Question: 1. Suppose that Nathan and Mia work for the same employer, but they choose different medical plans based on their needs. Use the following

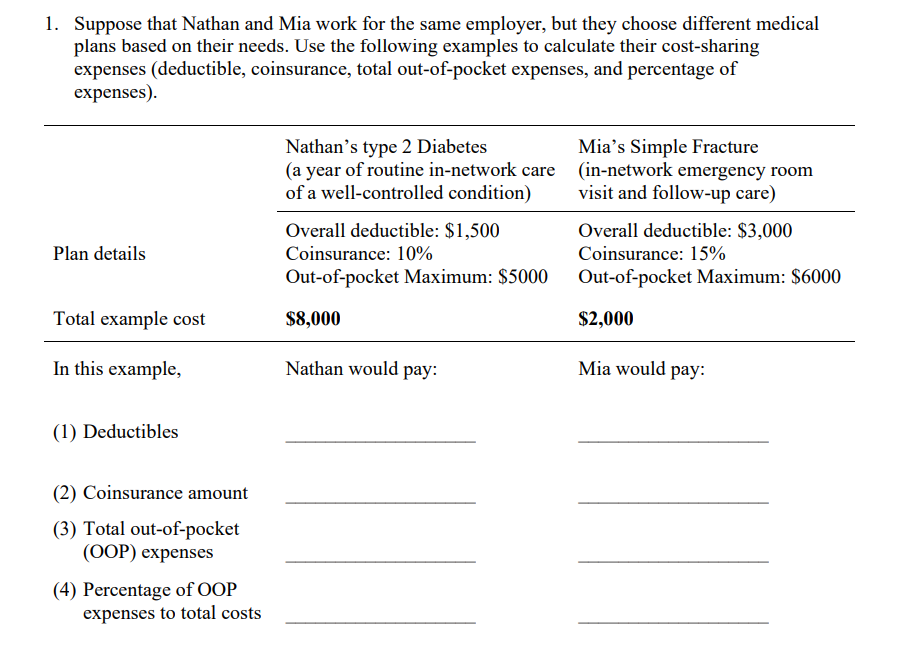

1. Suppose that Nathan and Mia work for the same employer, but they choose different medical plans based on their needs. Use the following examples to calculate their cost-sharing expenses (deductible, coinsurance, total out-of-pocket expenses, and percentage of expenses). Plan details Total example cost In this example, (1) Deductibles (2) Coinsurance amount (3) Total out-of-pocket (OOP) expenses (4) Percentage of OOP expenses to total costs Nathan's type 2 Diabetes (a year of routine in-network care of a well-controlled condition) Overall deductible: $1,500 Coinsurance: 10% Out-of-pocket Maximum: $5000 $8,000 Nathan would pay: Mia's Simple Fracture (in-network emergency room visit and follow-up care) Overall deductible: $3,000 Coinsurance: 15% Out-of-pocket Maximum: $6000 $2,000 Mia would pay:

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

For Nathan 1 Deductible Nathans deductible is 1500 Since his example cost is 8000 he would have to pay the full amount of his deductible before his in... View full answer

Get step-by-step solutions from verified subject matter experts