Question: 1. THE US$ IS THE FUNCTIONAL CURRENCY. Relevant information = Beg Inv: 80,000. Purchases: 100,000. End Inv: 50,000. Relevant Rates: Jan1 $1.15; Avg Rate: $1.17;

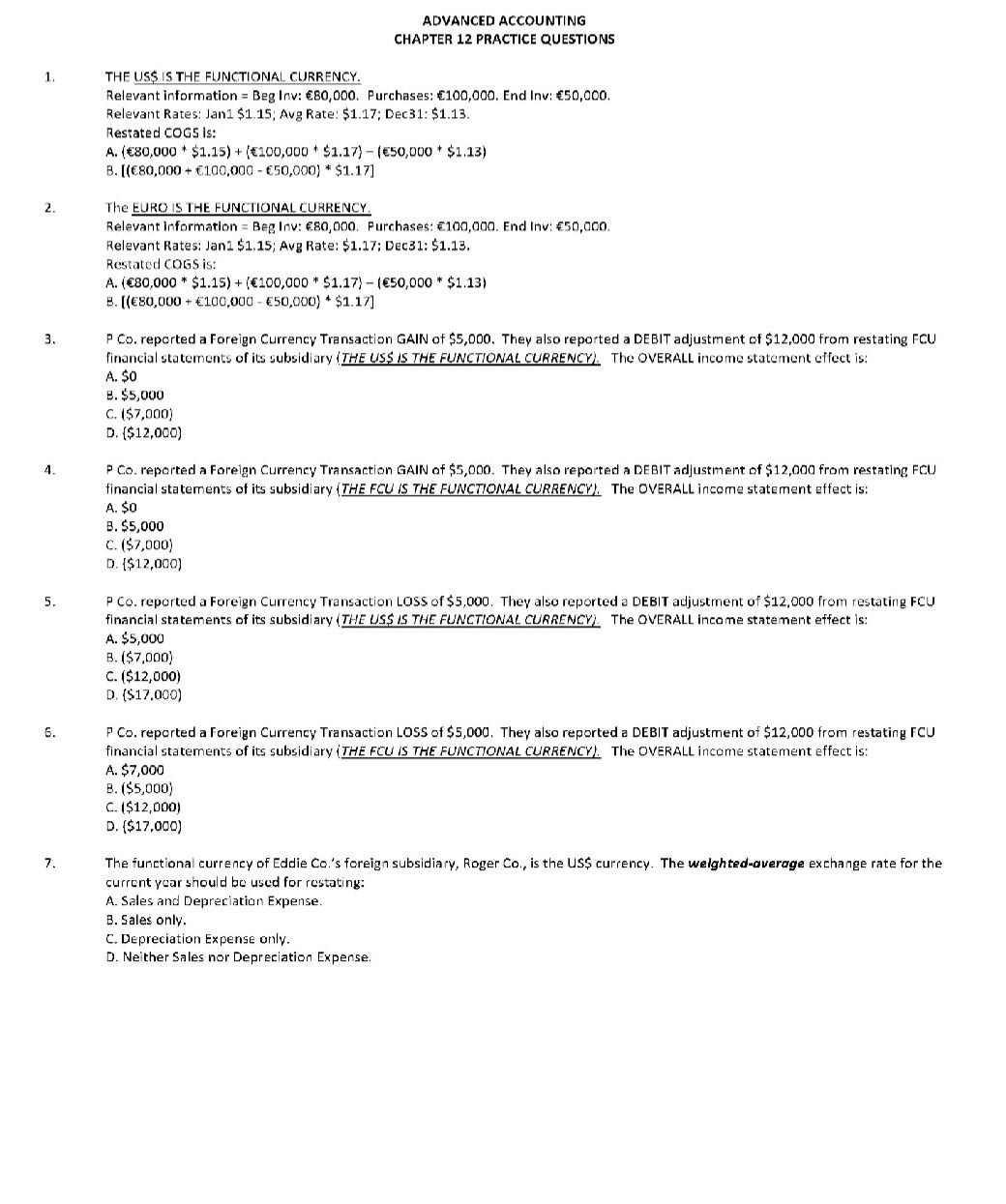

1. THE US\$ IS THE FUNCTIONAL CURRENCY. Relevant information = Beg Inv: 80,000. Purchases: 100,000. End Inv: 50,000. Relevant Rates: Jan1 \$1.15; Avg Rate: \$1.17; Dec31: \$1.13. Restated COGS is: A. (80,000$1.15)+100,000$1.17}(50,000$1.13) B. [(80,000+100,00050,000}$1.17] 2. The EURO IS THE FUNCTIONAL CURRENCY. Relevant Information = Beg Inv: 80,000. Furchases: 100,000. End Inv: 50,000. Relevant Rates: Jan 1 \$1.15; Avg Rate: \$1.17; Dec31: \$1.13. Restated COGS is: A. (80,000$1.15)+(100,000$1.17(50,000$1.13) B. [(80,000+100,00050,000)$1.17] 3. PCo. reported a Foreign Currency Transaction GAIN of $5,000. They also reported a DEBIT adjustment of $12,000 from restating FCU financial statements of its subsidiary (THE USS IS THE FUNCTIONAL CURRENCY). The OVERALL income statement effect is: A. $0 B. $5,000 C. ($7,000) D. {$12,000) 4. PC. reported a Foreign Currency Transaction GAIN of $5,000. They also reported a DEBIT adjustment of $12,000 from restating FCU financial statements of its subsidiary (THE FCU IS THE FUNCTIONAL CURRENCV). The OVERALL income statement effect is: A. $0 B. $5,000 C. ($7,000) D. {$12,000} 5. PC. reported a Foreign Currency Transaction LOSS of $5,000. They also reported a DEBIT adjustment of $12,000 from restating FCU financial statements of its subsidiary (THE USS IS THE FUNCTIONAL CURRENCY). The OVERALL income statement effect is: A. $5,000 B. ($7,000) C. ($12,000) D. ($17,000) 6. PCo. reported a Foreign Currency Transaction LOSS of $5,000. They also reported a DEBIT adjustment of $12,000 from restating FCU financial statements of its subsidiary (THE FCU iS THE FUNCTIONAL CURRENCY). The OVERALL income statement Effect is: A. $7,000 B. ($5,000) C. ($12,000) D. {$17,000) 7. The functional currency of Eddie Co.'s foreign subsidiary, Roger Co., is the US\$ currency. The welghted-average exchange rate for the current year should be used for restating: A. Sales and Depreciation Expense. B. Sales only. C. Depreciation Expense only. D. Neither Sales nor Depreciation Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts