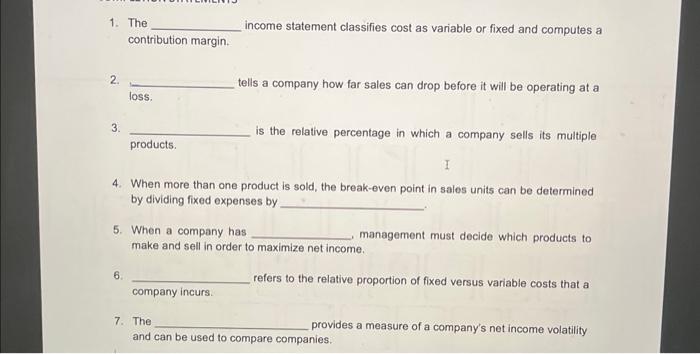

Question: 1. The income statement classifies cost as variable or fixed and computes a contribution margin. 2. tells a company how far sales can drop before

1. The income statement classifies cost as variable or fixed and computes a contribution margin. 2. tells a company how far sales can drop before it will be operating at a loss. 3. is the relative percentage in which a company sells its multiple products. I 4. When more than one product is sold, the break-even point in sales units can be determined by dividing fixed expenses by 5. When a company has management must decide which products to make and sell in order to maximize net income. 6. refers to the relative proportion of fixed versus variable costs that a company incurs. 7. The provides a measure of a company's net income volatility and can be used to compare companies. 1. The income statement classifies cost as variable or fixed and computes a contribution margin. 2. tells a company how far sales can drop before it will be operating at a loss. 3. is the relative percentage in which a company sells its multiple products. I 4. When more than one product is sold, the break-even point in sales units can be determined by dividing fixed expenses by 5. When a company has management must decide which products to make and sell in order to maximize net income. 6. refers to the relative proportion of fixed versus variable costs that a company incurs. 7. The provides a measure of a company's net income volatility and can be used to compare companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts