Question: 1. The most difficult factor to forecast when compiling a financial statement forecast is a. Trend. b. Cyclicality. c. Seasonality. d. A random event. 2.

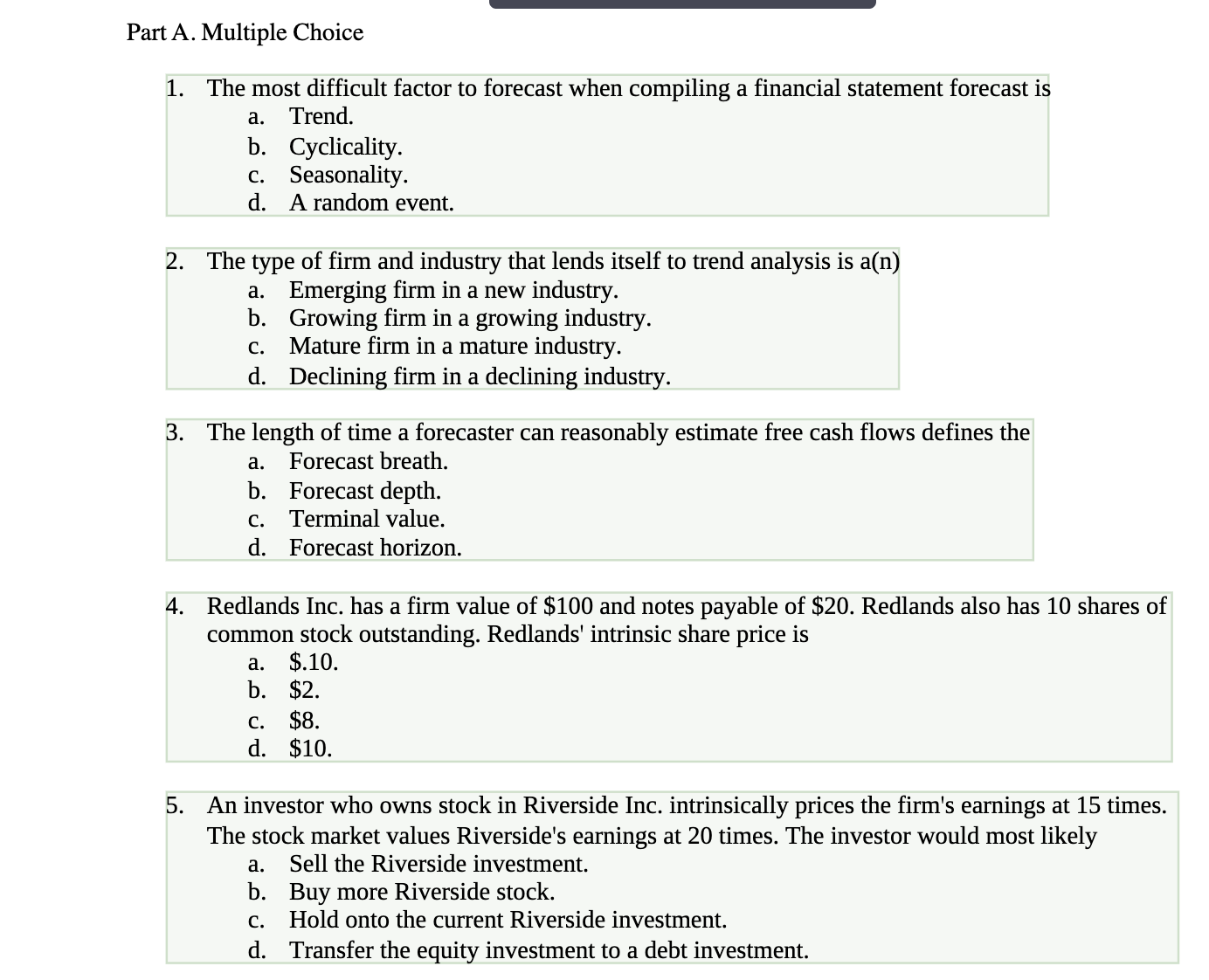

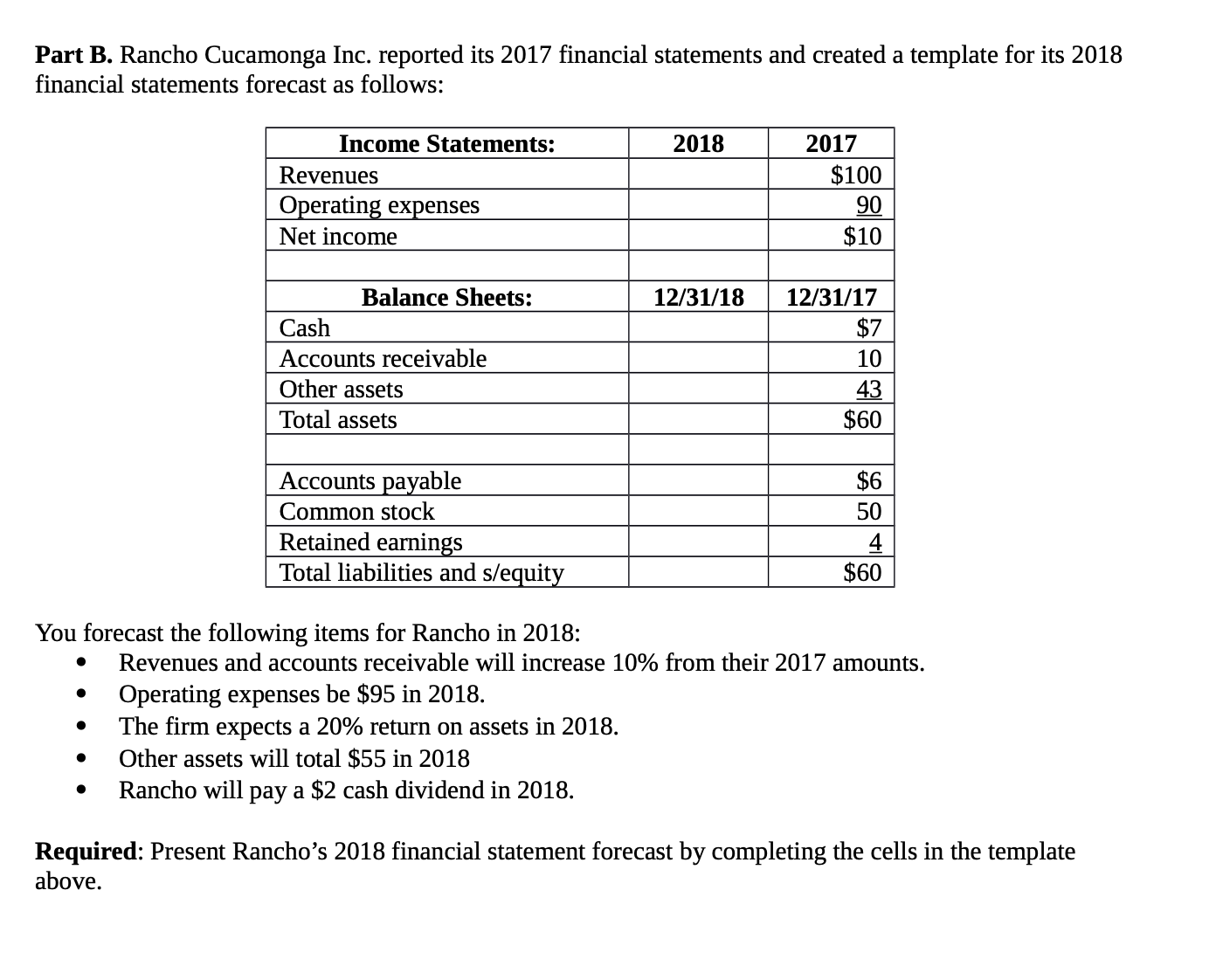

1. The most difficult factor to forecast when compiling a financial statement forecast is a. Trend. b. Cyclicality. c. Seasonality. d. A random event. 2. The type of firm and industry that lends itself to trend analysis is a(n) a. Emerging firm in a new industry. b. Growing firm in a growing industry. c. Mature firm in a mature industry. d. Declining firm in a declining industry. 3. The length of time a forecaster can reasonably estimate free cash flows defines the a. Forecast breath. b. Forecast depth. c. Terminal value. d. Forecast horizon. 4. Redlands Inc. has a firm value of $100 and notes payable of $20. Redlands also has 10 shares of common stock outstanding. Redlands' intrinsic share price is a. \$.10. b. \$2. c. $8. d. $10. 5. An investor who owns stock in Riverside Inc. intrinsically prices the firm's earnings at 15 times. The stock market values Riverside's earnings at 20 times. The investor would most likely a. Sell the Riverside investment. b. Buy more Riverside stock. c. Hold onto the current Riverside investment. d. Transfer the equity investment to a debt investment. Part B. Rancho Cucamonga Inc. reported its 2017 financial statements and created a template for its 2018 financial statements forecast as follows: You forecast the following items for Rancho in 2018: - Revenues and accounts receivable will increase 10% from their 2017 amounts. - Operating expenses be $95 in 2018. - The firm expects a 20% return on assets in 2018. - Other assets will total \$55 in 2018 - Rancho will pay a \$2 cash dividend in 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts