Question: 1) The Goal objective function is written as * Maximize G = 2(d1-) + 3(d2+) + (d3-) + (d4-) Maximize G = (d1+) + (d2-)

1) The Goal objective function is written as *

Maximize G = 2(d1-) + 3(d2+) + (d3-) + (d4-)

Maximize G = (d1+) + (d2-) + (d3+) + (d4+)

Minimize G = (d1-) + (d2-) + (d3+) + (d4+)

None of the answers.

2) The first goal constrain "Expected Return on Money invested" is written as *

0.05x1 - 0.02x2 + 0.02x3 + (d1-) + (d1+) = 0

0.05x1 - 2x2 + 0.02x3 + (d1-) - (d1+) = 0

None of the answers.

0.05x1 - 0.02x2 + 0.02x3 + (d1-) - (d1+) = 0

5x1 - 0.02x2 + 0.02x3 + (d1-) - (d1+) = 0

3) The second goal constrain "put at least 25% of the money in bonds" is written as *

0.025x1 - 7.5x2 + 0.25x3 + (d2-) - (d2+) = 0

2.5x1 - 0.75x2 + 0.25x3 + (d2-) - (d2+) = 0

0.25x1 - 0.75x2 + 0.25x3 + (d2-) - (d2+) = 0

0.025x1 - 0.75x2 + 0.25x3 + (d2-) - (d2+) = 0

None of the answers.

4)The third goal constraint "the amount of money invested in real estate" is written as: *

04x1 + 0.4x2 - x3 + (d3-) - (d3+) = 0

0.4x1 + 0.4x2 - x3 + (d3-) - (d3+) = 0

40x1 + 0.4x2 - x3 + (d3-) - (d3+) = 0

4x1 + 0.4x2 - x3 + (d3-) - (d3+) = 0

None of the answers.

I need the the answers in 30 mins please.

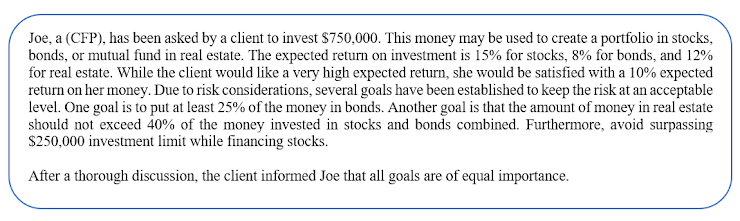

Joe, a (CFP), has been asked by a client to invest $750,000. This money may be used to create a portfolio in stocks, bonds, or mutual fund in real estate. The expected return on investment is 15% for stocks, 8% for bonds, and 12% for real estate. While the client would like a very high expected return, she would be satisfied with a 10% expected return on her money. Due to risk considerations, several goals have been established to keep the risk at an acceptable level. One goal is to put at least 25% of the money in bonds. Another goal is that the amount of money in real estate should not exceed 40% of the money invested in stocks and bonds combined. Furthermore, avoid surpassing $250,000 investment limit while financing stocks. After a thorough discussion, the client informed Joe that all goals are of equal importance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts