Question: 1. Suppose that US dollar (USD) has a continuously compounded interest rate of 1% per annum and Australian dollar (AUD) has a continuously compounded interest

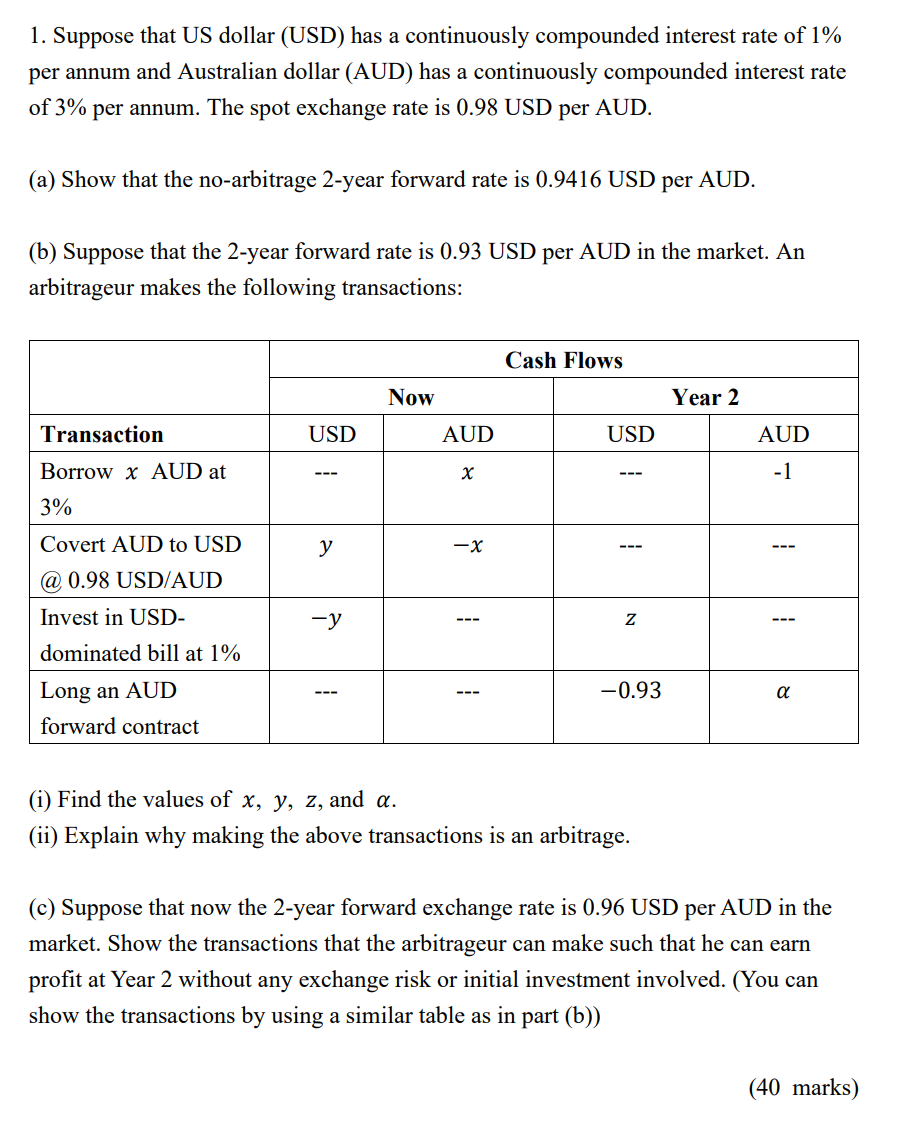

1. Suppose that US dollar (USD) has a continuously compounded interest rate of 1% per annum and Australian dollar (AUD) has a continuously compounded interest rate of 3% per annum. The spot exchange rate is 0.98 USD per AUD. (a) Show that the no-arbitrage 2-year forward rate is 0.9416 USD per AUD. (b) Suppose that the 2-year forward rate is 0.93 USD per AUD in the market. An arbitrageur makes the following transactions: Cash Flows Now Year 2 Transaction USD AUD USD AUD Borrow x AUD at -1 3% -X -y --- Z --- Covert AUD to USD @ 0.98 USD/AUD Invest in USD- dominated bill at 1% Long an AUD forward contract --- -0.93 (i) Find the values of x, y, z, and a. (ii) Explain why making the above transactions is an arbitrage. (c) Suppose that now the 2-year forward exchange rate is 0.96 USD per AUD in the market. Show the transactions that the arbitrageur can make such that he can earn profit at Year 2 without any exchange risk or initial investment involved. (You can show the transactions by using a similar table as in part (b)) (40 marks) 1. Suppose that US dollar (USD) has a continuously compounded interest rate of 1% per annum and Australian dollar (AUD) has a continuously compounded interest rate of 3% per annum. The spot exchange rate is 0.98 USD per AUD. (a) Show that the no-arbitrage 2-year forward rate is 0.9416 USD per AUD. (b) Suppose that the 2-year forward rate is 0.93 USD per AUD in the market. An arbitrageur makes the following transactions: Cash Flows Now Year 2 Transaction USD AUD USD AUD Borrow x AUD at -1 3% -X -y --- Z --- Covert AUD to USD @ 0.98 USD/AUD Invest in USD- dominated bill at 1% Long an AUD forward contract --- -0.93 (i) Find the values of x, y, z, and a. (ii) Explain why making the above transactions is an arbitrage. (c) Suppose that now the 2-year forward exchange rate is 0.96 USD per AUD in the market. Show the transactions that the arbitrageur can make such that he can earn profit at Year 2 without any exchange risk or initial investment involved. (You can show the transactions by using a similar table as in part (b)) (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts