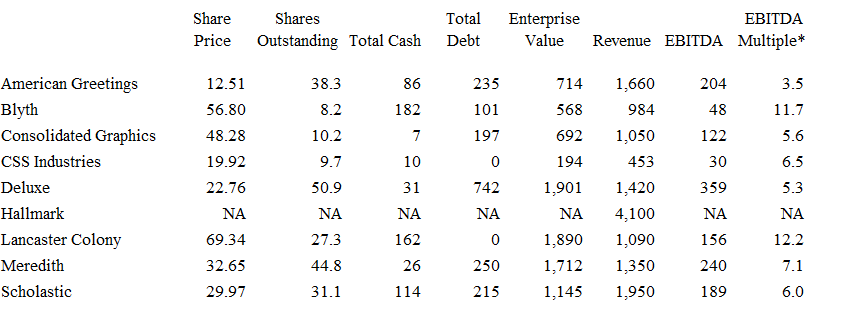

Question: 1. The average EV/EBITDA multiple for the peer group provided in the case (Blyth, Consolidated Graphics, CSS Industries, Deluxe, Lancaster Colony, Meredith, Scholastic) was 7.8x.

1. The average EV/EBITDA multiple for the peer group provided in the case (Blyth, Consolidated Graphics, CSS Industries, Deluxe, Lancaster Colony, Meredith, Scholastic) was 7.8x. Using the peer average multiple, what is the implied Enterprise Value of American Greetings at the end of 2011?

A. 1,591

B. 1,356

C. 1,660

D. None of these

2. Using the industry average EV/EBITDA multiple of 7.8x, what is the implied share price for American Greetings at the end of 2011?

A. $41.54

B. $12.51

C. $35.41

D. $203.97

I believe it's fair posting these two since it's in parts.

Share Shares Total Enterprise EBITDA Revenue EBITDA Multiple* Price Outstanding Total Cash Debt Value American Greetings Blyth Consolidated Graphics 204 12.51 38.3 86 235 714 1,660 3.5 11.7 56.80 8.2 182 101 568 984 48 1,050 122 48.28 10.2 7 197 692 5.6 CSS Industries 19.92 9.7 10 0 194 453 30 6.5 Deluxe 22.76 50.9 31 742 1,901 1,420 359 5.3 Hallmark Lancaster Colony NA NA NA NA NA 4,100 NA NA 1,890 156 12.2 69.34 27.3 162 0 1,090 Meredith 32.65 44.8 26 250 1,712 1,350 240 7.1 Scholastic 29.97 31.1 1,950 114 215 1,145 189 6.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts