Question: 1. This exercise uses the data in Table 1. Suppose that on February 15, 1994 a firm wants to enter into a forward contract to

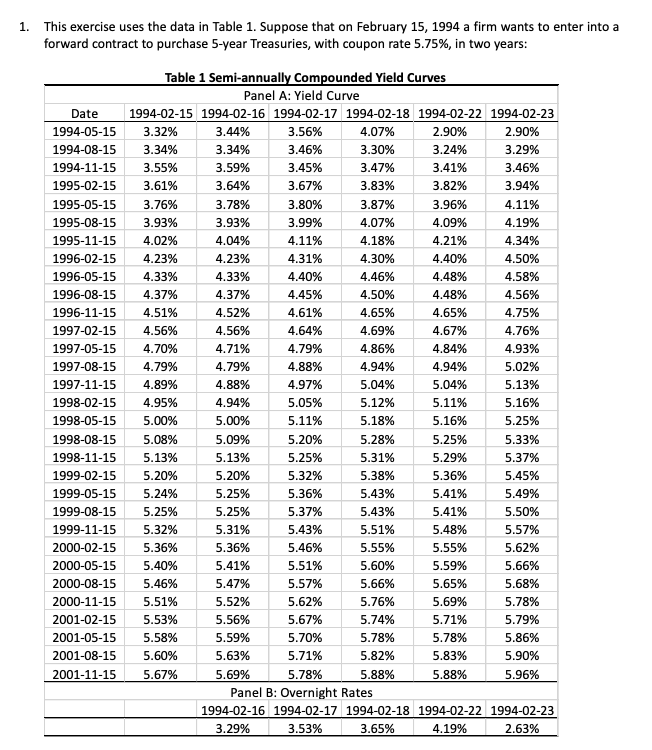

1. This exercise uses the data in Table 1. Suppose that on February 15, 1994 a firm wants to enter into a forward contract to purchase 5-year Treasuries, with coupon rate 5.75%, in two years: Date 1994-05-15 1994-08-15 1994-11-15 1995-02-15 1995-05-15 1995-08-15 1995-11-15 1996-02-15 1996-05-15 1996-08-15 1996-11-15 1997-02-15 1997-05-15 1997-08-15 1997-11-15 1998-02-15 1998-05-15 1998-08-15 1998-11-15 1999-02-15 1999-05-15 1999-08-15 1999-11-15 2000-02-15 2000-05-15 2000-08-15 2000-11-15 2001-02-15 2001-05-15 2001-08-15 2001-11-15 Table 1 Semi-annually Compounded Yield Curves Panel A: Yield Curve 1994-02-15 1994-02-16 1994-02-17 1994-02-18 1994-02-22 1994-02-23 3.32% 3.44% 3.56% 4.07% 2.90% 2.90% 3.34% 3.34% 3.46% 3.30% 3.24% 3.29% 3.55% 3.59% 3.45% 3.47% 3.41% 3.46% 3.61% 3.64% 3.67% 3.83% 3.82% 3.94% 3.76% 3.78% 3.80% 3.87% 3.96% 4.11% 3.93% 3.93% 3.99% 4.07% 4.09% 4.19% 4.02% 4.04% 4.11% 4.18% 4.21% 4.34% 4.23% 4.23% 4.31% 4.30% 4.40% 4.50% 4.33% 4.33% 4.40% 4.46% 4.48% 4.58% 4.37% 4.37% 4.45% 4.50% 4.48% 4.56% 4.51% 4.52% 4.61% 4.65% 4.65% 4.75% 4.56% 4.56% 4.64% 4.69% 4.67% 4.76% 4.70% 4.71% 4.79% 4.86% 4.84% 4.93% 4.79% 4.79% 4.88% 4.94% 4.94% 5.02% 4.89% 4.88% 4.97% 5.04% 5.04% 5.13% 4.95% 4.94% 5.05% 5.12% 5.11% 5.16% 5.00% 5.00% 5.11% 5.18% 5.16% 5.25% 5.08% 5.09% 5.20% 5.28% 5.25% 5.33% 5.13% 5.13% 5.25% 5.31% 5.29% 5.37% 5.20% 5.20% 5.32% 5.38% 5.36% 5.45% 5.24% 5.25% 5.36% 5.43% 5.41% 5.49% 5.25% 5.25% 5.37% 5.43% 5.41% 5.50% 5.32% 5.31% 5.43% 5.51% 5.48% 5.57% 5.36% 5.36% 5.46% 5.55% 5.55% 5.62% 5.40% 5.41% 5.51% 5.60% 5.59% 5.66% 5.46% 5.47% 5.57% 5.66% 5.65% 5.68% 5.51% 5.52% 5.62% 5.76% 5.69% 5.78% 5.53% 5.56% 5.67% 5.74% 5.71% 5.79% 5.58% 5.59% 5.70% 5.78% 5.78% 5.86% 5.60% 5.63% 5.71% 5.82% 5.83% 5.90% 5.67% 5.69% 5.78% 5.88% 5.88% 5.96% Panel B: Overnight Rates 1994-02-16 1994-02-17 1994-02-18 1994-02-22 1994-02-23 3.29% 3.53% 3.65% 4.19% 2.63% Compute the value of the forward contract on each of the next five days. Assume the firm and the counterparty mark to market the forward contract; describe the cash flows between the counterparties over time. Panel B contains overnight rates. Compute the total profit / loss on the contract after two, three, four, and five days. 1. This exercise uses the data in Table 1. Suppose that on February 15, 1994 a firm wants to enter into a forward contract to purchase 5-year Treasuries, with coupon rate 5.75%, in two years: Date 1994-05-15 1994-08-15 1994-11-15 1995-02-15 1995-05-15 1995-08-15 1995-11-15 1996-02-15 1996-05-15 1996-08-15 1996-11-15 1997-02-15 1997-05-15 1997-08-15 1997-11-15 1998-02-15 1998-05-15 1998-08-15 1998-11-15 1999-02-15 1999-05-15 1999-08-15 1999-11-15 2000-02-15 2000-05-15 2000-08-15 2000-11-15 2001-02-15 2001-05-15 2001-08-15 2001-11-15 Table 1 Semi-annually Compounded Yield Curves Panel A: Yield Curve 1994-02-15 1994-02-16 1994-02-17 1994-02-18 1994-02-22 1994-02-23 3.32% 3.44% 3.56% 4.07% 2.90% 2.90% 3.34% 3.34% 3.46% 3.30% 3.24% 3.29% 3.55% 3.59% 3.45% 3.47% 3.41% 3.46% 3.61% 3.64% 3.67% 3.83% 3.82% 3.94% 3.76% 3.78% 3.80% 3.87% 3.96% 4.11% 3.93% 3.93% 3.99% 4.07% 4.09% 4.19% 4.02% 4.04% 4.11% 4.18% 4.21% 4.34% 4.23% 4.23% 4.31% 4.30% 4.40% 4.50% 4.33% 4.33% 4.40% 4.46% 4.48% 4.58% 4.37% 4.37% 4.45% 4.50% 4.48% 4.56% 4.51% 4.52% 4.61% 4.65% 4.65% 4.75% 4.56% 4.56% 4.64% 4.69% 4.67% 4.76% 4.70% 4.71% 4.79% 4.86% 4.84% 4.93% 4.79% 4.79% 4.88% 4.94% 4.94% 5.02% 4.89% 4.88% 4.97% 5.04% 5.04% 5.13% 4.95% 4.94% 5.05% 5.12% 5.11% 5.16% 5.00% 5.00% 5.11% 5.18% 5.16% 5.25% 5.08% 5.09% 5.20% 5.28% 5.25% 5.33% 5.13% 5.13% 5.25% 5.31% 5.29% 5.37% 5.20% 5.20% 5.32% 5.38% 5.36% 5.45% 5.24% 5.25% 5.36% 5.43% 5.41% 5.49% 5.25% 5.25% 5.37% 5.43% 5.41% 5.50% 5.32% 5.31% 5.43% 5.51% 5.48% 5.57% 5.36% 5.36% 5.46% 5.55% 5.55% 5.62% 5.40% 5.41% 5.51% 5.60% 5.59% 5.66% 5.46% 5.47% 5.57% 5.66% 5.65% 5.68% 5.51% 5.52% 5.62% 5.76% 5.69% 5.78% 5.53% 5.56% 5.67% 5.74% 5.71% 5.79% 5.58% 5.59% 5.70% 5.78% 5.78% 5.86% 5.60% 5.63% 5.71% 5.82% 5.83% 5.90% 5.67% 5.69% 5.78% 5.88% 5.88% 5.96% Panel B: Overnight Rates 1994-02-16 1994-02-17 1994-02-18 1994-02-22 1994-02-23 3.29% 3.53% 3.65% 4.19% 2.63% Compute the value of the forward contract on each of the next five days. Assume the firm and the counterparty mark to market the forward contract; describe the cash flows between the counterparties over time. Panel B contains overnight rates. Compute the total profit / loss on the contract after two, three, four, and five days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts