Question: 1) The double-entry system requires that each transaction must be recorded: a. in at least two different accounts. b. in two sets of books. c

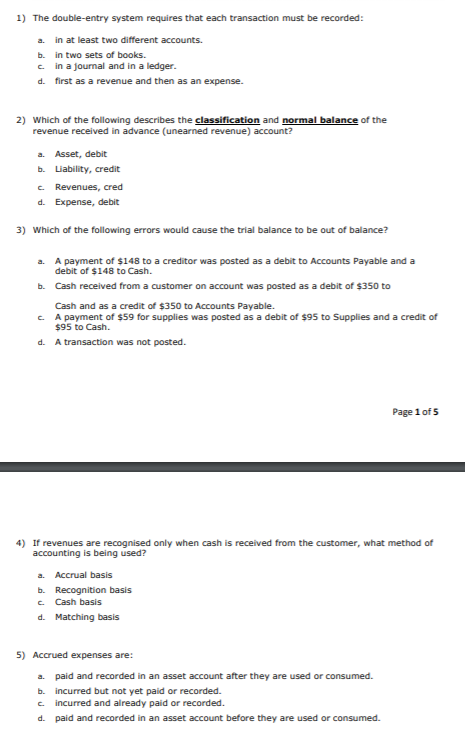

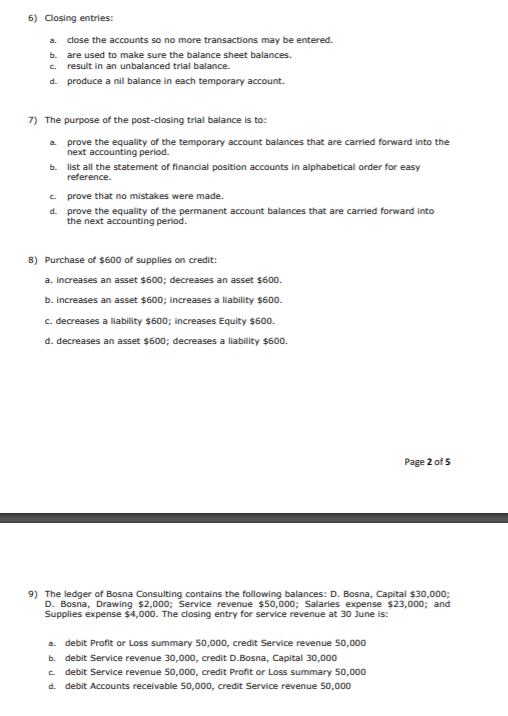

1) The double-entry system requires that each transaction must be recorded: a. in at least two different accounts. b. in two sets of books. c in a journal and in a ledger. d. first as a revenue and then as an expense. 2) Which of the following describes the classification and normal balance of the revenue received in advance (unearned revenue) account? 2. Asset, debit b. Liability, credit c. Revenues, cred d. Expense, debit 3) Which of the following errors would cause the trial balance to be out of balance? a. A payment of $148 to a creditor was posted as a debit to Accounts Payable and a debit of $148 to Cash. b. Cash received from a customer on account was posted as a debit of $350 to Cash and as a credit of $350 to Accounts Payable. A payment of $59 for supplies was posted as a debit of $95 to Supplies and a credit of $95 to Cash. d. A transaction was not posted. Page 1 of 5 4) If revenues are recognised only when cash is received from the customer, what method of accounting is being used? a. Accrual basis b. Recognition basis C Cash basis d. Matching basis 5) Accrued expenses are: b. paid and recorded in an asset account after they are used or consumed. incurred but not yet paid or recorded. incurred and already paid or recorded. d. paid and recorded in an asset account before they are used or consumed. 6) Closing entries: 2. close the accounts so no more transactions may be entered. b. are used to make sure the balance sheet balances. c result in an unbalanced trial balance. d. produce a nil balance in each temporary account. 7) The purpose of the post-closing trial balance is to: 2. prove the equality of the temporary account balances that are carried forward into the next accounting period. b. list all the statement of financial position accounts in alphabetical order for easy reference. prove that no mistakes were made. d. prove the equality of the permanent account balances that are carried forward into the next accounting period. B) Purchase of $600 of supplies on credit: a. increases an asset $500; decreases an asset $600. b. increases an asset $600; increases a liability $600. c.decreases a liability $600; increases Equity $600. d. decreases an asset $600; decreases a liability $600. Page 2 of 5 9) The ledger of Bosna Consulting contains the following balances: D. Bosna, Capital $30,000; D. Bosna, Drawing $2,000; Service revenue $50,000; Salaries expense $23,000; and Supplies expense $4,000. The closing entry for service revenue at 30 June is: a. debit Profit or Loss summary 50,000, credit Ser revenue 50,000 b. debit Service revenue 30,000, credit D.Bosna, Capital 30,000 debit Service revenue 50,000, credit Profit or Loss summary 50,000 d. debit Accounts receivable 50,000, credit Service revenue 50,000 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts