Question: 1. Suppose the estimated linear probability model used by an FI to predict business loan applicant default probabilities is PD=0.03X1 + 0.02X2 - 0.05X3 +

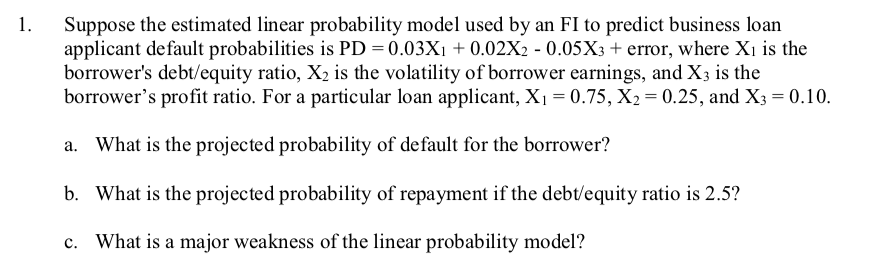

1. Suppose the estimated linear probability model used by an FI to predict business loan applicant default probabilities is PD=0.03X1 + 0.02X2 - 0.05X3 + error, where X is the borrower's debt/equity ratio, X2 is the volatility of borrower earnings, and X3 is the borrower's profit ratio. For a particular loan applicant, X1 = 0.75, X2 = 0.25, and X3 = 0.10. a. What is the projected probability of default for the borrower? b. What is the projected probability of repayment if the debt/equity ratio is 2.5? c. What is a major weakness of the linear probability model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts