Question: 1. The table below presents the state-based returns of security A, security B, the risk-free security, and the market portfolio. The recession state is three

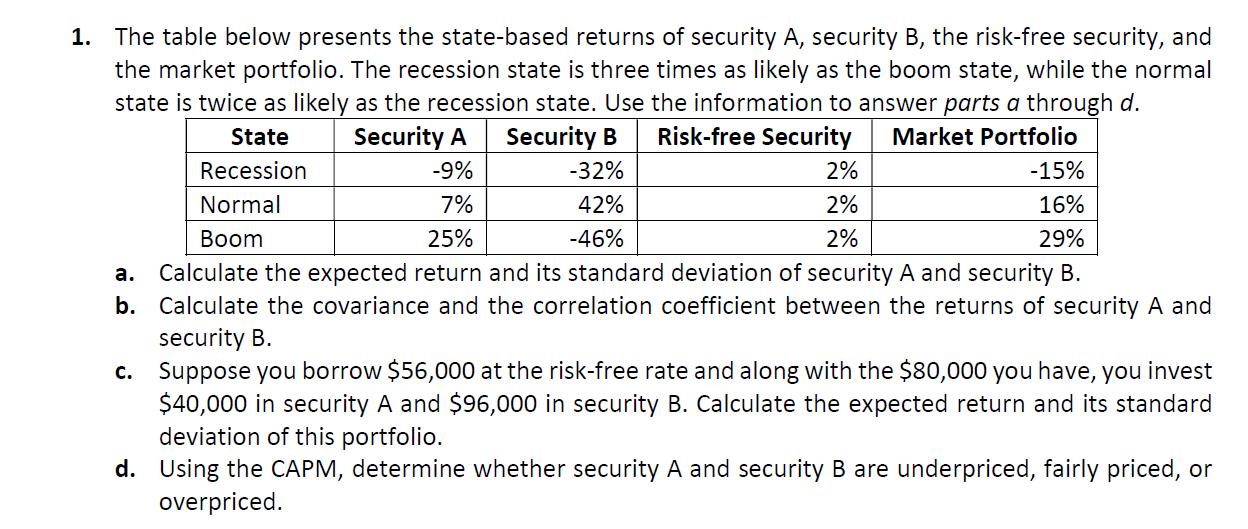

1. The table below presents the state-based returns of security A, security B, the risk-free security, and the market portfolio. The recession state is three times as likely as the boom state, while the normal state is twice as likely as the recession state. Use the information to answer parts a through d. State Security A Security B Risk-free Security Market Portfolio Recession -9% -32% 2% -15% Normal 7% 42% 2% 16% Boom 25% -46% 2% 29% Calculate the expected return and its standard deviation of security A and security B. b. Calculate the covariance and the correlation coefficient between the returns of security A and security B. Suppose you borrow $56,000 at the risk-free rate and along with the $80,000 you have, you invest $40,000 in security A and $96,000 in security B. Calculate the expected return and its standard deviation of this portfolio. d. Using the CAPM, determine whether security A and security B are underpriced, fairly priced, or overpriced. a. C. 1. The table below presents the state-based returns of security A, security B, the risk-free security, and the market portfolio. The recession state is three times as likely as the boom state, while the normal state is twice as likely as the recession state. Use the information to answer parts a through d. State Security A Security B Risk-free Security Market Portfolio Recession -9% -32% 2% -15% Normal 7% 42% 2% 16% Boom 25% -46% 2% 29% Calculate the expected return and its standard deviation of security A and security B. b. Calculate the covariance and the correlation coefficient between the returns of security A and security B. Suppose you borrow $56,000 at the risk-free rate and along with the $80,000 you have, you invest $40,000 in security A and $96,000 in security B. Calculate the expected return and its standard deviation of this portfolio. d. Using the CAPM, determine whether security A and security B are underpriced, fairly priced, or overpriced. a. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts