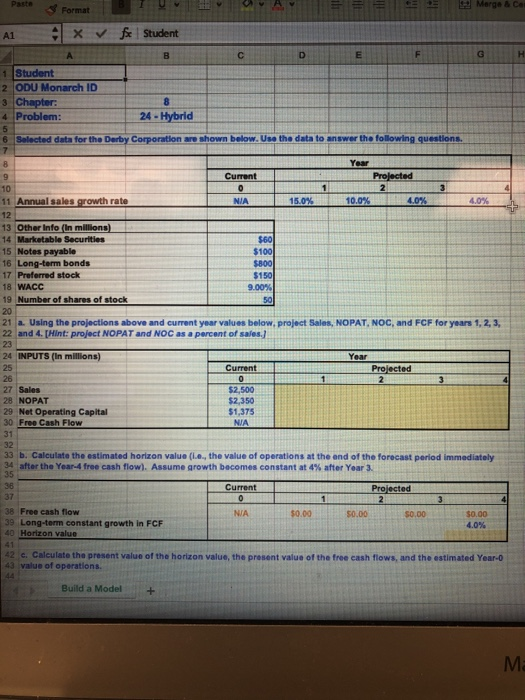

Question: 1 Student 2 ODU Monarch ID 3 Chapter 4 Problem: 24-Hybrid 6 Selected data for the Derby Corporation are shown below.Use the data to answer

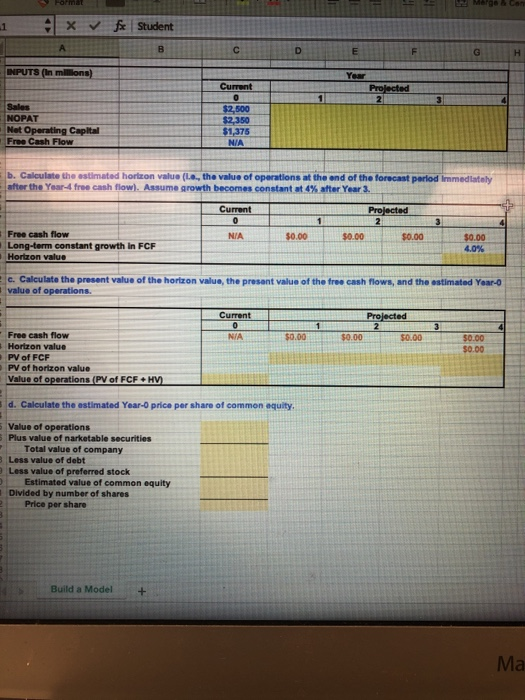

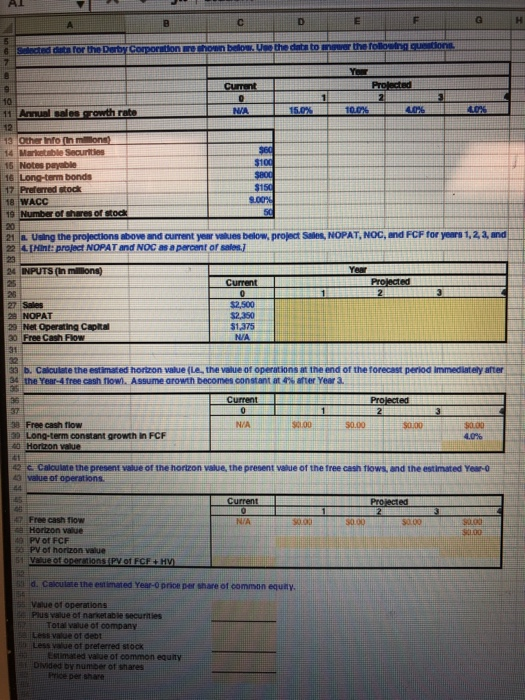

1 Student 2 ODU Monarch ID 3 Chapter 4 Problem: 24-Hybrid 6 Selected data for the Derby Corporation are shown below.Use the data to answer the following questions Year Current 11 Annual sales growth rate NIA 4.0% 15.0% 13 Other Info (In millions) 14 Marketable Securities 15 Notes payable 16 Long-term bonds 17 Preferred stock 18 WACC $100 $150 20 21 a. Using the projections above and current year values below, project Sales, NOPAT, NOC, and FCF for years 1,2,3, 22 and 4 [Hint: project NOPAT and NOC as a percent of sales. 24 INPUTS (In millions) Year Current Projected 27 Sales 28 NOPAT 29 Net Operating Capital 30 Free Cash Flow 31 32 33 b. Calculate the estimated horizon value (i.o, the value of operations at the and of the forecast period immediately 34 after the Year-4 free cash flow. Assume growth becomes constant at 4% after Year 3. $2,500 $2,350 $1,375 35 Current Projected 37 38 Free cash flow 39 Long-term constant growth in FCF 40 Horizon value NIA $0.00 s0.00 $0.00 4,0% 42 e. Calculate the present value of the horizon value, the present value of the free cash flows, and the estimated Year-0 43 value of operations. Build a Model+ Ma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts