the same expected return and standard deviation. The correlation coefficients between each pair of these stocks are: (1

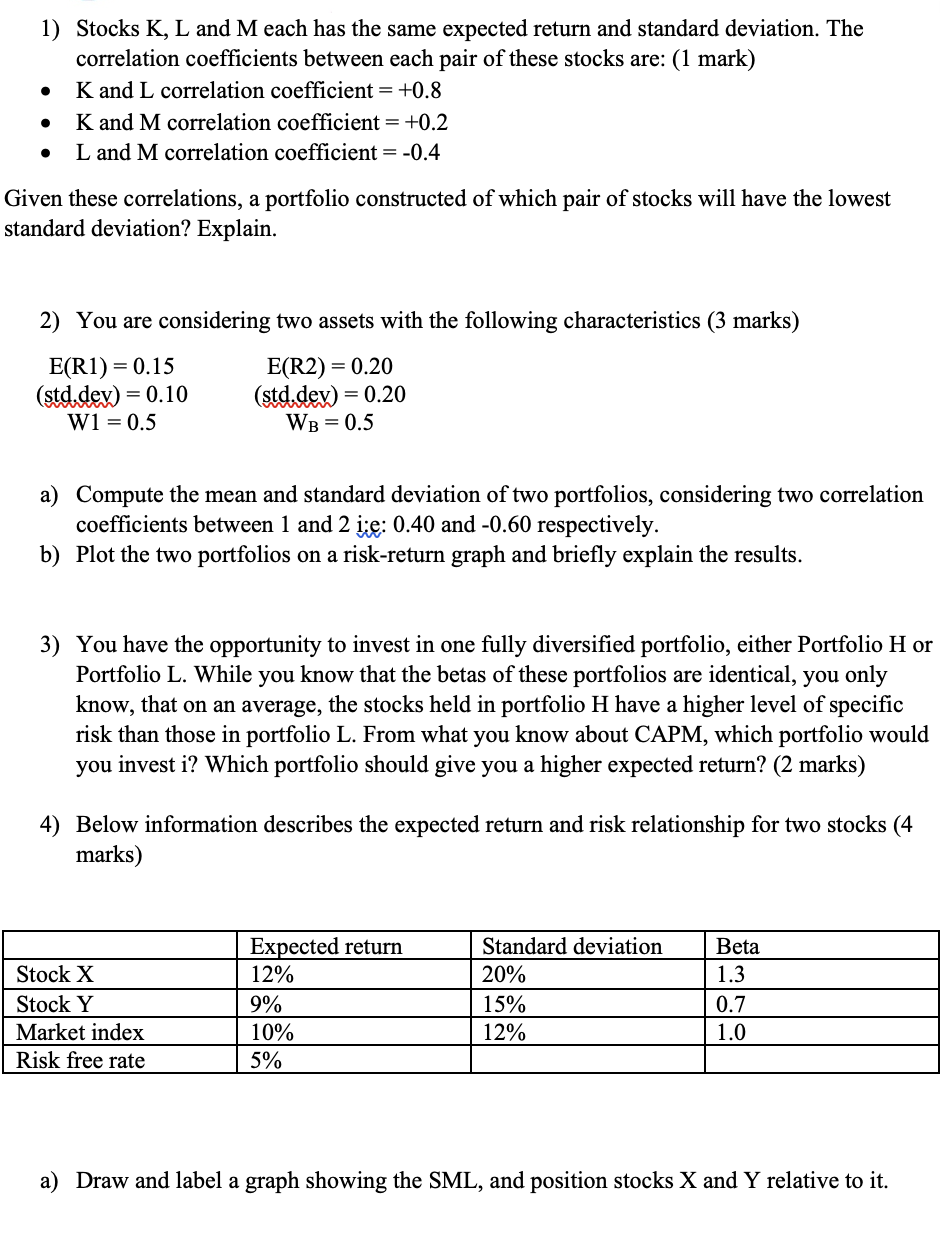

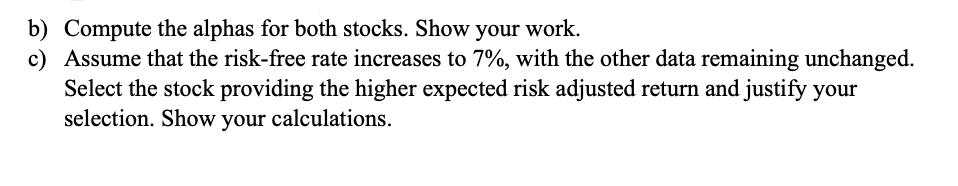

1) Stocks K,L and M each has the same expected return and standard deviation. The correlation coefficients between each pair of these stocks are: (1 mark) - K and L correlation coefficient =+0.8 - K and M correlation coefficient =+0.2 - L and M correlation coefficient =0.4 Given these correlations, a portfolio constructed of which pair of stocks will have the lowest standard deviation? Explain. 2) You are considering two assets with the following characteristics (3 marks) E(R1)=0.15(std.dey)=0.10W1=0.5E(R2)=0.20(std.dev)=0.20WB=0.5 a) Compute the mean and standard deviation of two portfolios, considering two correlation coefficients between 1 and 2 i:e: 0.40 and -0.60 respectively. b) Plot the two portfolios on a risk-return graph and briefly explain the results. 3) You have the opportunity to invest in one fully diversified portfolio, either Portfolio H or Portfolio L. While you know that the betas of these portfolios are identical, you only know, that on an average, the stocks held in portfolio H have a higher level of specific risk than those in portfolio L. From what you know about CAPM, which portfolio would you invest i? Which portfolio should give you a higher expected return? (2 marks) 4) Below information describes the expected return and risk relationship for two stocks (4 marks) a) Draw and label a graph showing the SML, and position stocks X and Y relative to it. b) Compute the alphas for both stocks. Show your work. c) Assume that the risk-free rate increases to 7%, with the other data remaining unchanged. Select the stock providing the higher expected risk adjusted return and justify your selection. Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts