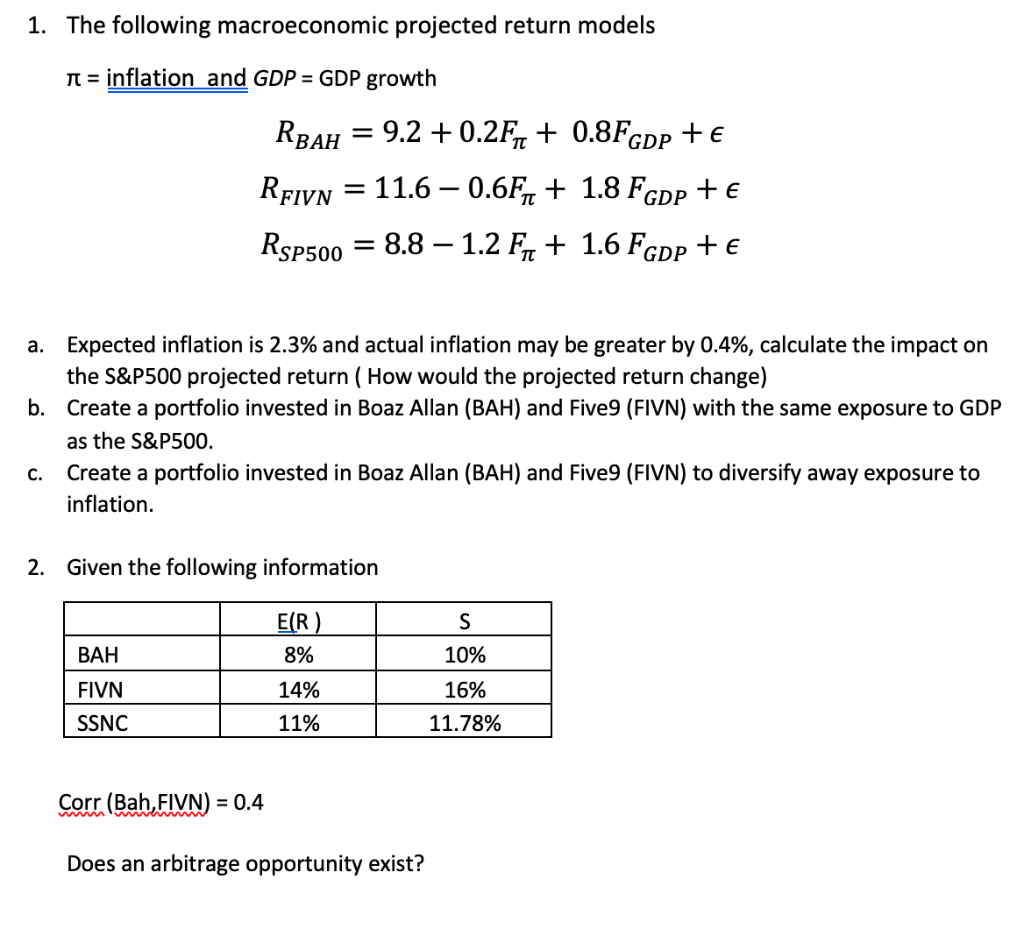

Question: 1. The following macroeconomic projected return models A = inflation and GDP = GDP growth RBAH = 9.2 +0.251 + 0.8FGpp +E Rein = 11.6

1. The following macroeconomic projected return models A = inflation and GDP = GDP growth RBAH = 9.2 +0.251 + 0.8FGpp +E Rein = 11.6 0.6F7x + 1.8 Fopp + RsP500 = 8.8 1.2 Ft + 1.6 Fgpp + a. Expected inflation is 2.3% and actual inflation may be greater by 0.4%, calculate the impact on the S&P500 projected return ( How would the projected return change) b. Create a portfolio invested in Boaz Allan (BAH) and Five 9 (FIVN) with the same exposure to GDP as the S&P500. Create a portfolio invested in Boaz Allan (BAH) and Five 9 (FIVN) to diversify away exposure to inflation. 2. Given the following information S BAH 10% E(R) 8% 14% 11% FIVN 16% 11.78% SSNC Corr (Bah, FIVN) = 0.4 wwwwww Does an arbitrage opportunity exist? 1. The following macroeconomic projected return models A = inflation and GDP = GDP growth RBAH = 9.2 +0.251 + 0.8FGpp +E Rein = 11.6 0.6F7x + 1.8 Fopp + RsP500 = 8.8 1.2 Ft + 1.6 Fgpp + a. Expected inflation is 2.3% and actual inflation may be greater by 0.4%, calculate the impact on the S&P500 projected return ( How would the projected return change) b. Create a portfolio invested in Boaz Allan (BAH) and Five 9 (FIVN) with the same exposure to GDP as the S&P500. Create a portfolio invested in Boaz Allan (BAH) and Five 9 (FIVN) to diversify away exposure to inflation. 2. Given the following information S BAH 10% E(R) 8% 14% 11% FIVN 16% 11.78% SSNC Corr (Bah, FIVN) = 0.4 wwwwww Does an arbitrage opportunity exist

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts