Question: 1. The matching principle is applied? because it is required by the Internal Revenue Code to help make the bookkeeper's job easier to help produce

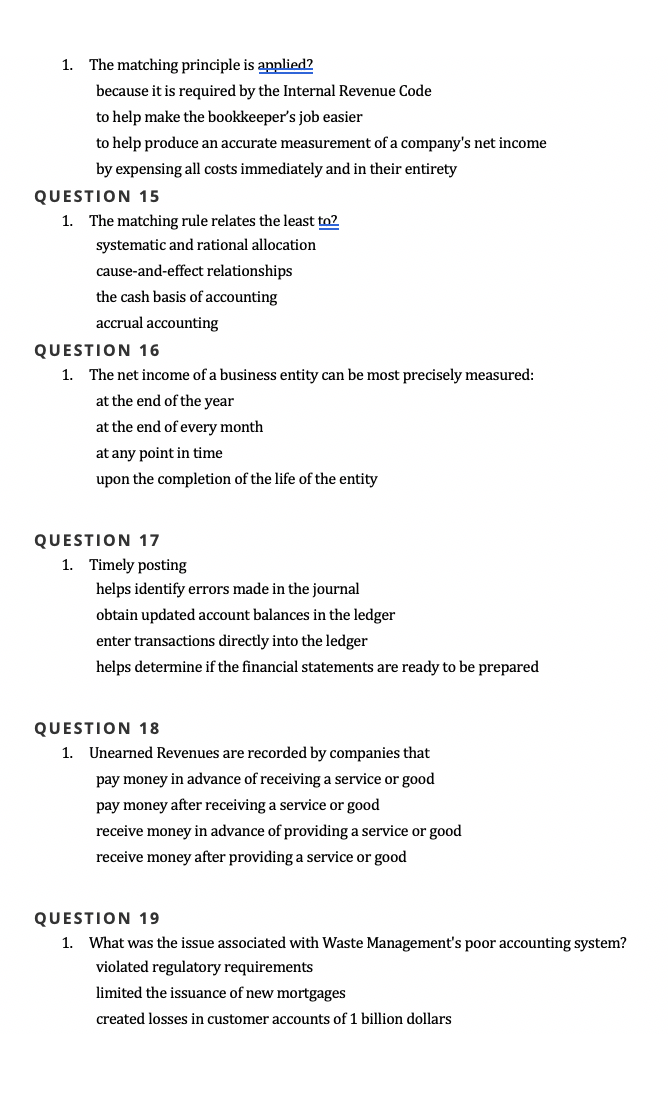

1. The matching principle is applied? because it is required by the Internal Revenue Code to help make the bookkeeper's job easier to help produce an accurate measurement of a company's net income by expensing all costs immediately and in their entirety QUESTION 15 1. The matching rule relates the least to? systematic and rational allocation cause-and-effect relationships the cash basis of accounting accrual accounting QUESTION 16 1. The net income of a business entity can be most precisely measured: at the end of the year at the end of every month at any point in time upon the completion of the life of the entity QUESTION 17 1. Timely posting helps identify errors made in the journal obtain updated account balances in the ledger enter transactions directly into the ledger helps determine if the financial statements are ready to be prepared QUESTION 18 1. Unearned Revenues are recorded by companies that pay money in advance of receiving a service or good pay money after receiving a service or good receive money in advance of providing a service or good receive money after providing a service or good QUESTION 19 1. What was the issue associated with Waste Management's poor accounting system? violated regulatory requirements limited the issuance of new mortgages created losses in customer accounts of 1 billion dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts