Question: . . 1. The following represents information about the first several years of operations Year 2, financial income before tax: $100,000 Warranty Year one the

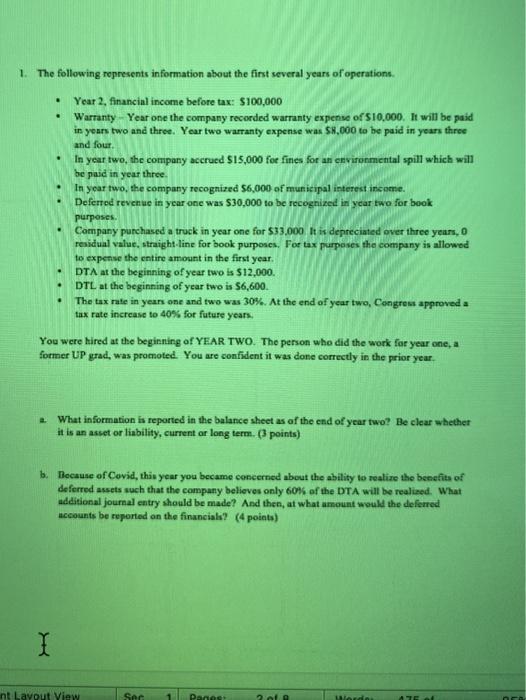

. . 1. The following represents information about the first several years of operations Year 2, financial income before tax: $100,000 Warranty Year one the company recorded warranty expense of $10,000. It will be paid in years two and three. Year two warranty expense was $8,000 to be paid in years three and four In year two, the company accrued $15,000 for fines for an environmental spill which will be paid in year three. In your two, the company recognized $6,000 of municipal interest income. Deferred revenue in year one was $30,000 to be recognized in year two for book purposes Company purchased a truck in year one for $33,000 It is depreciated over three years, o residual value, straight line for book purposes. Por tax purposes the company is allowed to expense the entire amount in the first year. DTA at the beginning of year two is $12,000. DTL at the beginning of year two is 56,600. The tax rate in years one and two was 30%. At the end of year two, Congress approved a tax rate increase to 40% for future years. You were hired at the beginning of YEAR TWO. The person who did the work for your one, a former UP grad, was promoted. You are confident it was done correctly in the prior year. What information is reported in the balance sheet as of the end of year two? Be clear whether it is an asset or liability, current or long term. (points) b. Because of Cavid, this year you became concerned about the ability to realize the benefits of deferred assets such that the company believes only 60% of the DTA will be realised. What additional journal entry should be made? And then, at what amount would the deferred accounts be reported on the financials? (4 points) I nt Layout View See 1 Paneg ola Mondo . . 1. The following represents information about the first several years of operations Year 2, financial income before tax: $100,000 Warranty Year one the company recorded warranty expense of $10,000. It will be paid in years two and three. Year two warranty expense was $8,000 to be paid in years three and four In year two, the company accrued $15,000 for fines for an environmental spill which will be paid in year three. In your two, the company recognized $6,000 of municipal interest income. Deferred revenue in year one was $30,000 to be recognized in year two for book purposes Company purchased a truck in year one for $33,000 It is depreciated over three years, o residual value, straight line for book purposes. Por tax purposes the company is allowed to expense the entire amount in the first year. DTA at the beginning of year two is $12,000. DTL at the beginning of year two is 56,600. The tax rate in years one and two was 30%. At the end of year two, Congress approved a tax rate increase to 40% for future years. You were hired at the beginning of YEAR TWO. The person who did the work for your one, a former UP grad, was promoted. You are confident it was done correctly in the prior year. What information is reported in the balance sheet as of the end of year two? Be clear whether it is an asset or liability, current or long term. (points) b. Because of Cavid, this year you became concerned about the ability to realize the benefits of deferred assets such that the company believes only 60% of the DTA will be realised. What additional journal entry should be made? And then, at what amount would the deferred accounts be reported on the financials? (4 points) I nt Layout View See 1 Paneg ola Mondo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts