Question: 1. The CPP premium rate, for 2021, is: a. 1.58% b. 5.45% C. $3600.00 d. None of the above 2. The El premium rate, for

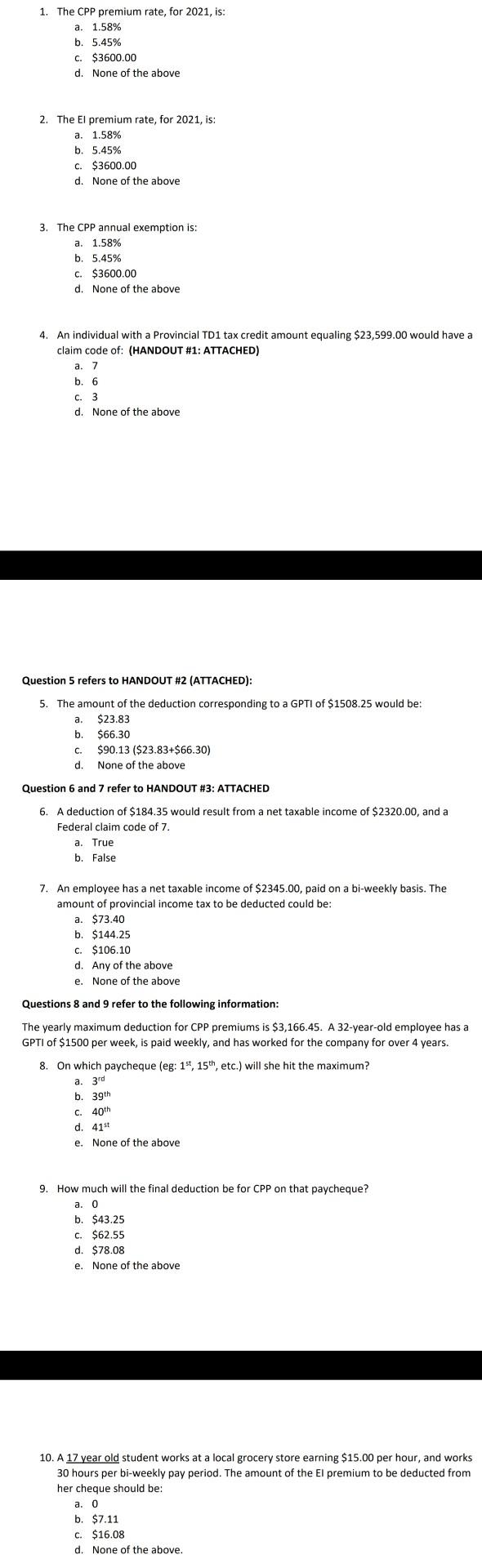

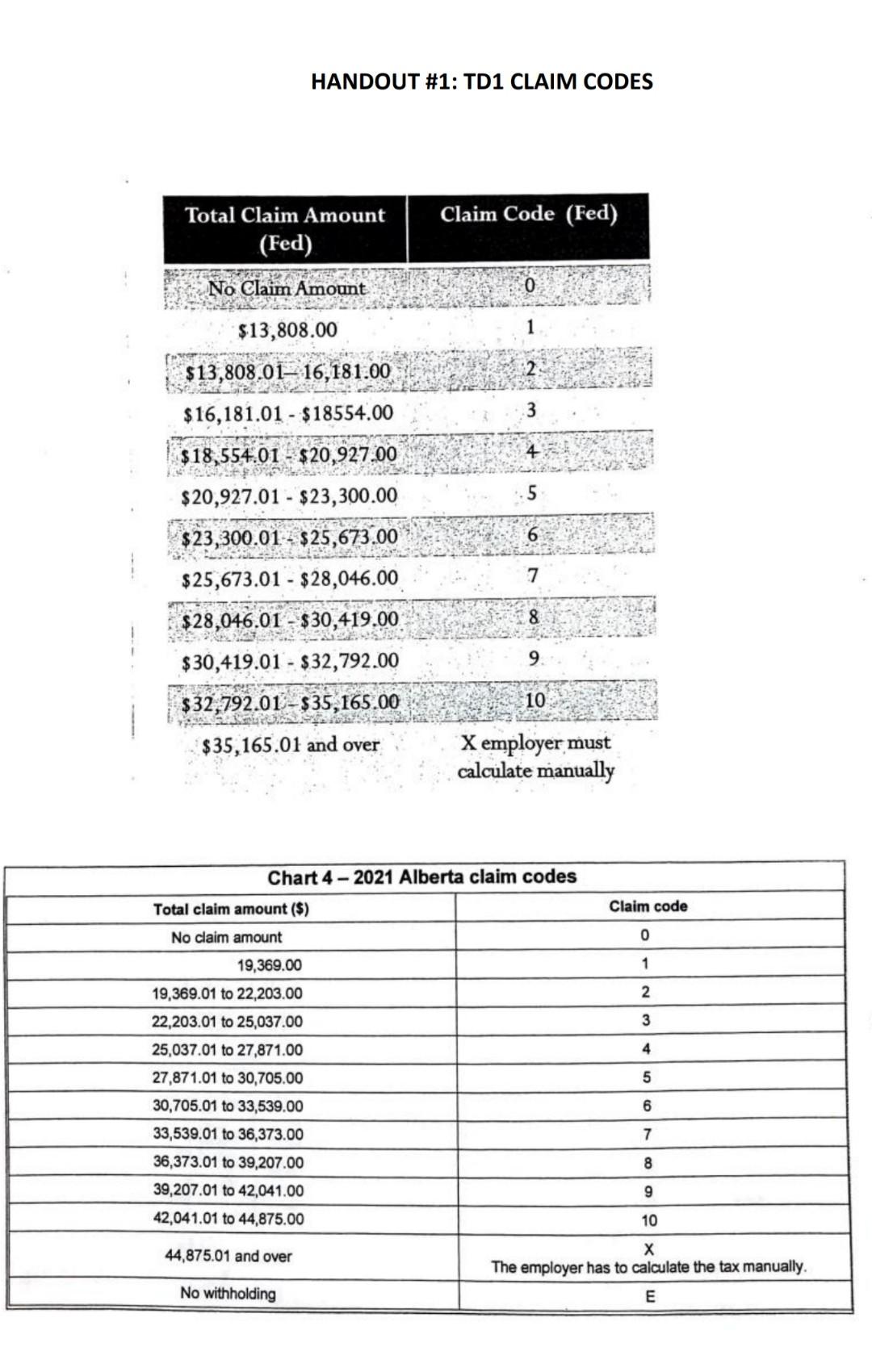

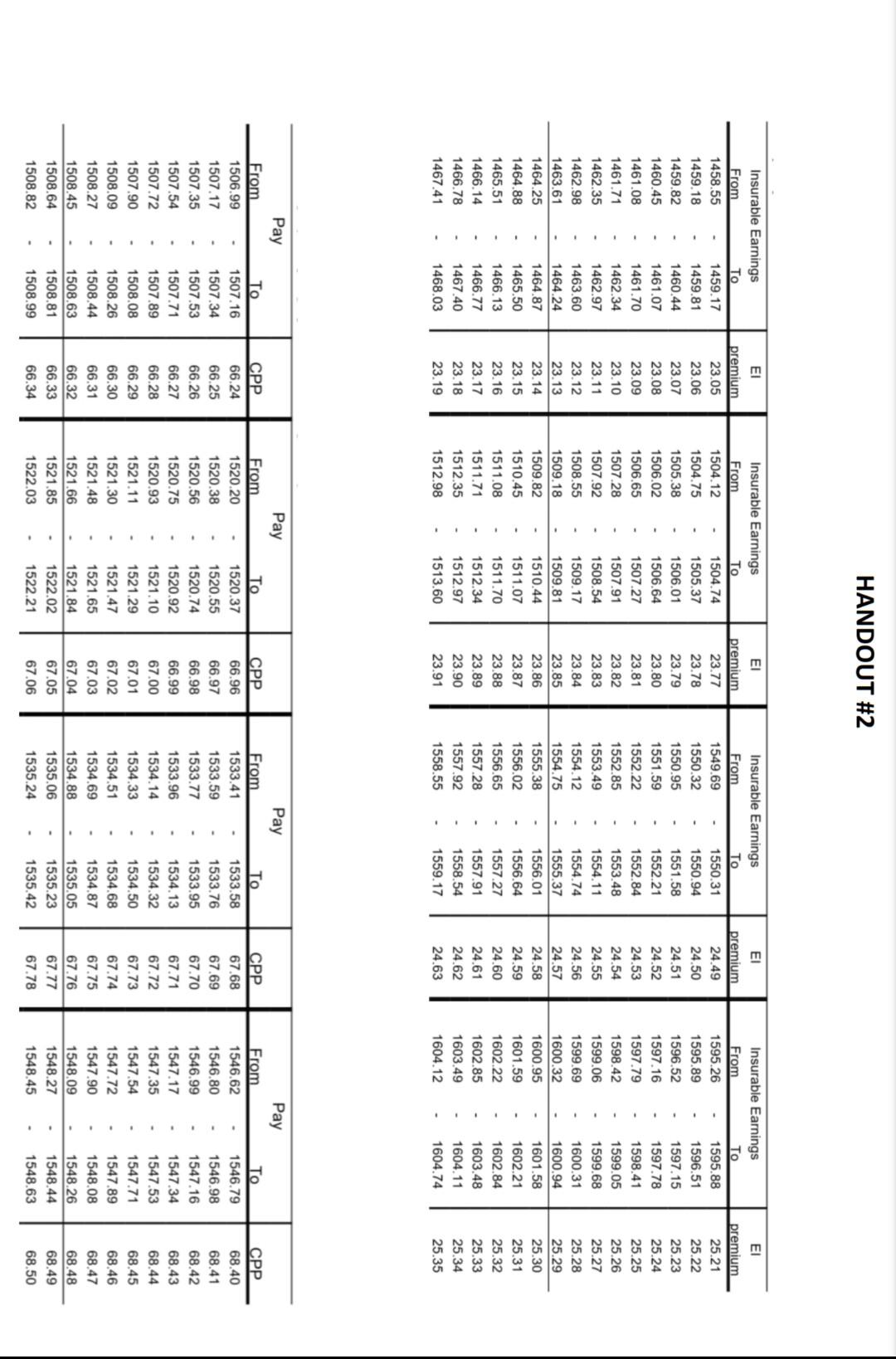

1. The CPP premium rate, for 2021, is: a. 1.58% b. 5.45% C. $3600.00 d. None of the above 2. The El premium rate, for 2021, is: a. 1.58% b. 5.45% C. $3600.00 d. None of the above 3. The CPP annual exemption is: a. 1.58% b. 5.45% C. $3600.00 d. None of the above 4. An individual with a Provincial TD1 tax credit amount equaling $23,599.00 would have a claim code of: (HANDOUT #1: ATTACHED) a. 7 b. 6 C. 3 d. None of the above Question 5 refers to HANDOUT #2 (ATTACHED): 5. The amount of the deduction corresponding to a GPTI of $1508.25 would be: a. $23.83 b $66.30 C. $90.13 ($23.83+$66.30) d. None of the above Question 6 and 7 refer to HANDOUT #3: ATTACHED 6. A deduction of $184.35 would result from a net taxable income of $2320.00, and a Federal claim code of 7. a. True b. False 7. An employee has a net taxable income of $2345.00, paid on a bi-weekly basis. The amount of provincial income tax to be deducted could be: a. $73.40 b. $144.25 C. $106.10 d. Any of the above e. None of the above Questions 8 and 9 refer to the following information: The yearly maximum deduction for CPP premiums is $3,166.45. A 32-year-old employee has a GPTI of $1500 per week, is paid weekly, and has worked for the company for over 4 years. 8. On which paycheque (eg: 1st, 15th, etc.) will she hit the maximum? a. 3rd b. 39th C. 40th d. 415 e. None of the above 9. How much will the final deduction be for CPP on that paycheque? a. 0 b. $43.25 C. $62.55 d. $78.08 e. None of the above 10.A 17 year old student works at a local grocery store earning $15.00 per hour, and works 30 hours per bi-weekly pay period. The amount of the El premium to be deducted from her cheque should be: 0 b. $7.11 C. $16.08 d. None of the above. a HANDOUT #1: TD1 CLAIM CODES Claim Code (Fed) Total Claim Amount (Fed) No Claim Amount $13,808.00 $13,808.0116,181.00 $ 16,181.01 - $18554.00 $ 18,554.01 - $20,927.00 $ 20,927.01 - $23,300.00 7 $23,300.01 - $25,673,00 $25,673.01 - $ 28,046.00 $28,046.01 - $30,419.00 $30,419.01 - $32,792.00 $32,792.01 - $35,165.00 10 $35,165.01 and over X employer must calculate manually Chart 4-2021 Alberta claim codes Claim code 0 1 2 3 4 Total claim amount ($) No claim amount 19,369.00 19,369.01 to 22,203.00 22,203.01 to 25,037.00 25,037.01 to 27,871.00 27,871.01 to 30,705.00 30,705.01 to 33,539.00 33,539.01 to 36,373.00 36,373.01 to 39,207.00 39,207.01 to 42,041.00 42,041.01 to 44,875.00 5 6 7 8 9 10 44,875.01 and over The employer has to calculate the tax manually. No withholding E HANDOUT #2 From From Insurable Earnings 1458.55 1459.17 1459.18 1459.81 1459.82 1460.44 1460.45 1461.07 1461.08 1461.70 1461.71 1462.34 1462.35 1462.97 1462.98 1463.60 1463.61 1464.24 1464.25 1464.87 1464.88 1465.50 1465.51 1466.13 1466.14 1466.77 1466.78 1467.40 1467.41 1468.03 EI premium 23.05 23.06 23.07 23.08 23.09 23.10 23.11 23.12 23.13 23.14 23.15 23.16 23.17 23.18 23.19 Insurable Earnings From 1504.12 1504.74 1504.75 1505.37 1505.38 1506.01 1506.02 1506.64 1506.65 1507.27 1507.28 1507.91 1507.92 1508.54 1508.55 1509.17 1509.18 1509.81 1509.82 1510.44 1510.45 1511.07 1511.08 1511.70 1511.71 1512.34 1512.35 1512.97 1512.98 1513.60 EI premium 23.77 23.78 23.79 23.80 23.81 23.82 23.83 23.84 23.85 23.86 23.87 23.88 23.89 23.90 23.91 Insurable Earnings From 1549.69 1550.31 1550.32 1550.94 1550.95 1551.58 1551.59 1552.21 1552.22 1552.84 1552.85 1553.48 1553.49 1554.11 1554.12 1554.74 1554.75 1555.37 1555.38 1556.01 1556.02 1556.64 1556.65 1557.27 1557 28 1557.91 1557.92 1558.54 1558.55 1559.17 premium 24.49 24.50 24.51 24.52 24.53 24.54 24.55 24.56 24.57 24.58 24.59 24.60 24.61 24.62 24.63 Insurable Earnings 1595.26 1595.88 1595.89 1596.51 1596.52 1597.15 1597.16 1597.78 1597.79 1598.41 1598.42 1599.05 1599.06 1599.68 1599.69 1600.31 1600.32 1600.94 1600.95 1601.58 1601.59 1602.21 1602.22 1602.84 1602.85 1603.48 1603.49 1604.11 1604.12 1604.74 EI premium 25.21 25.22 25.23 25.24 25.25 25.26 25.27 25.28 25.29 25.30 25.31 25.32 25.33 25.34 25.35 Pay From 1506.99 1507.17 1507.35 1507.54 1507.72 1507.90 1508.09 1508.27 1508.45 1508.64 1508.82 1507.16 1507.34 1507.53 1507.71 1507.89 1508.08 1508.26 1508,44 CPP 66.24 66.25 66.26 66.27 66.28 66.29 66.30 66.31 66.32 66.33 66.34 Pay From 1520.20 1520.38 1520.56 1520.75 1520.93 1521.11 1521.30 1521.48 1521.66 1521.85 1522.03 To 1520.37 1520.55 1520.74 1520.92 1521.10 1521.29 1521.47 1521.65 1521.84 1522.02 1522.21 CPP 66.96 66.97 66.98 66.99 67.00 67.01 67.02 67.03 67.04 67.05 67.06 Pay From 1533.41 1533.59 1533.77 1533.96 1534.14 1534.33 1534.51 1534.69 1534.88 1535.06 1535.24 To 1533.58 1533.76 1533.95 1534.13 1534.32 1534.50 1534.68 1534.87 1535.05 1535.23 1535.42 CPP 67.68 67.69 67.70 67.71 67.72 67.73 67.74 67.75 67.76 67.77 67.78 Pay From 1546.62 1546.80 1546.99 1547.17 1547.35 1547.54 1547.72 1547.90 1548.09 1548.27 1548.45 To 1546.79 1546.98 1547.16 1547.34 1547.53 1547.71 1547.89 1548.08 1548.26 1548.44 1548.63 CPP 68.40 68.41 68.42 68.43 68.44 68.45 68.46 68.47 68.48 68.49 68.50 1508.63 1508.81 1508.99 HANDOUT #3 Federal tax deductions Effective January 1, 2021 Biweekly (26 pay periods a year) Also look up the tax deductions in the provincial table CC 6 Pay From Less than 2152 2176 2176 2200 2200 2224 2224 2248 2248 2272 2272 2296 2296 2320 2320 2344 2344 2368 2368 2392 CCO 310.95 315.70 320.40 325.15 329.85 334.55 339.30 344.00 348.75 353.55 CC 1 231.30 236.00 240.75 245.45 250.20 254.90 259.65 264.35 269.10 273.90 CC 2 224.45 229.15 233.90 238.60 243.35 248.05 252.80 257.50 262.25 267.05 CC3 210.75 215.50 220.20 224.95 229.65 234.40 239.10 243.80 248.55 253.35 CC 4 197.05 201.80 206.50 211.25 215.95 220.70 225.40 230.15 234.85 239.65 CC5 183.40 188.10 192.80 197.55 202.25 207.00 211.70 216.45 221.15 226.00 169.70 174.40 179.15 183.85 188.60 193.30 198.05 202.75 207.50 212.30 CC 7 156.00 160.70 165.45 170.15 174.90 179.60 184.35 CC 8 142.30 147.05 151.75 156.50 161.20 165.90 170.65 175.35 CC 9 128.60 133.35 138.05 142.80 147.50 152.25 156.95 161.70 166.40 171.20 CC 10 114.95 119.65 124.35 129.10 133.80 138.55 143.25 148.00 152.70 157.55 189.05 193.80 198,60 180.10 184.90 Alberta provincial tax deductions Effective January 1, 2021 Biweekly (26 pay periods a year) Also look up the tax deductions in the federal table CC 4 CC 5 CC 7 84.30 CC 8 73.40 CC 9 62.50 CC 10 51.60 CC 1 144.25 146.50 148.90 106.10 108.35 110.75 64.75 67.15 Pay From Less than 2330 - 2354 2354 2378 2378 2402 2402 2426 2426 2450 2450 2474 2474 2498 2498 2522 2522 2546 2546 2570 CCO 218.75 221.00 223.40 225.80 228.20 230.60 233.00 235.40 237.80 240.20 CC 2 138.80 141.05 143.45 145.85 148.25 150.65 153.05 155.45 157.85 160.25 151.30 153.70 156.10 158.50 160.90 163.30 CC 3 127.90 130.15 132.55 134.95 137.35 139.75 142.15 144.55 146.95 149.35 117.00 119.25 121.65 124.05 126.45 128.85 131.25 133.65 136.05 138.45 113.15 115.55 117.95 CC 6 95.20 97.45 99.85 102.25 104.65 107.05 109.45 111.85 114.25 116.65 86.55 88.95 91.35 93.75 96.15 98.55 100.95 103.35 105.75 75.65 78.05 80.45 82.85 85.25 87.65 90.05 92.45 94.85 53.85 56.25 58.65 61.05 63.45 65.85 68.25 70.65 73.05 69.55 71.95 74.35 76.75 79.15 81.55 83.95 120.35 122.75 125.15 127.55 165.70

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts