Question: 1. The market demand function for down blankets is Qd=200P and the market supply function is Qs=2P100. Suppose the government imposes a $15 tax on

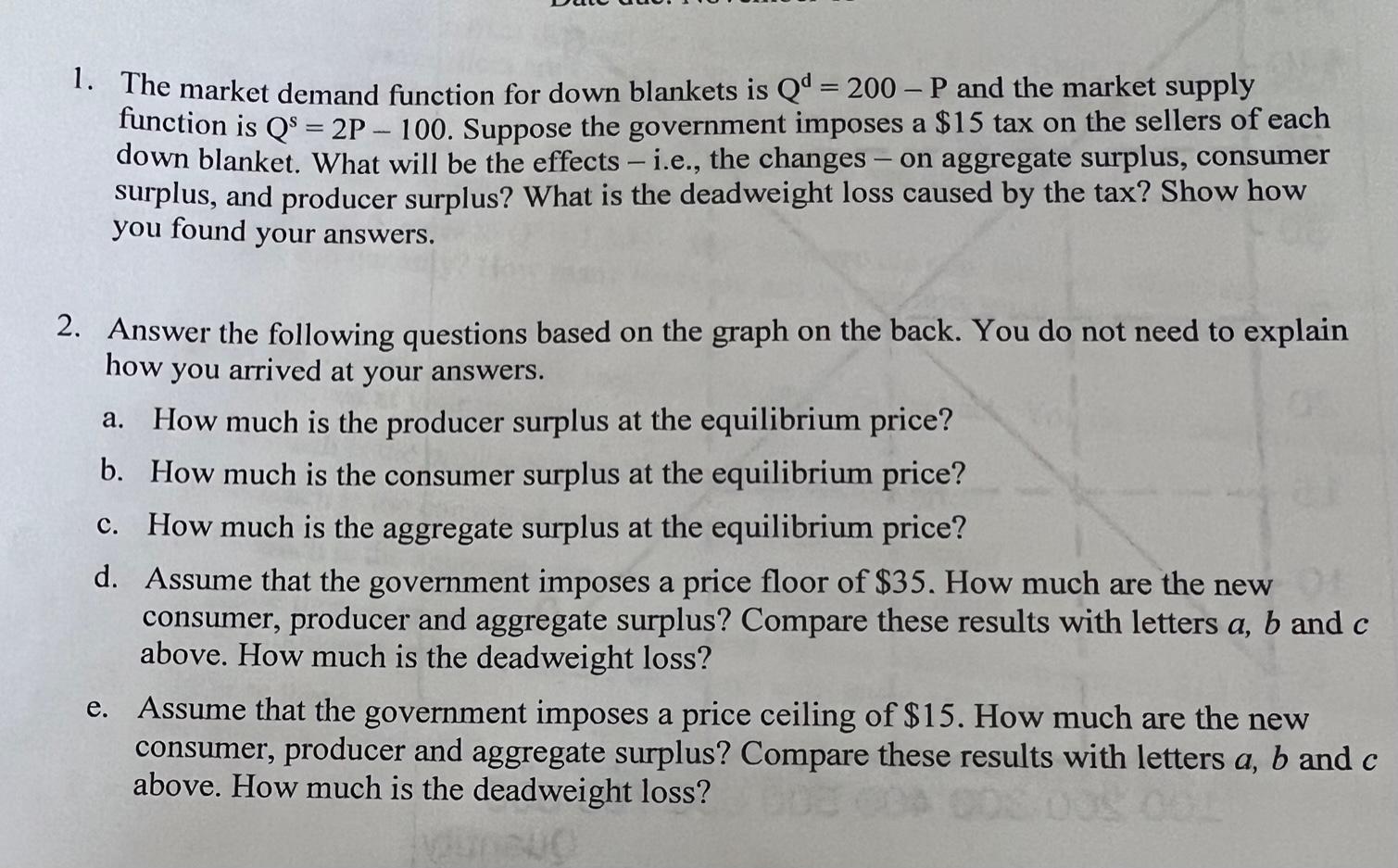

1. The market demand function for down blankets is Qd=200P and the market supply function is Qs=2P100. Suppose the government imposes a $15 tax on the sellers of each down blanket. What will be the effects - i.e., the changes - on aggregate surplus, consumer surplus, and producer surplus? What is the deadweight loss caused by the tax? Show how you found your answers. 2. Answer the following questions based on the graph on the back. You do not need to explain how you arrived at your answers. a. How much is the producer surplus at the equilibrium price? b. How much is the consumer surplus at the equilibrium price? c. How much is the aggregate surplus at the equilibrium price? d. Assume that the government imposes a price floor of $35. How much are the new consumer, producer and aggregate surplus? Compare these results with letters a,b and c above. How much is the deadweight loss? e. Assume that the government imposes a price ceiling of $15. How much are the new consumer, producer and aggregate surplus? Compare these results with letters a,b and c above. How much is the deadweight loss? 1. The market demand function for down blankets is Qd=200P and the market supply function is Qs=2P100. Suppose the government imposes a $15 tax on the sellers of each down blanket. What will be the effects - i.e., the changes - on aggregate surplus, consumer surplus, and producer surplus? What is the deadweight loss caused by the tax? Show how you found your answers. 2. Answer the following questions based on the graph on the back. You do not need to explain how you arrived at your answers. a. How much is the producer surplus at the equilibrium price? b. How much is the consumer surplus at the equilibrium price? c. How much is the aggregate surplus at the equilibrium price? d. Assume that the government imposes a price floor of $35. How much are the new consumer, producer and aggregate surplus? Compare these results with letters a,b and c above. How much is the deadweight loss? e. Assume that the government imposes a price ceiling of $15. How much are the new consumer, producer and aggregate surplus? Compare these results with letters a,b and c above. How much is the deadweight loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts