Question: 1) The Financial System main function is to a) Channeling funds from surplus units to deficit units b) Transfer money from those who haven't productive

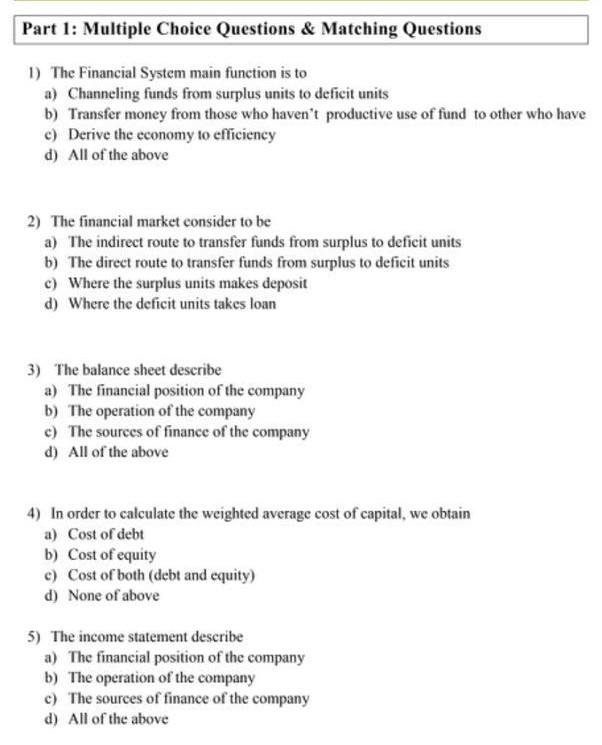

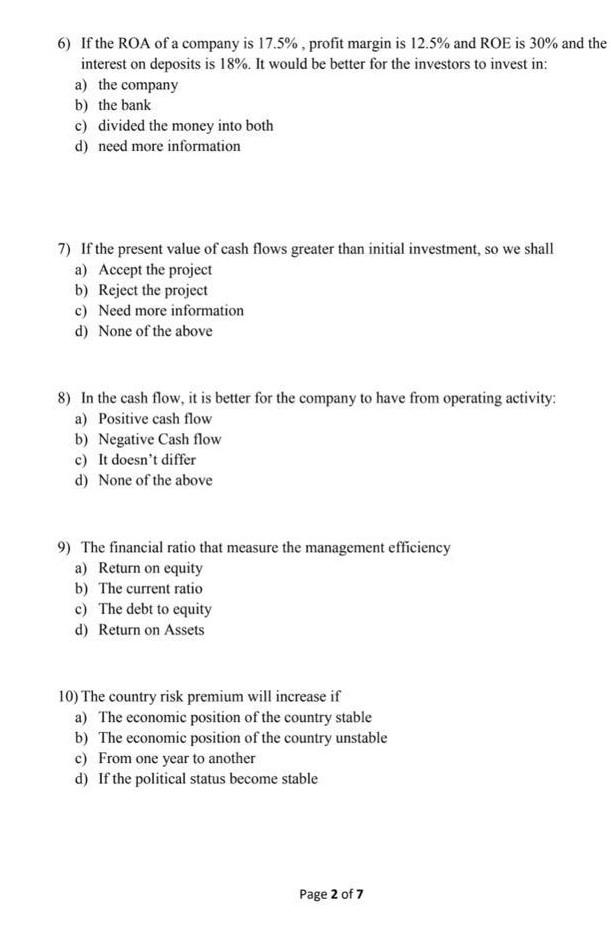

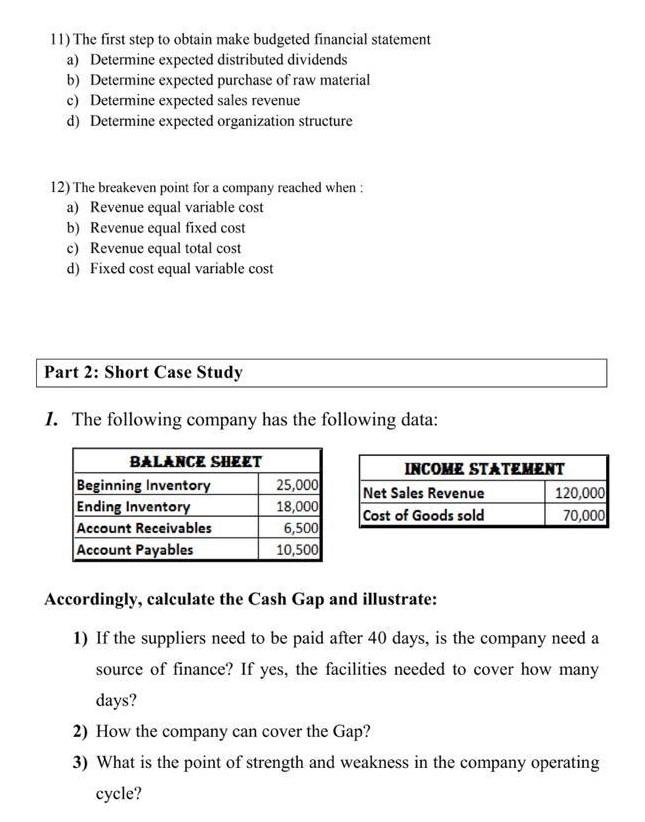

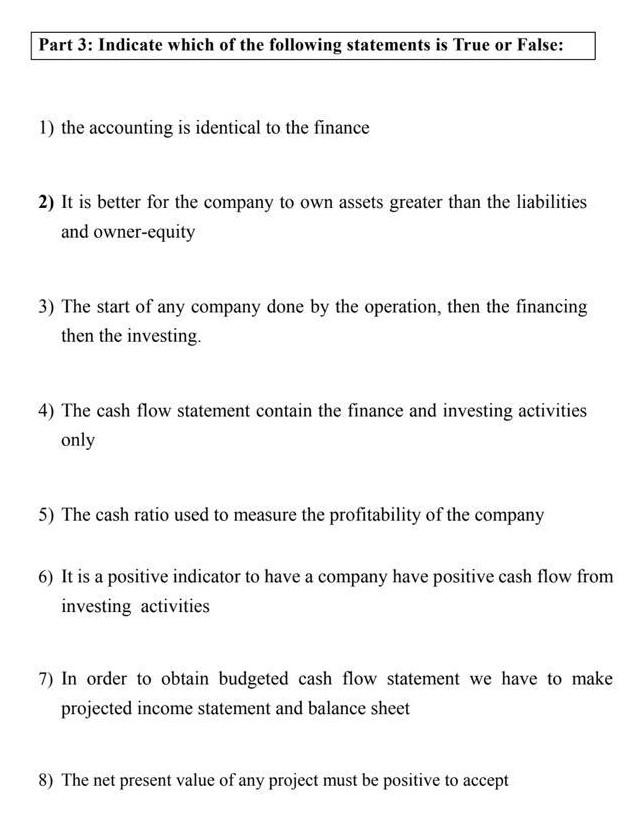

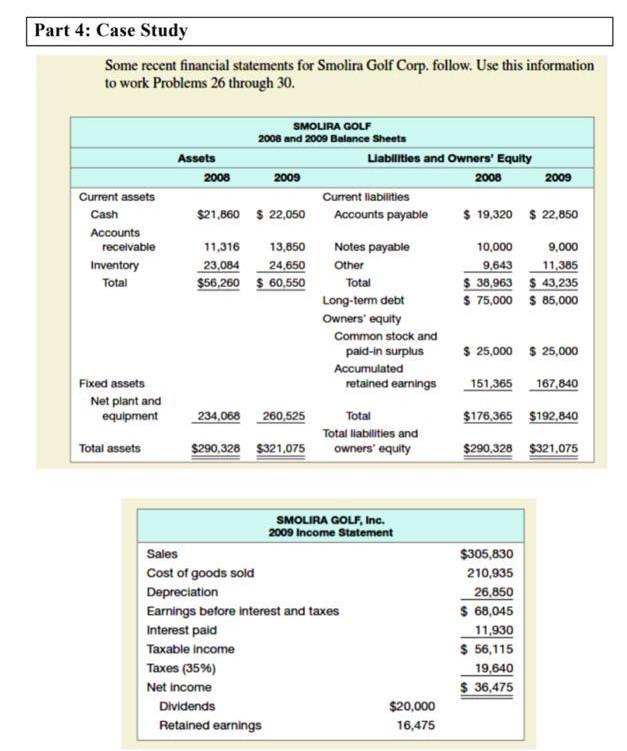

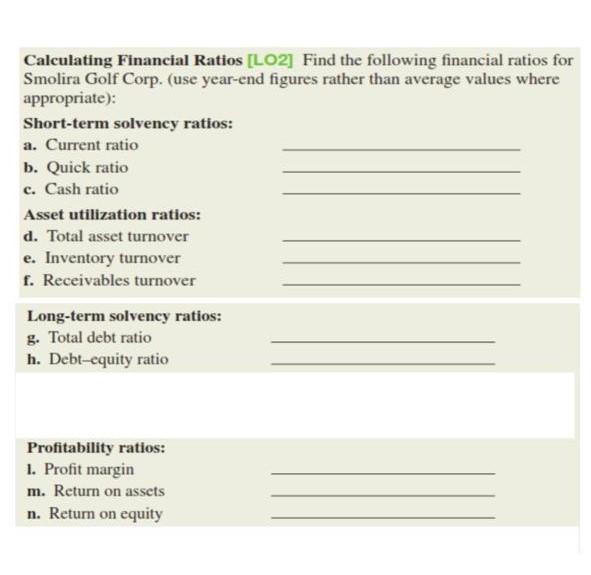

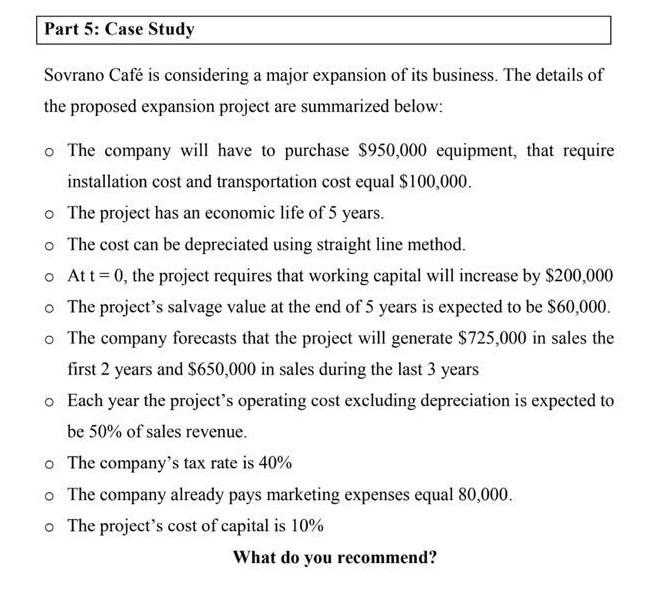

1) The Financial System main function is to a) Channeling funds from surplus units to deficit units b) Transfer money from those who haven't productive use of fund to other who have c) Derive the economy to efficiency d) All of the above 2) The financial market consider to be a) The indirect route to transfer funds from surplus to deficit units b) The direct route to transfer funds from surplus to deficit units c) Where the surplus units makes deposit d) Where the deficit units takes loan 3) The balance sheet describe a) The financial position of the company b) The operation of the company c) The sources of finance of the company d) All of the above 4) In order to calculate the weighted average cost of capital, we obtain a) Cost of debt b) Cost of equity c) Cost of both (debt and equity) d) None of above 5) The income statement describe a) The financial position of the company b) The operation of the company c) The sources of finance of the company d) All of the above 6) If the ROA of a company is 17.5%, profit margin is 12.5% and ROE is 30% and the interest on deposits is 18%. It would be better for the investors to invest in: a) the company b) the bank c) divided the money into both d) need more information 7) If the present value of cash flows greater than initial investment, so we shall a) Accept the project b) Reject the project c) Need more information d) None of the above 8) In the cash flow, it is better for the company to have from operating activity: a) Positive cash flow b) Negative Cash flow c) It doesn't differ d) None of the above 9) The financial ratio that measure the management efficiency a) Return on equity b) The current ratio c) The debt to equity d) Return on Assets 10) The country risk premium will increase if a) The economic position of the country stable b) The economic position of the country unstable c) From one year to another d) If the political status become stable 11) The first step to obtain make budgeted financial statement a) Determine expected distributed dividends b) Determine expected purchase of raw material c) Determine expected sales revenue d) Determine expected organization structure 12) The breakeven point for a company reached when : a) Revenue equal variable cost b) Revenue equal fixed cost c) Revenue equal total cost d) Fixed cost equal variable cost Part 2: Short Case Study 1. The following company has the following data: Accordingly, calculate the Cash Gap and illustrate: 1) If the suppliers need to be paid after 40 days, is the company need a source of finance? If yes, the facilities needed to cover how many days? 2) How the company can cover the Gap? 3) What is the point of strength and weakness in the company operating cycle? Part 3: Indicate which of the following statements is True or False: 1) the accounting is identical to the finance 2) It is better for the company to own assets greater than the liabilities and owner-equity 3) The start of any company done by the operation, then the financing then the investing. 4) The cash flow statement contain the finance and investing activities only 5) The cash ratio used to measure the profitability of the company 6) It is a positive indicator to have a company have positive cash flow from investing activities 7) In order to obtain budgeted cash flow statement we have to make projected income statement and balance sheet 8) The net present value of any project must be positive to accept Some recent financial statements for Smolira Golf Corp. follow. Use this information to work Problems 26 through 30 . Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate): Short-term solvency ratios: a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios: d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios: g. Total debt ratio h. Debt-equity ratio Sovrano Caf is considering a major expansion of its business. The details of the proposed expansion project are summarized below: The company will have to purchase $950,000 equipment, that require installation cost and transportation cost equal $100,000. The project has an economic life of 5 years. The cost can be depreciated using straight line method. At t=0, the project requires that working capital will increase by $200,000 The project's salvage value at the end of 5 years is expected to be $60,000. The company forecasts that the project will generate $725,000 in sales the first 2 years and $650,000 in sales during the last 3 years Each year the project's operating cost excluding depreciation is expected to be 50% of sales revenue. The company's tax rate is 40% The company already pays marketing expenses equal 80,000 . The project's cost of capital is 10% What do you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts