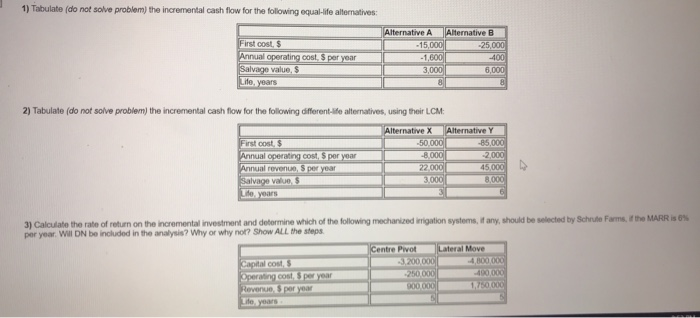

Question: 1) Tabulate (do not solve problem) the incremental cash flow for the following equal-life alternatives: Alternative A Alternative B - 15.000 25,000 First cost $

1) Tabulate (do not solve problem) the incremental cash flow for the following equal-life alternatives: Alternative A Alternative B - 15.000 25,000 First cost $ Annual operating costs per year Salvage value, $ Lite, years 5.000 2) Tabulate (do not solve problem) the incremental cash flow for the following different life alternatives, using their LCM Alternative X -50.000 Alternative Y 85.000 2000 First cost, $ Annual operating cost, $ per year Annual revenue, S per year Salvage value, $ 22 000 45.000 3) Calculate the rate of return on the incremental investment and determine which of the following mechanized irrigation systems, if any, should be selected by Schrute Farms, if the MARR is 6% per year. WII DN be included in the analysis? Why or why not? Show All the steps Capital costs Operating cost, $ per year Revenue, Spor year Centre Pivo Lateral Move 3200.000 4,100 000 -400,000 1750 1) Tabulate (do not solve problem) the incremental cash flow for the following equal-life alternatives: Alternative A Alternative B - 15.000 25,000 First cost $ Annual operating costs per year Salvage value, $ Lite, years 5.000 2) Tabulate (do not solve problem) the incremental cash flow for the following different life alternatives, using their LCM Alternative X -50.000 Alternative Y 85.000 2000 First cost, $ Annual operating cost, $ per year Annual revenue, S per year Salvage value, $ 22 000 45.000 3) Calculate the rate of return on the incremental investment and determine which of the following mechanized irrigation systems, if any, should be selected by Schrute Farms, if the MARR is 6% per year. WII DN be included in the analysis? Why or why not? Show All the steps Capital costs Operating cost, $ per year Revenue, Spor year Centre Pivo Lateral Move 3200.000 4,100 000 -400,000 1750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts