Question: 1. Task: Draw a BPMN diagram for the financial workflow business process illustrated on pages 133-134 in Chapter 5. FINANCIAL WORKFLOWS The integration of these

1. Task: Draw a BPMN diagram for the financial workflow business process illustrated on pages 133-134 in Chapter 5.

1. Task: Draw a BPMN diagram for the financial workflow business process illustrated on pages 133-134 in Chapter 5.

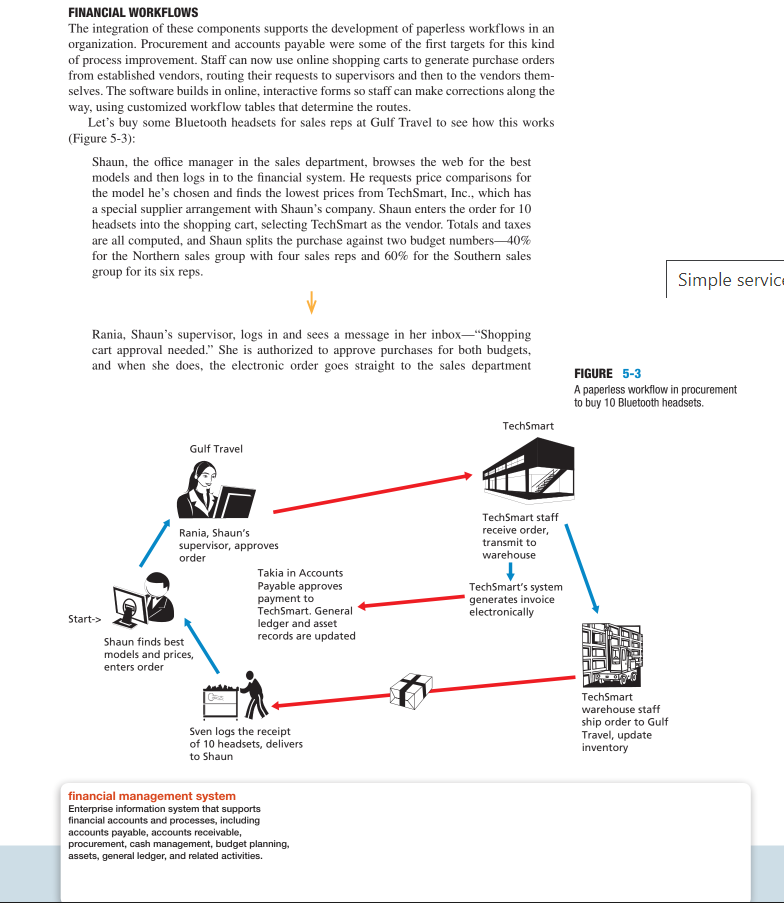

FINANCIAL WORKFLOWS The integration of these components supports the development of paperless workflows in an organization. Procurement and accounts payable were some of the first targets for this kind of process improvement. Staff can now use online shopping carts to generate purchase orders from established vendors, routing their requests to supervisors and then to the vendors them- selves. The software builds in online, interactive forms so staff can make corrections along the way, using customized workflow tables that determine the routes. Let's buy some Bluetooth headsets for sales reps at Gulf Travel to see how this works (Figure 5-3): Shaun, the office manager in the sales department, browses the web for the best models and then logs in to the financial system. He requests price comparisons for the model he's chosen and finds the lowest prices from TechSmart, Inc., which has a special supplier arrangement with Shaun's company. Shaun enters the order for 10 headsets into the shopping cart, selecting TechSmart as the vendor. Totals and taxes are all computed, and Shaun splits the purchase against two budget numbers-40% for the Northern sales group with four sales reps and 60% for the Southern sales group for its six reps. Simple service Rania, Shaun's supervisor, logs in and sees a message in her inbox"Shopping cart approval needed." She is authorized to approve purchases for both budgets, and when she does, the electronic order goes straight to the sales department FIGURE 5-3 A paperless workflow in procurement to buy 10 Bluetooth headsets. TechSmart Gulf Travel TechSmart staff receive order, transmit to warehouse Rania, Shaun's supervisor, approves order Takia in Accounts Payable approves payment to TechSmart. General Start-> ledger and asset Shaun finds best records are updated models and prices, enters order TechSmart's system generates invoice electronically Sven logs the receipt of 10 headsets, delivers to Shaun TechSmart warehouse staff ship order to Gulf Travel, update inventory financial management system Enterprise information system that supports financial accounts and processes, including accounts payable, accounts receivable, procurement, cash management, budget planning, assets, general ledger, and related activities. 134 INTRODUCTION TO INFORMATION SYSTEMS at TechSmart because the supplier's contact information is all filled out in Gulf Travel's system. TechSmart staff receive the order and electronically deliver it to the warehouse for fulfillment. Gulf Travel's system is linked to TechSmart's inventory information, so Shaun already knew that TechSmart had the headsets in stock. TechSmart's ware- house ships the box to Gulf Travel. Sven, the goods receipt clerk at Gulf Travel, signs for the 10 headsets and logs in to the system to indicate they have been received. He drops the headsets off to Shaun, who hands them out to the sales reps. TechSmart's system automatically generates the invoice and sends it electronically to Gulf Travel Accounts Payable, where Takia can see immediately that the goods were properly requested, approved, shipped, and received. She approves the electronic transfer of funds to TechSmart's bank account. The system automatically updates the general ledger and asset records to indicate the company now owns 10 Bluetooth headsets. Other staff may add detail to those records, such as serial numbers or warranty data. Humans are part of the loop, making decisions, approving actions, and confirming steps in the process. But except for the package's wrapping, paper is not. All the players have real- time access to the same underlying information, so inconsistencies are unlikely. Compare this scenario with one in which orders, approvals, invoices, and payments are all handled manu- ally, moving paper from one person's plastic in-tray to the next, with massive filing cabinets, handwritten signatures, inked stamps, and endless voice mail to clarify stock levels, prices, and shipping dates. Financial Reporting, Compliance, and Transparency Reports are the lifeblood of people in finance and accounting, and information systems rou- tinely generate detailed and summary reports on all the organization's transactions and assets. EXCEPTION REPORTING AND DATA MINING Financial systems generate considerable data, and they can tag unusual events and anoma- lies ones that human beings must review. Such reports and analyses are used to spot mis- takes and also patterns that might point to fraud. U.S companies lose hundreds of billions a year to fraud, and the incidence of fraud continues to mount. Exception reports that identify events that fall outside normal ranges and data mining software that picks up unusual trends are powerful tools to help curb this growing problem.' COMPLIANCE REPORTING Financial systems also carry the major burden of compliance reporting, and in doing so they must conform to local, national, and international regulations that grow increasingly strict. For example, changes in federal banking laws require all banks to report on the assets of American citizens, regardless of whether the bank is in the United States or another country

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts