Question: 1. The Shareholder Wealth Maximization Model a. combines the interests and inputs of shareholders, creditors, management, employees, and society. b. is being usurped by the

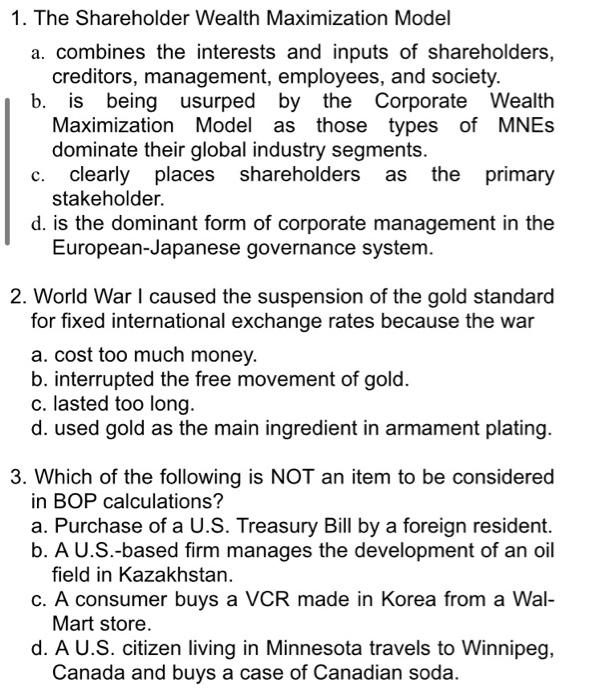

1. The Shareholder Wealth Maximization Model a. combines the interests and inputs of shareholders, creditors, management, employees, and society. b. is being usurped by the Corporate Wealth Maximization Model as those types of MNES dominate their global industry segments. c. clearly places shareholders as the primary stakeholder. d. is the dominant form of corporate management in the European-Japanese governance system. 2. World War I caused the suspension of the gold standard for fixed international exchange rates because the war a. cost too much money. b. interrupted the free movement of gold. c. lasted too long. d. used gold as the main ingredient in armament plating. 3. Which of the following is NOT an item to be considered in BOP calculations? a. Purchase of a U.S. Treasury Bill by a foreign resident. b. A U.S.-based firm manages the development of an oil field in Kazakhstan. c. A consumer buys a VCR made in Korea from a Wal- Mart store. d. A U.S. citizen living in Minnesota travels to Winnipeg, Canada and buys a case of Canadian soda

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts