Question: 1. The expected return on a security with an expected price of 155 lei is 10%. Given a dividend yield of 6.667%, the current price

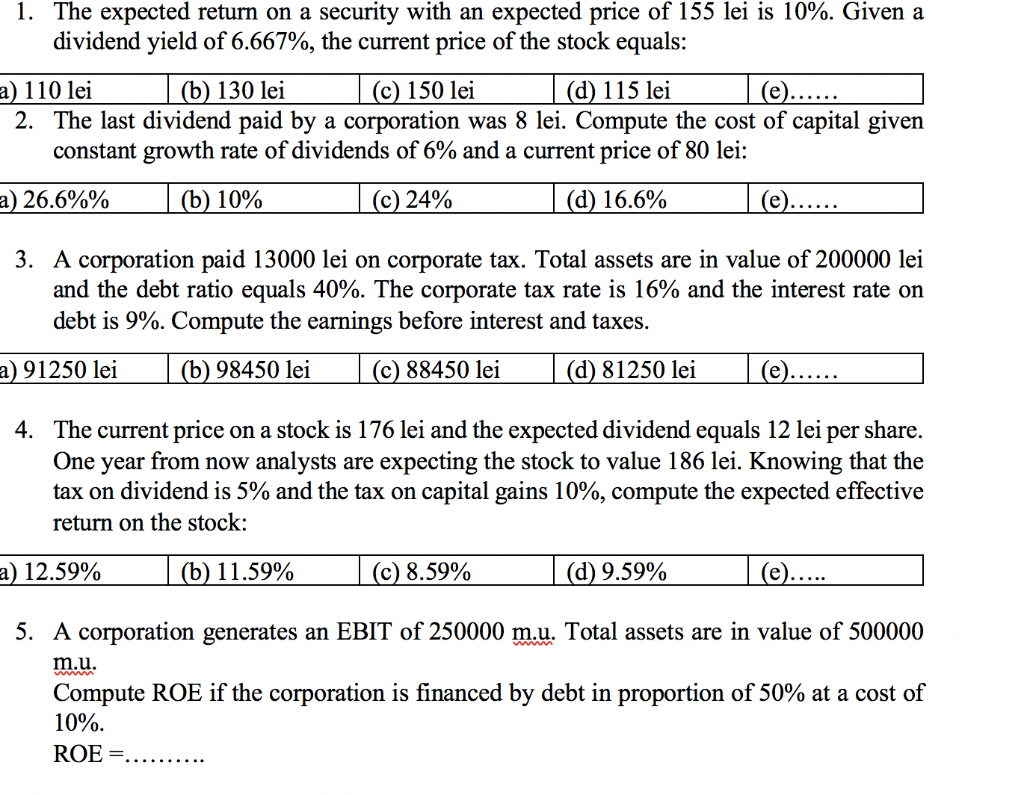

1. The expected return on a security with an expected price of 155 lei is 10%. Given a dividend yield of 6.667%, the current price of the stock equals: a) 110 lei (b) 130 lei (c) 150 lei (d) 115 lei (e)...... 2. The last dividend paid by a corporation was 8 lei. Compute the cost of capital given constant growth rate of dividends of 6% and a current price of 80 lei: a) 26.6%% (b) 10% (c) 24% (d) 16.6% | (e)...... 3. A corporation paid 13000 lei on corporate tax. Total assets are in value of 200000 lei and the debt ratio equals 40%. The corporate tax rate is 16% and the interest rate on debt is 9%. Compute the earnings before interest and taxes. a) 91250 lei (b) 98450 lei (C) 88450 lei (d) 81250 lei (e)...... 4. The current price on a stock is 176 lei and the expected dividend equals 12 lei per share. One year from now analysts are expecting the stock to value 186 lei. Knowing that the tax on dividend is 5% and the tax on capital gains 10%, compute the expected effective return on the stock: a) 12.59% (b) 11.59% (c) 8.59% (d) 9.59% 5. A corporation generates an EBIT of 250000 m.u. Total assets are in value of 500000 m.u. Compute ROE if the corporation is financed by debt in proportion of 50% at a cost of 10%. ROE=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts