Question: 1. The difference between a company's future cash flows if it accepts a project and the company's future cash flows if it does bot accept

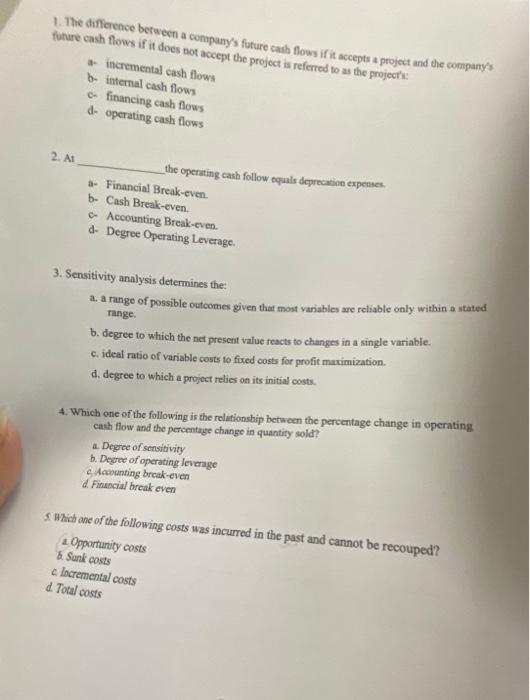

1. The difference between a company's future cash flows if it accepts a project and the company's future cash flows if it does bot accept the project is referred to as the projecth: a. incremental cash flows b- internal cash flows c- financing cash flows d- operating cash flows 2. At the operiting cash follow equals deprecasin expenses. a- Financial Break-even. b- Cash Break-even. c- Accounting Break-even. d- Degree Operating Leverage. 3. Sensitivity analysis determines the: a. a range of possible outcomes given that most variables are reliable only within a stated range. b. degree to which the net present value reacts to changes in a single variable. c. ideal ratio of variable costs to fixed costs for profit maximization. d. degree to which a project relies on its initial costs. 4. Which one of the following is the relationship between the percentage change in operating cath flow and the percentage change in quantity sold? a. Degree of sensitivity b. Degree of operating feverage C. Aawounting break-even d. Finsacial break even 5. Which ane of the following costs was incurred in the past and cannot be recouped? a. Opportunity costs 6. Sunk costs c. Lacremental costs d. Total costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts