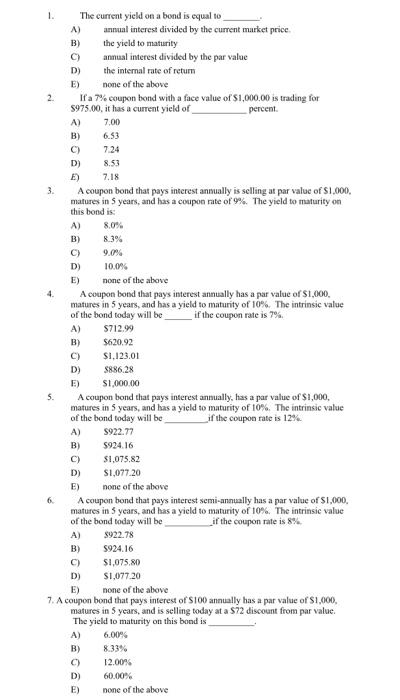

Question: 1. The current yield on a bond is equal to A) annual interest divided by the current market price. B) the yield to maturity C)

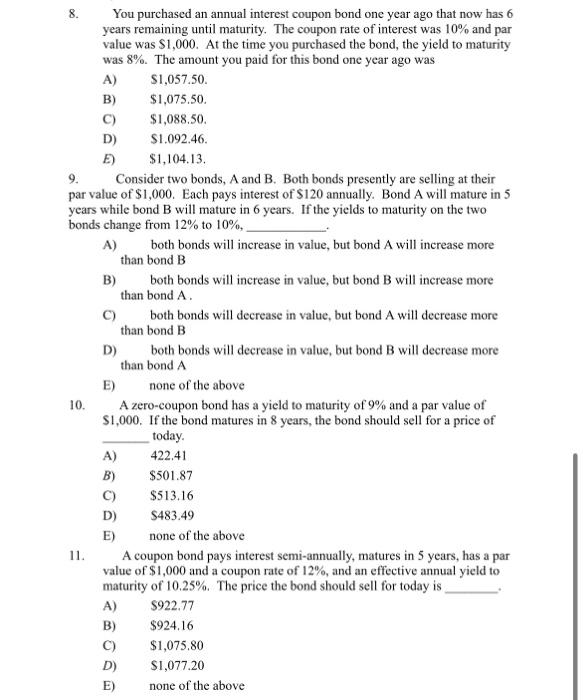

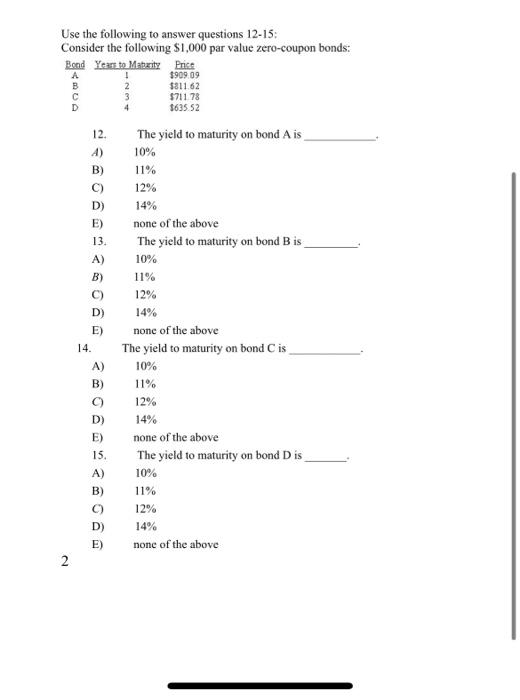

1. The current yield on a bond is equal to A) annual interest divided by the current market price. B) the yield to maturity C) annual interest divided by the par value D) the internal rate of return E) none of the above 2. If a 7% coupon bond with a face value of $1,000.00 is trading for 5975.00, it has a current yield of percent. A) 7,00 B) 6.53 C) 7.24 D) 8.53 E) 7.18 3. A coupon bond that pays interest ansually is selling at par value of $1,000, matures in 5 years, and has a coupon mate of 9%. The yield to maturity on this bond is: A) 8.0% B) 8.3% C) 9.0% D) 10.0% E) none of the above 4. A coupon bond that pays interest annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10%. The intrinsic value of the bond today will be if the coupon rate is 7%. A) 5712.99 B) $620.92 C) $1,123.01 D) $886.28 E) S1,000.00 5. A coupon bond that pays interest annually, has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10%. The intrinsic value of the bond today will be if the coupon rate is 12%. A) 5922.77 B) 5924.16 C) 51,075,82 D) $1,077.20 E) none of the above 6. A coupon bond that pays interest semi-annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 10%. The intrinsic value of the bond today will be A) $922.78 B) 5924.16 C) 51,075,80 D) $1,077.20 E) none of the above 7. A coupon bond that pays interest of $100 annually has a par value of $1,000, matures in 5 years, and is selling today at a $72 discount from par value. The yield to maturity on this bond is A) 6.00% B) 8.33% C) 12.00\% D) 60.00% E) none of the above 8. You purchased an annual interest coupon bond one year ago that now has 6 years remaining until maturity. The coupon rate of interest was 10% and par value was $1,000. At the time you purchased the bond, the yield to maturity was 8%. The amount you paid for this bond one year ago was A) $1,057.50. B) \$1,075.50. C) \$1,088.50. D) $1.092.46. E) $1,104.13. 9. Consider two bonds, A and B. Both bonds presently are selling at their par value of $1,000. Each pays interest of $120 annually. Bond A will mature in 5 years while bond B will mature in 6 years. If the yields to maturity on the two bonds change from 12% to 10%, A) both bonds will increase in value, but bond A will increase more than bond B B) both bonds will increase in value, but bond B will increase more than bond A. C) both bonds will decrease in value, but bond A will decrease more than bond B D) both bonds will decrease in value, but bond B will decrease more than bond A E) none of the above 10. A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in 8 years, the bond should sell for a price of today. A) 422.41 B) $501.87 C) $513.16 D) $483.49 E) none of the above 11. A coupon bond pays interest semi-annually, matures in 5 years, has a par value of $1,000 and a coupon rate of 12%, and an effective annual yield to maturity of 10.25%. The price the bond should sell for today is A) $922.77 B) $924.16 C) $1,075.80 D) $1,077.20 E) none of the above Use the following to answer questions 12-15: Consider the following $1,000 par value zero-coupon bonds: 12. The yield to maturity on bond A is A) 10% B) 11% C) 12% D) 14% E) none of the above 13. The yield to maturity on bond B is A) 10%. B) 11\% C) 12\% D) 14% E) none of the above 14. The yield to maturity on bond C is A) 10\% B) 11% C) 12% D) 14\% E) none of the above 15. The yield to maturity on bond D is A) 10\% B) 11% C) 12% D) 14\% E) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts