Question: 1. The optimal capital structure has been achieved when the: A) debt-equity ratio is equal to 1. B) weight of equity is equal to the

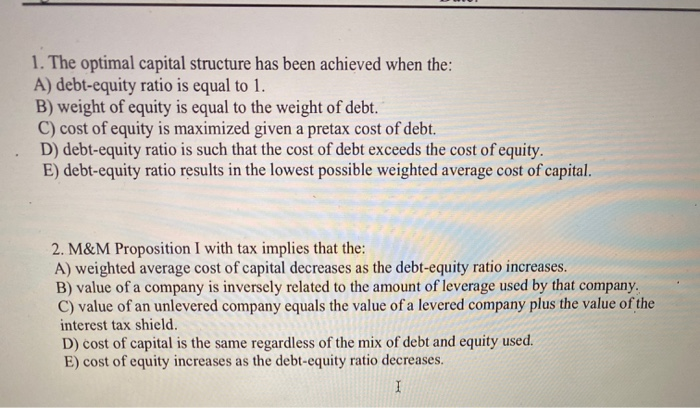

1. The optimal capital structure has been achieved when the: A) debt-equity ratio is equal to 1. B) weight of equity is equal to the weight of debt. C) cost of equity is maximized given a pretax cost of debt. D) debt-equity ratio is such that the cost of debt exceeds the cost of equity. E) debt-equity ratio results in the lowest possible weighted average cost of capital. 2. M&M Proposition I with tax implies that the: A) weighted average cost of capital decreases as the debt-equity ratio increases. B) value of a company is inversely related to the amount of leverage used by that company. C) value of an unlevered company equals the value of a levered company plus the value of the interest tax shield. D) cost of capital is the same regardless of the mix of debt and equity used. E) cost of equity increases as the debt-equity ratio decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts