Question: 1.) The Upton Uranium company is deciding whether it should open a strip mine, the net cost of which is $1,000,000. Net cash inflows are

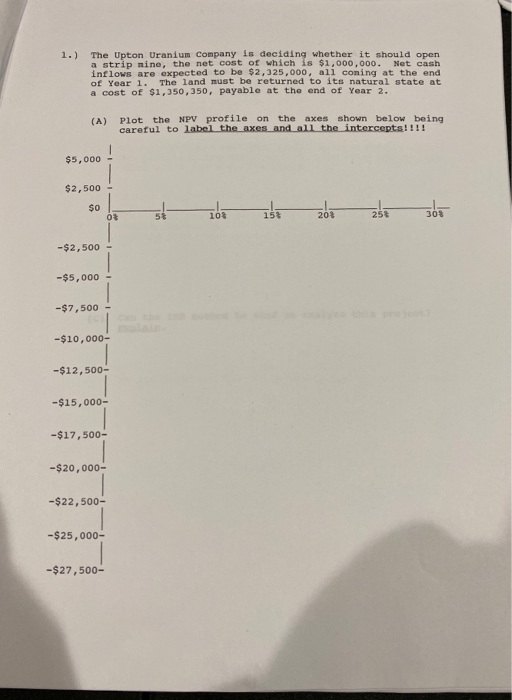

1.) The Upton Uranium company is deciding whether it should open a strip mine, the net cost of which is $1,000,000. Net cash inflows are expected to be $2.325,000, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $1,350, 350, payable at the end of Year 2. (a) Plot the NPV profile on the axes shown below being careful to label the axes and all the intercepts!!!! $5,000 - $2,500 so h de iba zbrabe -$2,500 -$5,000 -$7,500 - -$10,000- -$12,500- -$15,000- -$17,500- -$20,000- -$22,500- - $25,000- -$27,500- (B) Should the project be accepted if k-101? Should the project be accepted if k=16*? Explain your reasoning. (0) Can the IRR method be used to analyze this project? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts