Question: 1) Suppose you have a choice between two bonds. The first bond, issued by AT&T (rated A2 by Moody's in June 2020) has a zero-coupon

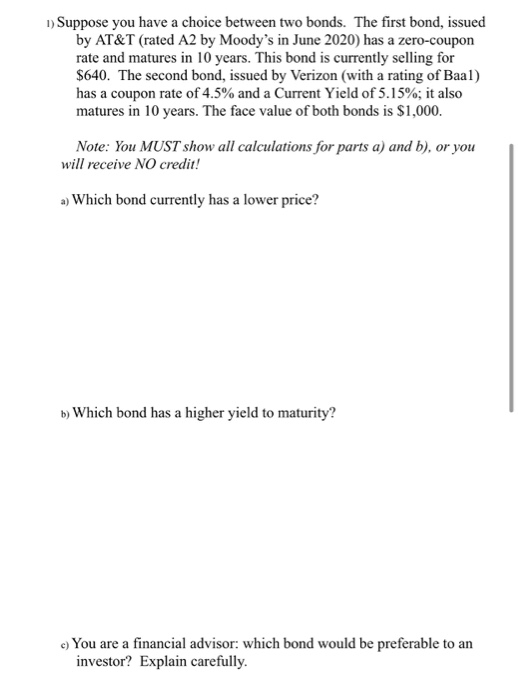

1) Suppose you have a choice between two bonds. The first bond, issued by AT&T (rated A2 by Moody's in June 2020) has a zero-coupon rate and matures in 10 years. This bond is currently selling for $640. The second bond, issued by Verizon (with a rating of Baal) has a coupon rate of 4.5% and a Current Yield of 5.15%; it also matures in 10 years. The face value of both bonds is $1,000. Note: You MUST show all calculations for parts a) and b), or you will receive NO credit! a) Which bond currently has a lower price? b) Which bond has a higher yield to maturity? c) You are a financial advisor: which bond would be preferable to an investor? Explain carefully

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts